Second in a series

A dusty, government report from the late 1960s offers some insight into why banks and credit unions were able to peacefully coexist for decades, before their relationship descended into a series of lawsuits and lots of name-calling.

According to the report prepared by the Social Security Administration, which oversaw the Bureau of Federal Credit Unions, the precursor to today’s National Credit Union Administration, the average balance in a credit union savings account in 1967 was $549. At the time, credit unions, which are tax exempt, only offered savings accounts and small consumer loans to low- and middle-income members who were linked by a common bond — typically an employer or association — and most banks didn’t view them as competitive threats.

But beginning in the mid-1970s, credit unions steadily expanded the menu of products and services they provided, as well as their fields of membership, all with the blessing of their federal regulator, the NCUA. Today, credit unions count more than 110 million people as members and hold deposits totaling $1.1 trillion. They are major players in auto and mortgage lending and are making deepening inroads into commercial and small-business lending.

As credit unions have come to look increasingly like banks, bankers and their trade groups have questioned why they remain exempt from paying federal taxes.

Credit unions have countered that they have stayed true to their mission by passing the savings on to their members in the form of higher rates on deposits and lower rates on loans. They contend, too, that no matter how large some credit unions have grown, their cooperative structure justifies the tax exemption.

Credit unions vs. banks

It’s a long-running debate that has only heated up in recent months after a prominent U.S. senator questioned whether the tax exemption still made sense and a federal court ruled both for and against credit unions in a lawsuit filed by bankers that challenged credit unions’ ability to expand.

What follows is a look at how the credit union tax exemption came to be and how it has survived for more than a century even as credit unions’ business model has changed.

An industry’s origins

Credit unions in the United States trace their roots to Manchester, N.H., in 1908, when the La Caisse Populaire Ste-Marie was founded to provide basic financial services to French-Canadian millworkers employed by Amoskeag Mills.

The founding of La Caisse Populaire Ste-Marie, now called St. Mary’s Bank, caught the attention of Massachusetts’ banking commissioner, Pierre Jay. Advised by the French-Canadian journalist Alphonse Desjardins and the department store magnate Edward Filene, Jay drafted the Massachusetts Credit Union Act, which became law in 1909.

Both Filene, who pioneered the “bargain basement” retailing concept, and Jay would devote much of the remainder of their careers to promoting the credit union movement. By the early 1930s, 38 states had joined Massachusetts in establishing credit union charters.

Despite the organizers’ efforts, credit unions remained a comparative backwater in the financial services industry, even with their tax exemption. By the mid-1930s, they counted just 119,000 members and barely $2.2 million of deposits.

By contrast, the Bank of Italy, which A.P. Giannini founded in San Francisco in 1906 with a mission similar to La Caisse Populaire’s, had more than $350 million of deposits in California alone by the late 1920s. (Bank of Italy was renamed Bank of America in 1930.)

There was definitely a need for reasonably priced credit. During the debates before enactment of the Federal Credit Union Act, Congress estimated that private, high-interest lenders were lending about $2 billion a year to low-income borrowers.

The first credit unions were owned and managed by their members, who were tied together by a close common bond, usually an employer or an association. In St. Mary’s case, members were also parishioners at St. Mary’s Catholic Church in Manchester’s French Hill neighborhood.

Given their business model built around the close association between members, credit unions were ideally positioned to offer small, unsecured loans at low rates, according to John Walter, a Federal Reserve Bank of Richmond economist who wrote a 2006 study on credit unions.

In place of the collateral banks and other lenders regularly required, credit unions could substitute close knowledge of a borrower’s creditworthiness.

Congress created a national credit union charter in 1934 with the Federal Credit Union Act, signed into law by President Franklin D. Roosevelt. Per the act, membership in individual credit unions was limited “to groups having a common bond of occupation or association" or to groups within a “well-defined neighborhood community or rural district.” The law also set limits of $50 for unsecured loans and $200 for secured credits.

In the early 1940s, banks objected to efforts to raise credit unions’ threshold for unsecured loans to $300 from the original $50 level

Interestingly, a provision exempting credit unions from federal and state income taxes was deleted from the original legislation. The full exemption was granted three years later as part of legislation sponsored by Texas Sen. Morris Sheppard, who had drafted the original Federal Credit Union Act. Sheppard’s 1937 revisions also authorized the Farm Credit Administration, the industry’s original supervisory agency, to research barriers to credit affecting individuals of small means.

Friction between banks and credit unions arose almost immediately after Roosevelt signed the Federal Credit Union Act. In the early 1940s, for instance, banks objected to efforts to raise credit unions’ threshold for unsecured loans to $300 from the original $50 level. Banks clearly sought to keep credit unions’ scope as narrow as possible, but the competitive tension between the two industries wouldn’t erupt into open combat until the mid-1970s.

