Loan demand is finally picking up after several lackluster quarters, and the big challenge for banks now is finding cheap deposits to fund all those new loans.

Bankers say competition has become especially fierce in recent months, with banks not only battling each other for consumer and business deposits, but also a new crop of digital-only banks that are paying market-leading rates.

“The way I described it in December was that it was a steel-cage match, wrestling,” Joseph DePaolo, CEO of the $47 billion-asset Signature Bank in New York,

“The want for deposits, and the lack of liquidity out there, makes it very, very difficult,” said DePaolo.

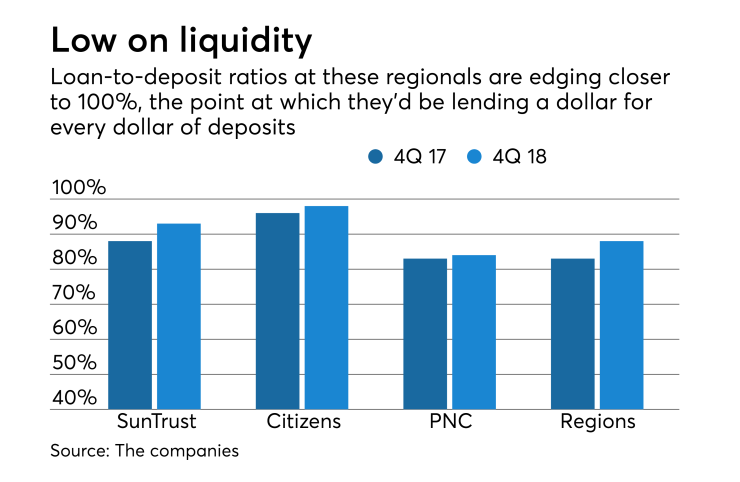

At some of these banks, loan growth is outpacing deposit growth, which presents a tricky task for regional banks. On one hand, they don’t want to tap the brakes on lending because loans, above all else, drive profits. But if they overpay for deposits, their profit margins shrink.

“We’re obviously balancing growth in deposits with profitability,” Allison Dukes, the chief financial officer at the $216 billion-asset SunTrust, said in a Friday conference call with analysts discussing fourth-quarter results. “We’re carefully looking at the marginal cost of deposit funding against the marginal cost of wholesale funding sources.”

At SunTrust, in Atlanta, total deposits increased 1% in the fourth quarter when compared with a year earlier to $161.5 billion. But because loans increased 6% its loan-to-deposit ratio rose 500 basis points to 93% in the fourth quarter from a year earlier. When a bank’s loan-to-deposit ratio reaches 100%, it’s loaning $1 for every dollar of deposits.

SunTrust’s strategy for adding deposits to keep pace with loan demand is to increase rates on certificates of deposit, Dukes said during the call. CDs are more expensive than non-interest-bearing deposits, but still cheaper than brokered deposits or other sources of liquidity, she said.

“We continue to see a migration from lower cost deposits to CDs, largely due to higher rates and our targeted strategy, which allows us to retain our existing depositors and capture new market share,” Dukes said.

Still, SunTrust can boost its liquidity from other sources, if loan growth further accelerates and the deposit competition becomes even more intense, she said.

“We feel good about the access we have to alternative funding sources, whether that’s the unsecured debt markets or" Federal Home Loan Bank advances, Dukes said.

The $126 billion-asset Regions Financial in Birmingham, Ala., said its total deposits fell 4% in the quarter from a year earlier, but, importantly, it did see a slight increase in consumer deposits. Regions derives a higher percentage, compared to its peers, of its deposits from consumers who use retail branches. Those deposits tend to pay lower rates than other types of deposits.

“We benefit from what we believe is our competitive advantage, which is a very loyal customer deposit base, two-thirds of which is retail,” CEO John Turner said in an earnings conference call Friday.

First Horizon in Memphis, Tenn., has been among the more successful regionals at gathering deposits.

The $41 billion-asset company said Friday that its deposits in the fourth quarter climbed 7% year over year to $32.7 billion. The lion's share of that growth, more than $1.5 billion, came in the fourth quarter, as the company's efforts to drive new business in the markets it entered after its December 2017 acquisition of Capital Financial in Charlotte, N.C., began paying dividends, said Chief Financial Officer BJ Losch.

"We laid a very strong emphasis on customer acquisition, particularly in those new markets” in the Carolinas and Florida, Losch said Friday.

First Horizon has a goal of reducing its reliance on costly brokered deposits, and the growth in core deposits allowed First Horizon to cancel contracts for about $200 million of brokered CDs in the fourth quarter, Losch said. The company expects to exit additional contracts this quarter, he said.

“It's a pretty positive sign,” Losch said. "Our deposit trends were excellent across the board in both consumer and commercial as well as across all markets.”

Other banks are pushing hard on deposit-gathering through digital platforms. For Citizens Financial, in Providence, R.I., its new online bank helped fuel deposit growth, as average deposits rose 4%, to $117.8 billion in the fourth quarter from the year-earlier quarter.

Deposits at its digital bank, Citizens Access, which went live midyear, totaled $3 billion at Dec. 31. While that represents a small share of the $161 billion-asset company’s overall deposit base, Chairman and CEO Bruce Van Saun described the digital bank as strategically important and necessary, as some of Citizens’ other large rivals are developing similar operations.

Capital One Financial has a well-established online-only bank, Capital One 360, while rivals JPMorgan Chase and PNC Financial Services Group have recently established online-only platforms to gather deposits in markets where they have no physical locations.

“That one-two punch of the big brand spend and the big tech spend have allowed the very biggest banks to gain share,” Van Saun said in an interview.

The $382 billion-asset PNC in Pittsburgh has

While the new savings account pays a rate that’s higher than the market average, it has attracted more than just rate-chasers, PNC said. About one-fourth of the new customers opted to make PNC their primary bank after opening the online account, Chairman and CEO Bill Demchak said during a Wednesday conference call.

These are "totally new clients to PNC who are using us as their primary bank and that’s quite interesting to us,” Demchak said.

For that reason and others, digital platforms are almost certain to become more important to PNC in 2019, Demchak said during the call.

“Through time, you will see greater portions of our total deposits coming from the online channel,” Demchak said.

Laura Alix and John Reosti contributed to this story.