Aaron Du is fighting to ensure the company he founded, Beam Financial, isn’t remembered as a cautionary tale in the fintech world. But the job is getting harder by the day.

In his first interview

However, Du acknowledged that the San Francisco company, which has to make money on interest rate spreads after paying customers as much as 4% on deposits, faces strategic challenges.

“It is a difficult market, frankly, to just offer the rate product,” he said, explaining Beam wanted to deliver affordable services to underserved consumers. “The reason we've been trying to focus on that is because we think that this is a mission that's worth dedicating ourselves to.”

Moreover, Du will have to defuse tensions with two companies he did business with who say they’ve been unfairly dragged into Beam’s disputes with its customers. Huntington Bank and the transaction software provider Dwolla told American Banker they’re in the process of filing a lawsuit against Beam in an Ohio court.

In a statement, the companies said they are "seeking to require Beam to provide the identities of its customers and the amount each is due in an effort to help Beam’s customers and expedite the return of their funds.”

The companies declined to provide a copy of the suit or say where exactly it was being filed. The pleading will become public in a few days when the court clerk has accepted it, a Dwolla spokeswoman said.

A spokeswoman for Beam said Wednesday it has already sent the requested information to Huntington and Dwolla. In a follow-up statement, Beam said Dwolla had the power to refund 43 customers but was refusing to do so.

How did it all get to this? Du said his company has been beset by problems since it launched in September 2019, many of which it had no control over.

Account fraud issues

Beam is a small fintech dependent on a network of partners. When customers agree to deposit money with Beam, it transfers those funds from their existing bank account to a custody account at Huntington Bank, using Yodlee’s account aggregation service and Dwolla’s platform to access the automated clearinghouse.

From there the money is directed to banks that are affiliated with the deposit network provider R&T. At least, this is how Beam operated until R&T and Dwolla terminated their relationships with Beam last month.

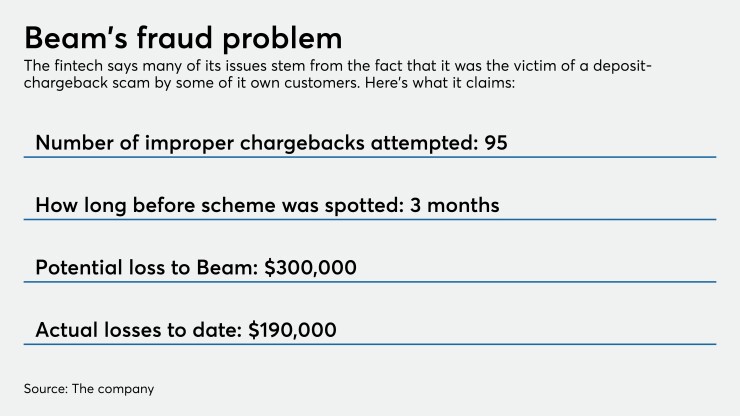

Beam’s first challenge came during its first three months. It suffered about $190,000 of fraud losses between September and December of 2019, Du said. There were 95 attempted ACH chargebacks, Du says: Customers would deposit funds from an outside bank account with Beam, withdraw money from their Beam account and then have their bank reverse the deposit through the ACH system.

An inability to withdraw

The next challenge that arose, according to Du, was a problem with the account Beam had opened at Huntington Bank.

“When we first onboarded, they did not tell us that this account only goes one way, which means that basically the pool account can only go in deposit, it cannot withdraw,” Du said. “They're not able to do a net withdrawal from that pool account. If we knew it was going to be a one-way thing, we wouldn’t have worked with Huntington.”

Beam spent several months trying to get through Huntington’s compliance approval process to get that feature of the account changed, Du said. He said Huntington told him Beam did not have the right compliance “muscle” for the withdrawal feature to be turned on.

Du said this feature blocked Beam from withdrawing money from the Huntington account to return it to customers.

Customer complaints against Beam in Apple's App Store and at the Better Business Bureau website chronicle stories of people waiting months to get money out of Beam.

Du also said Beam only has part-time customer service agents.

“We're very stretched in terms of our staffing,” Du said. “We just didn't do a good job there in terms of being responsive.”

Huntington did not respond to questions about the account issues cited by Du. In an earlier statement, the bank said: “Huntington has a custody relationship with Beam Financial. We are not Beam’s partner and have no relationship with Beam’s customers or knowledge of any underlying Beam customer accounts. Huntington stands ready to cooperate with the appropriate parties to resolve these questions.”

ACH software shutdown

Next, partners Dwolla and Huntington began cutting Beam off, Du said.

Dwolla and Beam both say Dwolla terminated their agreement Oct. 1. Dwolla says it gave one month’s notice; Beam says it gave no notice. A Dwolla spokesperson said Dwolla did this because Beam violated a term of their agreement.

But where Dwolla has said Beam could have used any other provider to continue processing ACH transactions, Du says this is not so easy.

“In reality, it takes much longer to find a new vendor in this space,” Du said. “From identifying a vendor to onboarding for Dwolla took us six months.” Beam has started the process over again, but it’s not something that can be completed within four weeks, he said.

Jackie Ward, vice president of risk and compliance at Dwolla, said she didn't have information available on how long it took Beam to integrate with Dwolla.

The average time it takes a new customer to onboard with Dwolla is three months, she said.

“It is done at the pace of the client," Ward said. "We do have clients that go live much quicker than that.”

Dwolla’s action was devastating for Beam, Du said.

“What that means is that basically, because all the deposit withdrawal transactions are processed by Dwolla, nobody else — the minute they cut us off, that effectively froze all the transactions, so none of our users can withdraw or deposit. To this day, that remains true.”

Du said that he has been trying to work with Huntington and Dwolla to return Beam customers' money to them, but that neither company will talk to him.

“We are in a powerless position,” Du said.

A Dwolla spokeswoman said Dwolla has been trying to assist Beam with returning money to customers.

“As will be disclosed in the pleadings when they become public, there is a concern that there is not an accurate accounting of who Beam’s customers are and the amount owed to those customers,” she said.