As more U.S. workers tap new ways to spend their wages before payday, one question looms over the nascent early wage access industry: Are these on-demand products a form of credit?

If so, the raft of young companies in the sector are lenders, and thereby subject to a range of federal and state regulations. If not, the providers should be able to operate with greater confidence that they will not run afoul of regulators.

Two recent moves by the Consumer Financial Protection Bureau can be viewed as tentative steps toward resolving the regulatory uncertainty. In late November, the agency

And last week, the CFPB

Firms that want a regulatory stamp of approval hope that it will give them an advantage in discussions with employers. Employers, which can partner with these companies to enable their workers to access wages that have been earned but not yet paid, are often interested in providing the service to employees whose tight finances lead to mismatches between when their bills are due and when their paychecks arrive.

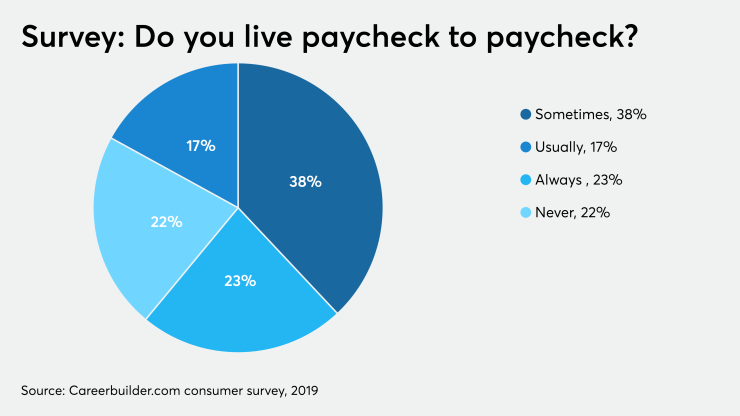

Some 78% of U.S. consumers said that they sometimes, usually or always lived paycheck to paycheck in a 2019 survey by Careerbuilder.com. Still, employers often express concern about the lack of regulatory certainty in the early-pay sector.

“We view this as good news for the industry, and frankly for employers and employees,” said David Reidy, PayActiv’s chief legal officer. “The more clarity and certainty that we can get, the more we feel this will be a standard benefit offered to working people.”

In 2019, PayActiv led an

The CFPB recently granted that status to PayActiv, as long as its products remain within certain parameters. Under one model that got the agency’s blessing, PayActiv charges a $1 fee when employees access earned wages, with fees capped at $5 during each two-week pay period. The bureau said in its earlier advisory opinion that companies that charge “nominal” fees and meet certain additional standards can similarly seek its approval.

While the CFPB’s moves mark a watershed for the industry, there are reasons to question how enduring and market-shaping they will ultimately be.

First, the announcements came in the waning days of the Trump administration, and some industry officials wonder whether the incoming Biden administration, which is expected to replace CFPB Director Kathy Kraninger, will take a different approach.

Whoever heads the CFPB next is likely to be more attuned to the concerns of consumer advocacy groups than Kraninger was. Though early wage access products typically cost considerably less than payday loans, consumer advocates have expressed worry that some of the offerings could nonetheless trap consumers in a cycle where workers are essentially borrowing repeatedly against their next paycheck.

Lauren Saunders, associate director at the National Consumer Law Center, spoke out Thursday in opposition to the CFPB’s approval of certain PayActiv products. She argued that the bureau should not be offering new, questionable interpretations of the law without providing members of the public the opportunity to comment.

“The CFPB should not be in the business of ‘approving’ specific products, and this approval is based on sloppy and flawed legal reasoning that will be cited beyond PayActiv,” Saunders said in an email.

The widely anticipated change at the top of the CFPB could cut in different directions. One possibility is that the bureau will formalize its recent advisory opinion into rules, which could have the effect of encouraging more standard product offerings at various companies. Another scenario is that the bureau backs away from issuing additional approval letters like the one it sent to PayActiv.

Early wage access providers use a wide variety of business models, which means that any regulatory initiative will likely help some firms and hurt others.

Companies that do not partner with employers, but instead offer early wage access directly to consumers, are generally seen as more vulnerable to the possibility that regulators will classify them as lenders. Earnin, which has drawn

Even some firms that partner with employers seem unlikely to seek the CFPB’s approval. One example is DailyPay, which charges $1.99 for next-day pay advances and $2.99 for instant transfers. The fees can be paid by the employer, the employee or a combination of both, according to the company’s website.

DailyPay does not use employer-facilitated payroll deductions to get repaid, a method that is required by the CFPB in order to qualify for the agency’s determination that a firm is not offering credit.

DailyPay CEO Jason Lee argued that the detailed criteria laid out by the CFPB will cause headaches for human resources departments that are interested in providing the employee benefit. “For the models specifically covered by this announcement, employers will have a tough time keeping the vendor compliant,” he said.

The CFPB is unlikely to be the only governmental entity that has a say on the shape of the early wage access industry. On Monday, state Assembly members in New Jersey are expected to vote on legislation that would establish a legal framework for the industry.

“I still believe at the end of the day, states will probably be in the driver’s seat in terms of providing long-term certainty,” said Dan Quan, a former CFPB official who has advised companies in the early wage access sector.