Marching orders for a new accounting standard for expected loan losses remain unclear just 18 months before publicly traded banks will have to comply with it.

Banks and credit unions, in correspondence to banking regulators and the Financial Accounting Standards Board, continue to press for major changes to how capital will be measured under the current expected credit loss standard, or CECL. While a

The American Bankers Association and the Independent Community Bankers of America want, at minimum, a five-year phase-in, with the ABA pressing for an indefinite adjustment “until a long-term recalibration of the regulatory capital framework can be completed.”

Bankers are weighing in, too.

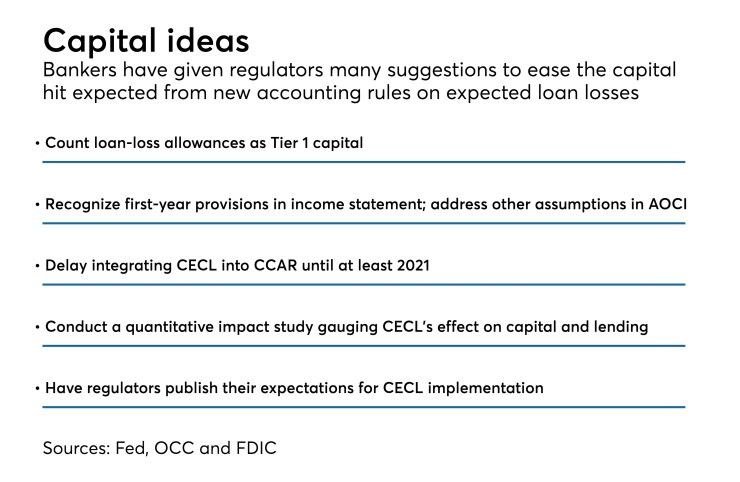

Paul Burdiss, the chief financial officer at Zions Bancorp., suggested counting the CECL loan-loss allowance as Tier 1 capital. Scott Blackley, Capital One's CFO, would like to see losses forecast during a loan’s first year reflected in the provision, while accounting for any losses expected after that as accumulated other comprehensive income.

Beyond accounting adjustments, bankers want a quantitative impact study conducted to gauge CECL’s long-term impact on loan-loss reserves, capital and lending.

While the FASB said efforts continue to make the CECL transition as painless as possible, it declined to discuss the banker letters.

“The FASB has been working closely with both regulators and financial institutions to ensure a smooth and effective implementation of the credit losses standard,” spokesperson Christine Klimek said in an email to American Banker. “We will continue this work through and beyond the standard’s effective dates.”

The National Credit Union Administration has not yet announced any plan to assist credit unions in their CECL transition, which is scheduled to begin in 2021, though that may soon change. An agency spokesman said financial regulators, including the NCUA, plan to meet next week for additional discussions.

Representatives for the Federal Deposit Insurance Corp., Office of the Comptroller of the Currency and Federal Reserve declined to comment.

Banks and credit unions have been focused on CECL for nearly a decade. The standard, which received final FASB approval in June 2016, radically changes the model for expected loan losses. It would replace the current system, where banks account for a loss when credit deterioration becomes apparent, to a framework that requires them to project any losses they expect over the lifetime of a loan at the time the credit is booked.

“This is a sea-change deal,” said Christopher Williston, president and CEO of the Independent Community Bankers Association of Texas. “I think there's a lot of frustration that the current situation wasn’t broke. It’s unfortunate that we’re going to layer more regulation on community banks that have long based their loan-loss reserves on historical losses. … I think this was a solution in search of a problem and that’s how many have perceived it.”

CECL represents another instance where “Ph.D.s from Harvard and Yale” are replacing “bankers in the trenches working with customers," said Dennis Nixon, the CEO of International Bancshares in Laredo, Texas.

“We’ve got people imposing academic frameworks on the industry,” added Nixon, who was the only bank CEO to submit a comment letter to regulators. “It’s another straw on the camel’s back for an industry already grappling with compliance costs that are clearly killing community banking.”

While it’s premature to draw conclusions about banks’ experiences transitioning to CECL, some early indications are worrisome, industry experts said.

“While most institutions are progressing along fairly well, there are unexpected hurdles coming from those that are further along in the process,” said John Reedy, a senior manager at Grant Thornton.

"Organizations that have started implementation are finding unexpected outcomes on some of their initial modeling, namely in either reserve levels that are a lot higher or lower than they may have been expecting, [and] they’re finding challenges in understanding those models and the data driving those results," Reedy added.

To be sure, some bankers remain optimistic that the industry will weather the accounting change.

Most institutions, even smaller ones, will manage the change without undue hardship, said Timothy Zimmerman, CEO of Standard AVB Financial in Monroeville, Pa. He expressed a belief that most banks would forgo the phase-in option and opt to "bite the bullet" by recording any changes on day one.

“Unless their capital situation makes it impossible for them to avoid it, most banks would prefer not to report a number to regulators that differs from generally accepted accounting principles,” Zimmerman said. “Only those that are close to the edge will do it."