Among the nation’s largest retail banks, Capital One Financial is ranked No. 1 for customer satisfaction, thanks largely to the strength of its digital offerings, according to a recent survey by J.D. Power.

Capital One leapfrogged several competitors to nab the highest score in J.D. Power’s 2020 National Banking Satisfaction Study, even as it has aggressively

The McLean, Va.-based company ranked fourth in last year's national banking survey.

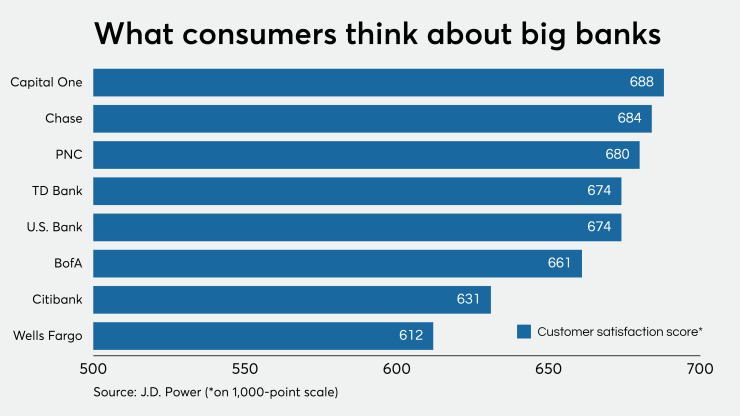

Capital One earned a total score of 688 on a 1,000-point scale. JPMorgan Chase, PNC Financial Services Group, TD Bank and U.S. Bancorp rounded out the top five. Citibank and Wells Fargo had the lowest scores, at 631 and 612, respectively. The average score among the eight banks was 657.

Last year, TD Bank topped the list

Capital One has by far the fewest branches among the eight banks included in the survey. According to Federal Deposit Insurance Corp. data, Capital One has slashed its number of branches by more than 40% since 2015, to 394 as of June 30. It has relied heavily on its mobile and online channels to serve existing customers

McAdam said that Chase Bank ranked the highest for resolving complaints and allowing customers to bank how and when they choose. PNC earned the highest marks for customer loyalty and trust.

“The more banks can really help customers tangibly, better understand how banking works and try to improve their financial understanding and health, the better,” he said. “Just really tactical things like, ‘Help me manage my spending, help me not pay fees, be on my side.’ ”

J.D. Power surveyed 8,877 bank customers between Aug. 25 and Sept. 28 this year.

The study looked at domestic banks with more than $200 billion in domestic deposits at the end of 2019. J.D. Power said it did not rank BB&T and SunTrust because at the time the survey was conducted, the two brands were still operating separately in some of their markets and because the two brands did not meet the deposit threshold.