Flagstar Bancorp has been busy the past few months. In addition to agreeing to a

The $18 billion-asset Flagstar last week announced the

CEO Alessandro DiNello says the Fed move will not have have a big operational effect, since the central bank's order was markedly less restrictive than the one the Office of the Comptroller of the Currency terminated in December 2016. On the other hand, DiNello said it provides a strategic flexibility the company has not been able to enjoy for a long time.

In an interview with American Banker this week, DiNello reflected on the effort it took to get out from under regulatory scrutiny and discussed how Flagstar expects to capitalize on its new options.

Here is the interview, which has been edited for length and clarity.

Now that the Fed and OCC orders have been terminated and you can reflect on the experience, was it a tough situation to manage?

ALESSANDRO DiNELLO: When you start down that path of having to address all the things that were in those orders, it was a monumental task. We weren’t equipped with the right people to really attack it at first. It was hard to bring the right people into the organization. If you’re on the outside and considering joining an organization, and you look at everything that company’s dealing with: it’s not profitable, it’s operating under two regulatory orders. It’s like, "Why would I go to work there?"

It put a big, big burden on a small number of people early on. Then, over time, as we were able to build some strength and start to get the company back on its feet, we were able to attract good people. That made it better because we could spread the work over more people.

Things got better and better, but during my first 24 months as CEO, there was more than one time I slept on my couch. You had specific deadlines you had to meet on the regulatory side, and they weren’t particularly forgiving about those deadlines. You had to do what you had to do to get it done.

There were a lot of people here that worked awful hard to get us to a point where we could start to breathe a little bit and then think about changing this company from being a mortgage organization to a bank. It’s a real credit to all the people that worked so hard here to make this change. It’s really quite remarkable.

What would you say are the biggest benefits that have flowed from the experience?

We now have a risk management program that will support the bank for a long time. We’re an $18 billion company. We can grow a lot and not have to change our risk and compliance programs very much because there’s so much rigor in them today.

And though today the regulatory oversight is a little more reasonable than it was a few years ago, things ebb and flow. I’ve been here 39 years. I know it’s going to change again.

In the

The important thing is, it gives us much more latitude to execute on capital strategies at the holding company that would have been less under our control previously. Take dividends as an example. We’re not making any commitment we’re going to pay a dividend, but now it’s more within our control to decide when and how much we pay, as opposed to having to go through a nonobjection process with the Fed.

And we can continue to acquire. Everything we’ve done so far have been asset purchases. When you buy the assets of a company, it’s not a holding company transaction, it’s a bank transaction. We were able to do those because we were no longer under an order at the bank level.

So now that this is lifted at the Fed level, if we wanted to buy an entire company, regardless of whether it was a bank, a consumer finance company or another business, we have much more latitude to do that.

Did you find it frustrating to have to sit on the sidelines as the price for banks rose over the past year?

While I get your point relative to what costs are in the marketplace, I don’t think it’s caused us to miss opportunities. I think if you’re patient, the right deal will come along.

Right now, we have our hands full with this Wells Fargo branch acquisition. We’re planning for that to close in early December. For the next few months we’re working on getting that under our belts. Then we’ll need some time to digest it afterwards. So, we’re a little way away from worrying about M&A. I think in time the right situation will present itself, and we plan to take advantage of it when the opportunity arises.

Even under two regulatory orders, Flagstar managed to find a way to stay active in the M&A market. Can you talk about your strategy of buying assets and the significance of the recent branch purchase from Wells Fargo?

There were a number of things that made sense for us. The first is that we are bringing $2.3 billion of core consumer deposits in the bank. The reason they are clearly core, and no one would argue otherwise, is the cost of these deposits is 5 basis points. These are not customers that are jumping from this bank to that bank to get the best rate. They’ve been customers of those branches for years and years.

Secondly, we’re adding 52 branches in contiguous Midwest markets that will give us the No. 1 market share in the Upper Peninsula of Michigan, as well as the No. 1 market share in northern Indiana. It doubles our consumer customer base from 200,000 to 400,000, which is a transformational change when it comes to the balance sheet of the company.

Much has been made about Flagstar’s shift from a mortgage lender to commercial bank. Can you discuss the progress of the transformation?

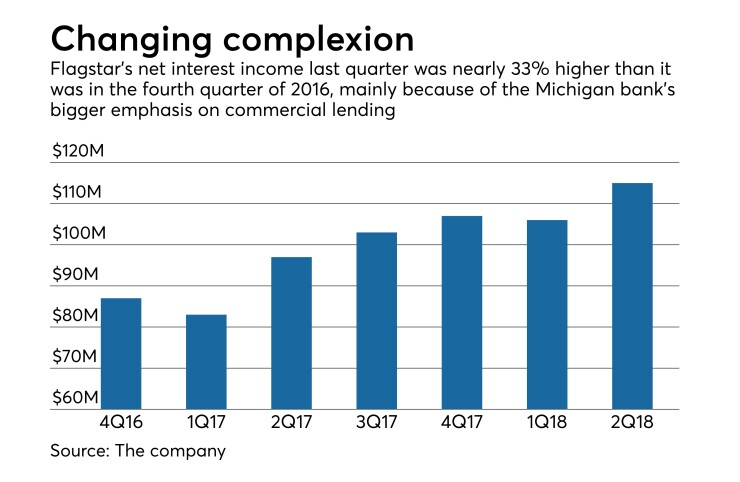

Our net interest income keeps growing quarter over quarter, while, because of competitiveness and the decline in the size of the mortgage industry, the revenue from the mortgage business, from the sale of mortgages, has declined over that same period.

We’re still earning at the top end of the market for midsize banks, even though the mortgage revenue has declined fairly significantly over the past 24-36 months. Three years ago, if we would have had the mortgage revenue we do today, we would be deep in red ink.

How big a role does Small Business Administration lending play in your plans?

It’s an area of opportunity for us. While we’re doing more in that area, we’re not doing as much as I’d like to do. One of the points of growth that we are targeting is the SBA, because we do think that is an opportunity to help us build our banking business even further.

There’s no denying the dramatic turnaround in asset quality over the past five years. All the trends continue to head in a positive direction. How long can that continue?

We have yet to see any cracks in credit. The delinquency level across all lines of business has remained at historically low levels. We actually don’t even have one commercial loan that’s over 30 days delinquent. That said, I’ve been around here 39 years. I know there’s a downturn coming.