To justify its September 2011 decision to fire Claudia Ponce de Leon, Wells Fargo claimed the Southern California bank manager drank excessively and that she engaged in other inappropriate behavior.

Three weeks before her termination, she had called the company ethics line – to report that bankers under her supervision in the city of Pomona were opening fake client accounts to meet sales goals. This was almost exactly five years before regulators fined the bank for opening millions of bogus accounts nationwide for clients without their knowledge.

The Department of Labor, in investigating her complaint under whistleblower protection laws, found no evidence to support the bank's allegations against Ponce de Leon. On Dec. 6 of last year, it put Wells on notice that it is likely to order the company to reinstate her to her former job, according to documents obtained by American Banker.

If the department issues such an order, Ponce de Leon would become the second Wells Fargo whistleblower that the federal government is known to have told the bank to rehire. On Monday, the department’s Occupational Safety and Health Administration announced

Such reinstatements are unusual, and could signal a more aggressive approach by the government to protecting whistleblowers in the financial services sector.

"It is rare" to see reinstatements, said William Black, a former bank regulator known for being among those who exposed the “Keating Five” savings-and-loan scandal in 1989.

"Given the number of whistleblowers from the big banks and the incredible frequency of retaliation, we would know if there were any substantial numbers of reinstatement orders," said Black, who is now an associate professor of economics and law at the University of Missouri in Kansas City. Last year he co-founded Bank Whistleblowers United, which advocates on behalf of industry employees who speak up about actual or potential wrongdoing.

Wells Fargo said in a statement that it has provided “rebuttal evidence” to OSHA’s preliminary decision.

“We disagree with the findings and we will continue to defend ourselves to ensure all facts have been fully considered,” the bank said. "We take seriously the concerns of current and former team members.”

A spokeswoman for Wells Fargo said she could not further discuss the details of a bank employee case.

Commended for years, then fired

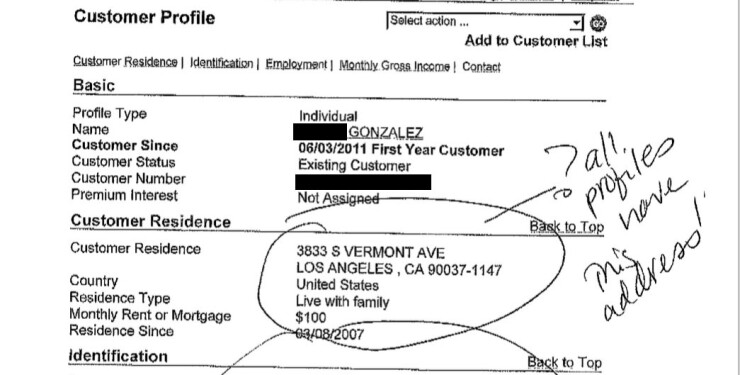

The OSHA decision, which runs 78 pages, is full of Ponce de Leon's handwritten notes on new client accounts that appear, on their face, to be falsified.

The notice also contains 20 pages of commendations that Wells Fargo awarded to Ponce de Leon over a period of six years, the last one of which it awarded six months before firing her.

Ponce de Leon deserved protection under the law when she "reported conduct that she reasonably believed amounted to bank, wire and mail fraud involving regarding at least three private bankers," Teri Wigger, acting assistant regional administrator in the San Francisco office, wrote in the preliminary decision sent to the bank on Dec. 6.

"Preliminary reinstatement of Claudia Ponce de Leon is warranted," Wigger wrote.

Ponce de Leon's lawyer, Yosef Peretz, said he has provided a rebuttal to the bank's challenge.

Ponce de Leon, who now works for another bank in the Los Angeles area, according to Peretz, could not be reached for comment.

OSHA did not release the identity of the Los Angeles-based wealth manager, who the bank fired in 2010, after he blew the whistle on suspected fraud on the part of two bankers he supervised.

Although Wells Fargo also says it will fight OSHA's decision in that case, too, the order requires the bank to rehire him into a comparable position "immediately."

Wells said it has not yet done so. "The individual hasn't been reinstated," a bank spokeswoman said. "Wells Fargo is evaluating its options having just received the preliminary order."

Evidence of retaliation

In a scandal that riveted national attention last year, Wells Fargo admitted in September that it opened about 2 million fraudulent accounts without the permission of customers. It agreed to pay $185 million to federal regulators and the City and County of Los Angeles to settle the case. The bank's CEO, John Stumpf, resigned over the controversy after the company fired about 5,300 midlevel bankers nationwide.

Stumpf’s successor, Tim Sloan, told employees in November that retaliation against whistleblowers was unacceptable and “

OSHA has come in for heavy criticism for alleged mishandling of Wells Fargo whistleblower cases. Former federal investigators claim that

In response to concerns like these, former Secretary of Labor Tom Perez ordered a "top-to-bottom" review of the Labor Department’s whistleblower protection program last year.

In a statement, OSHA said that it "has been working diligently to streamline investigative processes to ensure that whistleblower complaints are resolved quickly and fairly."

To receive the fullest protection under the law, most financial services employees who report misconduct must file complaints with OSHA's Whistleblower Protection Program, which handles such complaints under 22 different statutes, including Sarbanes-Oxley and Dodd-Frank.

In the Ponce de Leon case, there is "reasonable cause to believe" that Wells Fargo retaliated against her when it fired her on Sept. 28, 2011, Wigger wrote in the OSHA decision.

Nonworking numbers, dubious addresses

Twenty one days earlier, Ponce de Leon had called Wells Fargo's ethics line to report that one of the personal bankers she supervised allegedly had filled out new client account forms using the Vermont Avenue address of a Los Angeles County building, nonworking phone numbers and email addresses that repeated across unrelated customer accounts.

In response, the bank painted Ponce de Leon as a manager who drank too much at a lunch with a banker she supervised and engaged in other unprofessional conduct.

OSHA disagreed.

"While [Wells Fargo] claimed [Ponce de Leon] had a long, well-documented history of unprofessional conduct, the evidence does not support that assertion," Wigger wrote.

Wells Fargo provided the following statement about its overall treatment of whistleblowers:

"If team members ever see activity that is inconsistent with our Code of Ethics and Business Conduct, we encourage them to report it immediately, and if a team member thinks that they or someone else has been retaliated against for reporting an issue, they should report it as soon as possible to our EthicsLine, HR advisor, employee relations or their manager. Wells Fargo will take measures to protect team members from retaliation."

However, Ponce de Leon and the Los Angeles wealth manager followed many of these instructions closely right before they were sacked, OSHA found.

A bank spokeswoman did not immediately reply when asked to identify any whistleblowers the bank has protected.

After losing her job, Ponce de Leon ended up working for Nordstrom's for $9.80 an hour for nine months before going to work for another bank, according to OSHA.

The anonymous wealth manager, like so many other whistleblowers, lost his career. Ever since Wells Fargo fired him, he has not been able to find another position in banking.