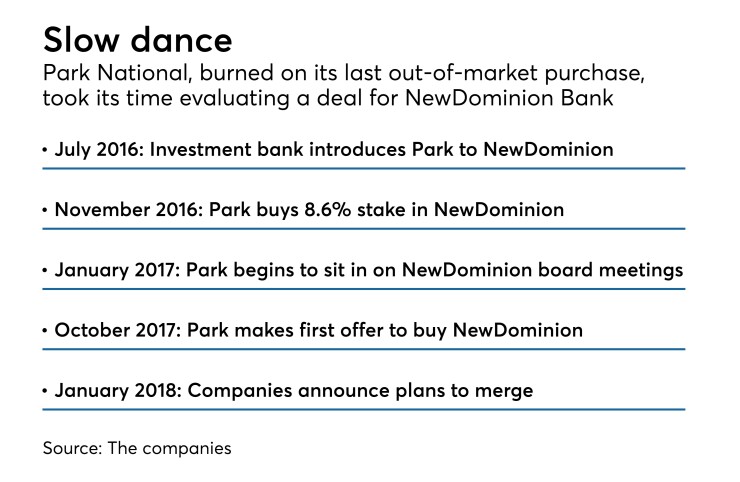

Park National in Newark, Ohio, burned by its last out-of-market bank deal, took a cautious approach as it looked to return to making acquisitions.

The $7.5 billion-asset company

Park took three months to conduct due diligence before making a $3.5 million investment in NewDominion in November 2016, or a roughly 8.6% stake, according to

Park quickly exchanged the 5,000 shares of preferred stock for voting and nonvoting common stock, the filing said.

The investment, which had been suggested by Jackson, granted Park board-observation rights that allowed it to have someone attend NewDominion board meetings. Park representatives also met regularly with NewDominion executives, providing the company with information about the North Carolina bank’s business, operations and management team, the filing said.

A meticulous approach to an effort Park called “Project Hornet” — reflecting the name of Charlotte’s pro basketball team — made sense given the company’s last experience with a bank acquisition. Park completed its $171 million purchase of Vision Bancshares in Panama, Fla., just before the

NewDominion endured its own hard knocks in the aftermath of the financial crisis. The company was deemed significantly undercapitalized and was hit with a consent order in 2010 that required management to improve its capital levels and financial condition. The bank brought in new management, including Jackson as chief financial officer (he was promoted to CEO in January 2015), raised capital and aggressively tackled credit issues.

NewDominion’s consent order was lifted in February 2017. Management has since been trying to recast NewDominion as Charlotte’s last local bank and an

Executives at NewDominion began considering M&A — either as a buyer or seller — or raising capital around the time the order was lifted. Park, meanwhile, had identified North Carolina as a state where it could expand beyond its more rural markets, the filing said.

Common interests became clear as the two sides connected last year. The banks began to discuss a merger in October. Within three weeks, Park had presented NewDominion with a letter of intent that priced it at $1.08 a share. Park initially proposed an all-stock transaction.

In January, Park agreed to change the consideration to 60% stock and 40% cash. The deal, which was announced on Jan. 22, is expected to close in mid-2018.

NewDominion is expected to operate as a division of Park. The bank will retain its name, local board and decision-making processes.

Most of NewDominion’s executives will keep their titles, including Jackson; Timothy Ignasher, president; Todd Bogdan, chief operating officer; and Greg Burke, chief credit officer. Kelly B. King, NewDominion’s CFO, will also stay with the bank as its director of credit.

All those executives have employment agreements with Park National that end on the fourth anniversary of the deal’s closing.

The arrangement is consistent for Park, which has 11 community bank divisions, each run by local leadership. Those banks share operational, technology, compliance and administrative resources while maintaining local identities and commitments.