Blockchain, a long-running digital currency startup that offers one of the world's most popular bitcoin wallets, has raised $40 million.

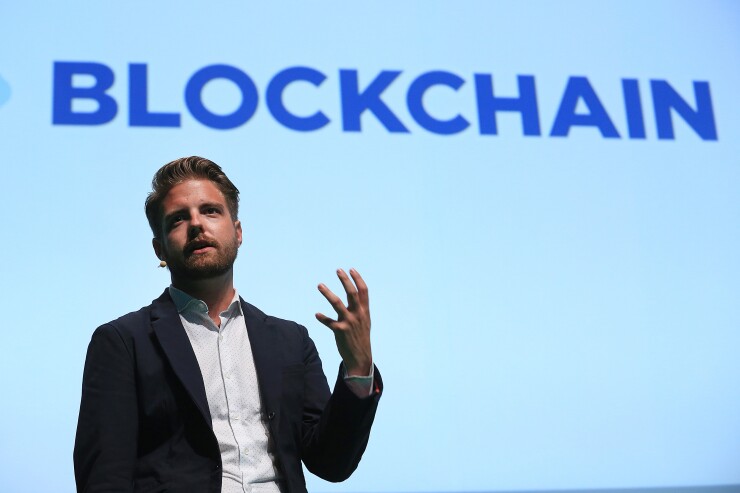

The funds will be used to make "big, bold bets in research and development," release new products and expand further internationally, the company's CEO, Peter Smith, said in a

Led by Lakestar and GV (formerly Google Ventures), the Series B funding round appears to be a sign of renewed interest in digital currency among investors. A bull market this spring saw bitcoin triple in price from about $1,000 to just over $3,000, while the total cryptocurrency market has increased by more than six times since the beginning of the year.

Founded in 2011, Blockchain survived a period marked by scandals and shutdowns for bitcoin companies to become one of the market leaders. More than 14 million Blockchain wallets have been created, and the startup's technology has powered more than 100 million transactions, according to its website.

The company's name refers to the groundbreaking technology underlying bitcoin and other cryptocurrencies. But to be clear, Blockchain is a bitcoin startup focused on digital currency applications, not a company building enterprise blockchain software.

Blockchain started as a one-man software project run by Ben Reeves, a British programmer. He single-handedly built a website and created the first versions of Blockchain's digital wallet app for iPhone and Android. Reeves received early funding from Roger Ver, a libertarian angel investor who has since become a controversial figure in the bitcoin community for his support of Bitcoin Unlimited, one of the proposals to scale the network.

But the company soon grew beyond what Reeves could handle on his own. In 2013, Ver

That was when Blockchain really

By May 2014, Blockchain had 20 employees. Five months later, the startup raised a $30.5 million Series A, the largest single round of funding for a digital currency company at that time. The company moved its headquarters to London, and Cary handed over the top job to Smith, assuming the role of president.

Reached by email on Thursday, Cary said it had been a "really exciting day."

Smith said in his blog post that Blockchain's new funding round represents "the most substantial investment in the fintech space [in Europe] since Brexit." And while other blockchain startups have raised larger rounds, Blockchain's $40 million is "the larger Series B of any digital currency company to date," Smith added.

Nokota Management and Barry Silbert's Digital Currency Group made their first investments in Blockchain alongside Lakestar and GV. Existing Blockchain investors Lightspeed Venture Partners, Mosaic Ventures, Virgin, Prudence Holdings and Richard Branson also joined the new funding round.

Now that Blockchain has $40 million of new "rocket fuel" in its tanks, Smith said, "you can expect new products aimed at allowing anyone to transact, save or hedge digital assets with greater speed, efficiency and control."