Citi Ventures has made an investment in the artificial intelligence software company Anaconda, which its parent company Citigroup knows very well.

It turns out Citigroup has been using this popular open source software across its entire enterprise for a couple of years.

Though the size of the investment was not disclosed, the news Monday was significant for three reasons:

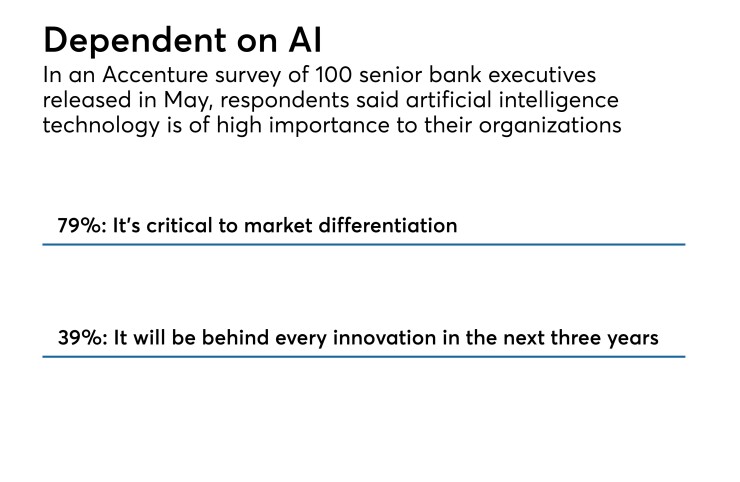

- It’s another sign that more banks are implementing artificial intelligence.

Large banks like

David B. Weiss, principal of the consulting firm Market Structure Metrics, said he has observed “an ever-growing, five-year trend of banks tactically trialing and deploying AI and related technologies like machine learning and robotic process automation to target multiple processes in various parts of their businesses.”

Jesse McWaters, financial innovation lead at the World Economic Forum, has also been seeing “a significant increase in investment in AI specialist companies” among banks.

- It is a feather in the cap of advocates of using open source software for AI.

“A significant portion of this work is done in an open source environment,” McWaters said.

“I think that’s indicative of the fact that the algorithms themselves, the methodologies for developing AI, are relatively commoditized.”

- It provides a window into Citi’s growing use of AI across the company.

“We’ve been working to build out the technology stack at Citi so that we can drive broad adoption of machine learning within various use cases and functions,” said Ramneek Gupta, managing director and co-head of venture investing at Citi Ventures.

Hundreds of data scientists at Citi use Anaconda on top of the bank’s Hadoop-based enterprise analytics platform.

“The usage has been high enough that it warranted an enterprisewide relationship with the company,” Gupta said. “The usage has continued to grow, and we expect it to be multiples of what it is today.”

Use cases for Anaconda at Citi include real-time credit evaluation when raising credit card limits and when conducting anti-money-laundering reviews.

Why Anaconda?

Every major bank in the U.S. uses Anaconda’s software, according to CEO Scott Collison. HSBC, JPMorgan Chase, Barclays and now Citi have gone public with it, as well as USAA on the insurance side and BMW, Jeep and Samsung in manufacturing.

Some banks use it for stress-testing. Others, like Citi, use it for credit evaluation and AML. Still others use it for loan decisions, risk analysis and treasury applications and settlement.

Anaconda, based in Austin, Texas, has 135 employees and $45 million in total capital. General Catalyst in Boston was Anaconda’s original investor. BuildGroup in Austin is its other investor.

Neither Anacaonda nor Citi would say how much Citi Ventures has invested, but both described the financial injection as "significant."

The startup is “headed toward profitability, and we have a pretty good top-line number,” Collison said.

Anaconda put itself on the map with its free open source offering, Anaconda Distribution.

“In any given month we have 6 million users — that represents most modern data scientists worldwide,” Collison said. “As data science shifts from more traditional platforms to a couple of languages, primarily Python and R, we support both those modern languages, so most universities use our platform to teach on and most companies are moving in this direction.”

Its use by students and universities was part of what drew Gupta’s team to Anaconda.

“That has driven wide adoption and students are getting trained in and growing up on this,” Gupta said. “When they move into the workforce, they will want the same environment, and that drives demand for the platform.”

Enterprises like Citi purchase enterprise licenses for additional capabilities, such as an overall management environment.

“Within an enterprise you always have more requirements and need to manage these in a certain way, because you’re putting them into production,” Gupta said. “You need to make sure the dependencies of various packages are understood, as opposed to downloading something from here or there in an open source project.”

Anaconda also sells large companies collaboration capabilities that allow multiple groups to work together and manage who is doing what, what kinds of assets are being used, the results and the versions of models being used.

Moreover, the company's enterprise license makes it easier to scale up, Gupta said.

“Downloading the version for your desktop and doing things in school is one thing, but doing things in production on a cloudlike offering with thousands of nodes requires a very different version and scalable platform,” he said.

Citi Ventures' investment philosophy is to find “category-defining platform companies that are going to forward an area, changing the way things are done in a large market,” Gupta said.

It also tries to find companies in areas where Citi could benefit. People around the bank share their needs, and the venture capital arm seeks top providers who have those solutions.

Companies in Citi Ventures’ portfolio include DocuSign, Chain.com, Ayasdi and Jumio.

Anaconda will use the infusion of cash from Citi for basic expenses, Collison said.

“Unlike a lot of VC-backed companies that take more and more rounds of funding and dilute the rank and file of their company, we want to preserve the value of our employees’ equity,” he said. “As we head to break even, and we expect to break even this quarter, we wanted a little cushion. As we got there, Citi stepped up and provided that cushion for us, and we’re grateful for it.”

Challenges of large-scale AI

The hard part of implementing AI tools like Anaconda in large organizations, McWaters said, is getting access to large and sometimes exclusive data sets to train those algorithms.

“That’s where the rubber hits the road in terms of generating value for the business,” he said.

In a recent study the World Economic Forum conducted with Deloitte, banks described siloed environments with raw data that needed to be cleaned up, as well as legacy systems that needed to be revamped for the cloud before they could start to deploy machine learning.

”So while these types of capability acquisitions can be useful, they need to be combined with some challenging, expensive and often relatively unglamorous investments in getting the data and the tech of these legacy institutions up to speed so that you can deploy agile methodologies,” McWaters said.

Mathew Lodge, senior vice president of products and marketing at Anaconda, said its software can support a wide variety of data sources, not just cleaned and scrubbed data, “though obviously that’s the best.” The company helps data scientists bring in data, clean it and get it to a point where it can be used for machine learning, he said.

Rob Galaski, global banking and capital marketing consulting leader at Deloitte, who also worked on the forum's study, emphasized that with AI, banks are venturing into territory that demands expertise not normally found at banks.

“We expect to run into the same types of cultural and human capital challenges we’ve seen in other instances over time, where we need to figure out how the acquisition can plant a seed and build roots across the entire company, as opposed to remaining a seed,” he said.

Editor at Large Penny Crosman welcomes feedback at