New structure ushers in era of rapid growth

The Federal Credit Union Act empowered a new agency, the Bureau of Federal Credit Unions, to examine and supervise federal credit unions. During its nearly 40 years of existence, the bureau was treated as something of a bureaucratic stepchild, shunted from its original home in the Farm Credit Administration to the Federal Deposit Insurance Corp. in 1942, the Social Security Administration in 1948 and finally the Department of Health Education and Welfare (forerunner of the present Department of Health and Human Services), when that cabinet-level office was created in 1953.

Those agencies “weren’t really interested in credit unions,” Susan Hoffmann, a professor of political science at Western Michigan University, said in a recent interview. “Nobody really wanted them.”

Hoffmann chronicled the creation of the NCUA in her 2001 book, “Politics and Banking: Ideas, Public Policy and the Creation of Financial Institutions.”

By the end of the 1960s, Congress, led by Rep. Wright Patman, concluded that burying the regulator inside larger bureaucratic organizations had stymied the credit union industry’s growth, and in 1970 it established the NCUA as an independent agency.

Patman, who represented Texas’ 1st congressional district from 1928 until his death in 1976, had helped Sheppard win passage of the original Federal Credit Union Act during the New Deal. Thirty-six years later, Patman and his allies in Congress aimed to shift credit unions’ focus from assisting disadvantaged populations, an enterprise that had understandably commanded HEW’s attention during the 1960s War on Poverty, to a more ecumenical mission: serving the financial needs of millions of ordinary, middle-income Americans.

“There was a philosophical split,” Hoffmann explained. “Where early on, people viewed credit unions in terms of offering help to lower-income people or as a kind of social-services agency,” Patman and his supporters saw the industry “as a platform for middle-income households, and by the 1970s, their financial needs were beginning to expand.”

The creation of the the NCUA proved to be a crucial turning point in bank-credit union relations. For nearly four decades, banks and credit unions had coexisted more or less peacefully, largely because credit unions remained limited-purpose institutions that had evolved little beyond their original mission of providing credit and encouraging thrift among people of “small means.” Beginning in the 1970s, however, credit unions essentially reinvented themselves, as the new regulator oversaw the introduction of a host of products, including checking accounts, certificates of deposit and mortgages.

New products combined with the gradual loosening of field-of-membership restrictions that began in the 1980s triggered an explosion of growth. Credit union assets, which totaled $12.5 billion in 1971, mushroomed to $64.5 billion a decade later. By the end of 1991, assets topped $225 billion, and they now stand at just under $1.4 trillion.

Bankers declare war

To say that credit unions’ rapid growth set off alarm bells in the banking industry is putting it mildly.

According to Chris Cole, the senior regulatory counsel at the Independent Community Bankers of America, executives at his first employer, First Virginia Bank, were casting nervous, sidelong glances at credit unions when he started there in the early 1980s.

“They were worried about them even then,” Cole said in an interview.

As the competitive pressure continued to grow over the past four decades, the tension frequently erupted in highly publicized legal battles. In the mid-1970s, for instance, the American Bankers Association sued to block credit unions from offering interest-bearing checking accounts, only to see a short-lived courtroom triumph overturned by Congress, which authorized negotiated order of withdrawal, or NOW, accounts in 1980.

The conflict reached another white-hot state following the NCUA’s decision to abandon a time-honored policy requiring that a single common bond unite all members of a credit union. In 1982, the agency began permitting institutions to include multiple common bonds, unrelated groups, each with its own separate common bond. Several credit unions took advantage of the looser field-of-membership policies to go on unprecedented growth sprees. Total membership at AT&T Family Federal Credit Union in Winston-Salem, N.C. (now the $2.2 billion-asset Truliant) increased from 46,000 in the late 1980s to more than 110,000 half a decade later, as it added a number of groups.

