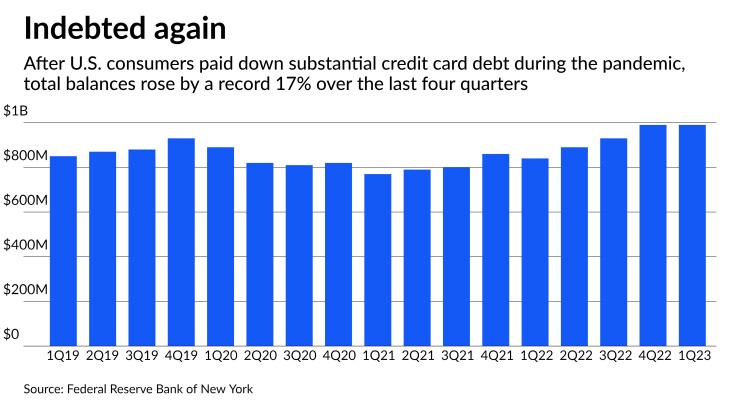

Consumers borrowed heavily on their credit cards at the start of 2023, driving up their balances at a pace that far outstripped past years.

Credit card balances stood at nearly $1 trillion at the end of the first quarter, up from about $840 billion one year earlier, according to a quarterly report on household debt from the Federal Reserve Bank of New York. The 17% yearly increase was higher than any other period in the data's 20-year history.

The increased borrowing reflects changes in the behavior of both upper-income and lower-income consumers. But the two groups are taking on more debt for different reasons, said Ted Rossman, senior industry analyst at Bankrate.com.

Many higher-earning Americans have been spending big on travel, restaurants and entertainment, making up for opportunities they may have missed during the pandemic. But the overall borrowing increase also reflects cash-strapped consumers who are struggling to pay off their cards and carrying higher balances.

Those borrowers are facing higher prices on food, rent and other essentials. And today's soaring interest rates on credit cards mean that more of each payment is going toward paying off interest, not principal.

"These things have a way of compounding over time, and I think that is straining a lot of people," Rossman said.

The New York Fed's report did not break down what drove the balance increases, but it did point to some consumers' troubles in

Delinquency rates have been rising steadily, but from very low levels earlier in the pandemic, New York Fed researchers said on a call with reporters. Many consumers used stimulus money and savings they accumulated during the pandemic to pay down their balances, leading to a lengthy period when credit metrics were exceedingly healthy.

Consumers have shown few signs of slowing their credit card borrowing in recent weeks, according to disclosures by several card issuers.

At Capital One Financial, credit card loans grew 1.3% in April to end the month at nearly $132.7 billion. Discover Financial Services and Synchrony Financial reported similar upticks, according to their April disclosures.

The balance growth was even larger at American Express, which generally has higher-income customers and has long offered premium travel cards. Total credit card loans at Amex rose to $73.8 billion in April, up 2.6% from $71.9 billion in March.

Amex should continue to benefit from the spending boom among well-heeled Americans, wrote Jon Arfstrom, an analyst at RBC Capital Markets, in a note to clients about the New York-based credit card company.

"We believe that the growth outlook is benefiting from consumer tailwinds within the premium customer base focus," he wrote.

Overall during the first quarter, U.S. household debt rose to a record $17.05 trillion, according to the New York Fed's report. That was up 0.9% from the same period one year earlier, and represented a smaller increase than in recent quarters.

The more muted increase in total household debt was largely due to the lowest level of mortgage originations since 2014, the New York Fed reported. Lenders made just $324 billion in mortgage loans during the quarter, down from $859 billion a year earlier and more than $1 trillion in originations during each quarter of 2021.

Mortgage originations boomed during the pandemic, with low rates fueling strong demand for refinancing and prompting many Americans to buy homes. Activity has slowed substantially following the Federal Reserve's interest rate increases.

A

Those homeowners reduced their average monthly payments by $220, giving them more money to spend or pay down other debts.

"The mortgage refinancing boom is over, but its impact will be seen for decades to come," Andrew Haughwout, director of household and public policy research at the New York Fed, said in a news release.