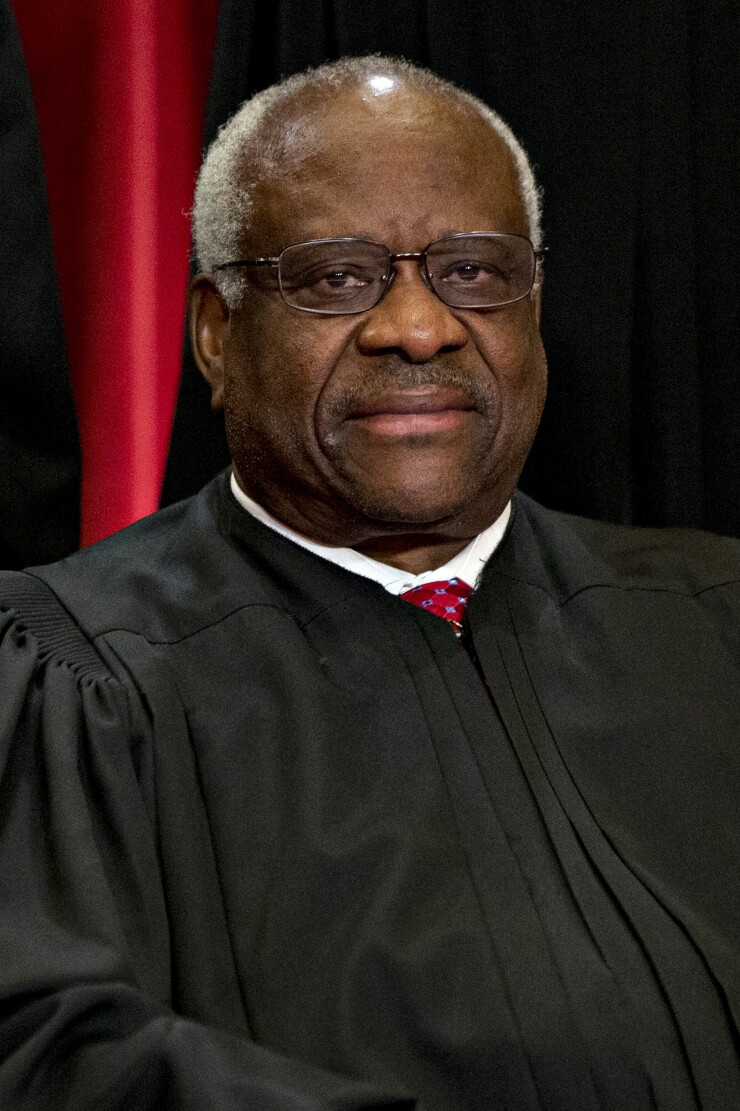

Banks cried foul. In 1990, the ABA sued the NCUA again, arguing that multiple common bonds violated membership restrictions written into the Federal Credit Union Act. As with the earlier checking-account lawsuit, banks prevailed in court, this time the U.S. Supreme Court, where Justice Clarence Thomas held for a five-member majority in February 1998 that the NCUA’s post-1982 field-of-membership policy violated “the unambiguously expressed intent of Congress that the same common bond of occupation must united each member of an occupationally defined federal credit union.”

But once again, that victory was short-lived, as Congress rushed the Credit Union Membership Access Act into law in August, authorizing multiple common bonds. As a concession to banks, the new law capped an individual credit union’s business lending portfolio at approximately 12.25% of total assets.

Since 1998, the conflict between the two industries has centered mainly on issues involving membership and business lending. Credit unions have continued to seek looser restrictions on membership while fighting to raise or eliminate the cap on business lending. Banks have pushed back, continuing to resort to lawsuits to fight expanded member business lending and looser membership restrictions.

Into the early 1990s, it seemed bank groups could count on some sympathy from the judiciary. Indeed, judges frequently commented on credit unions’ rapid growth. In the checking-account case, for instance, the appeals panel noted in its 1979 decision that credit unions and banks “were becoming homogeneous types of financial institutions offering virtually identical services to the public.”

And Justice Thomas

Over time, however, those reservations faded as Congress continued turn a blind eye to banker complaints and maintained the tax exemption despite its mounting costs in terms of foregone revenue. In January, the Tax Foundation, a Washington think tank concluded that the exemption would cost the Treasury roughly $14.4 billion between 2016 and 2020.

The NCUA has continued to overhaul key regulations in recent years, making it easier for credit unions to make business loans and expand their fields of membership — while bankers have continued to challenge those actions.

In a suit filed in March 2016, the Independent Community Bankers of America challenged an NCUA ruling that allowed credit unions to purchase commercial loans and loan participations originated by other institutions without counting them against the 12.25% cap. In January 2017, a federal judge ruled the

Yet there are signs the tide may be turning. In December 2016, the ABA filed a field-of-membership challenge, claiming the NCUA violated the law loosening restrictions on community-chartered credit unions by allowing them to serve large, vaguely defined regions, and last month, a federal judge in the U.S. District Court for the District of Columbia

In her March 29 ruling, Judge Dabney L. Friedrich found that provisions allowing credit unions to use combined statistical areas to delineate fields of membership and to allow rural districts with up to 1 million residents — even they crossed state lines — were too expansive to be considered well-defined neighborhoods or rural districts.

Referring specifically to the NCUA’s policy on field-of-memberships within large core-based statistical areas, Friedrich concluded that it “pushes against the outer limits of reasonableness.”

Of course, even if that court ruling holds, credit unions will still retain what they treasure most — their tax exemption.

Tomorrow: What the financial services landscape would look like if the tax exemption were eliminated.