Millennials and Generation Z have a strong desire to make an impact through charitable giving, especially after years of political upheaval, a sharp focus on racial injustice and the havoc of a global pandemic.

Nearly three out of four millennials have sent financial aid to family or friends or donated to a nonprofit since the COVID-19 pandemic began, according to a consumer payment behavior report issued last fall by Early Warning, the company behind the payment app Zelle. That was the highest rate among any of the generations polled.

Gen Z had the second highest giving rate at 66%. The report defined Gen Zers as 18 to 24 years old, and millennials as 25 to 34.

Challenger banks like

They are finding ways to automate giving so that it’s as simple as a click or a set-it-and-forget-it payment. Some banks also offer mechanisms for charitable giving; for instance,

Some fintechs are helping banks create giving tools. Amicus.io in Charlotte, North Carolina, helps banks offer donor-advised funds to retail customers, and Harness will help banks automate donations to local charities.

Customers and employees expect companies to do more than give lip service about helping to solve some of the world’s complex social issues.

“You can’t be Switzerland anymore,” said Bryan de Lottinville, founder of Benevity, a software company in Calgary, Canada, that helps companies, including financial institutions, run corporate purpose programs. “You have to stand for something, say something, otherwise the customers aren’t listening to you.”

Banks and fintechs are encouraging acts of generosity by making it easy for customers to transfer money to various causes through keep-the-change programs, recurring payments and donor-advised funds, charitable investment accounts traditionally regarded as vehicles for the wealthy.

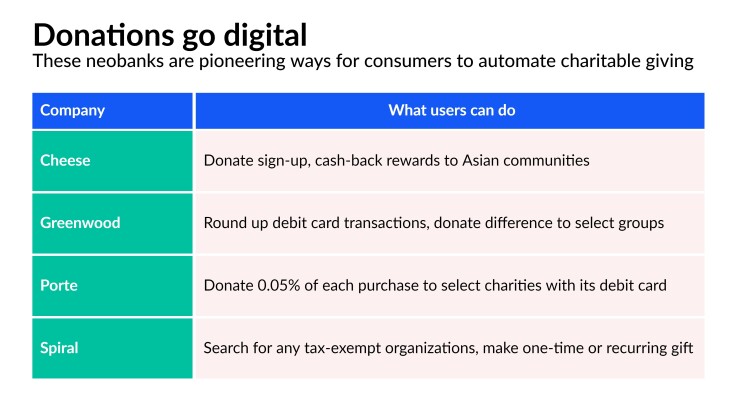

Opening an account at Greenwood Financial, a digital bank for Black and Hispanic customers, triggers the donation of five meals to a family through the nonprofit Goodr. Customers can also round up debit card transactions and direct the difference to the NAACP, the United Negro College Fund and other groups.

The founders of

The European challenger bank Revolut carried its donation feature over to the U.S. version of the app. Users can decide whether they want to round up their purchases to the nearest dollar, set up recurring donations or make one-time payments to one of three partners in the app: Feeding America, Habitat for Humanity and OutRight Action International.

Charitable giving is a central feature for Porte. Users of this neobank can select an organization such as GLAAD or Save the Children in their app’s dashboard, and the company will donate an amount equal to 0.05% of each purchase made with its debit card, at no cost to the user.

“Porte funding the program makes it easier for [customers] to give back without challenging their own budget or savings goals,” said Melanie Few, the chief marketing officer of Porte.

Spiral combines checking, savings and philanthropy into one app. Users can search for any tax-exempt organization and send money in monthly or one-time payments. Spiral matches these donations up to $150 per year, provides automatic reports for tax returns and reveals tidbits about how donations have made a difference.

Banks have not yet rolled out a similar set of features to the masses the way Spiral has done, said Bryce VanDiver, a partner at the technology and management consultancy Capco.

“Spiral did a really nice job out of the gate from a branding standpoint, clearly showing what its value proposition is, along with more traditional things like goal-based savings and no fees or minimums,” said VanDiver. “It’s a speed-to-market play that will be harder for traditional financial institutions to replicate.”

Instead, he foresees banks partnering with fintechs to deliver such tools to their broad customer bases.

Amicus.io is capitalizing on the popularity of donor-advised funds and opening the door for banks to offer them to their retail customers.

These accounts, commonly sponsored by brokerage firms, community foundations or single-issue charities, let donors make tax-deductible contributions, invest the money and designate grants to charities of their choice. The National Philanthropic Trust’s 2020 Donor-Advised Fund Report found that the number of DAF accounts in the U.S. increased by 19.4% in 2019 from the previous year. A COVID-era survey from the same organization found that grants from DAFs to qualified charities rose 29.8% in the first six months of 2020 compared with the same period in 2019.

Amicus.io’s proprietary platform is white-labeled to institutions, and bank customers will typically be able to log into their accounts and see their DAFs in the same dashboard as their checking and savings. The software performs all the calculations necessary for maintaining a donor-advised fund and enables real-time notifications for the account holder, meaning customers can easily check the status of a grant online.

“As most people are experiencing their banking through a digital platform, being able to have your charitable giving and storing your tax receipts in one place, and bringing it to the center of mind when it comes to managing all your assets, is something we are looking for,” said Joan Lundell, director of user experience and strategy at Amicus.

Amicus.io is working with five of the top 10 banks in the U.S., but cannot name its clients.

Harness, in Tampa, Florida, provides fundraising tools for nonprofits. The next phase of its business will help community banks and credit unions set up automated donation programs, which it will pilot with around 30 financial institutions in the fourth quarter of the year.

Bank customers who opt in will see each debit card purchase rounded up to the nearest dollar. Half of that amount will benefit a local nonprofit (the customer will choose one out of several options provided by the bank); the other half will fund a prize pool with gift card drawings to take place daily and larger prizes, such as box seats to a local sports team, that will be handed out quarterly. Customers can cap their contributions each month.

The founders of Harness, Miraj Patel and Andrew Scarborough, point out that banks will benefit from increased interchange revenue if customers are incentivized in these two ways to swipe their cards. The emphasis on local organizations can also be a selling point for community bank and credit union customers.

“These small- and medium-sized nonprofits are usually the bottom of the barrel,” said Patel, who is also the CEO of Harness. “Even though they are creating the most immediate impact for the communities they serve, they are usually the last to get funds. You can use the affinity cardholders have towards these local initiatives as a competitive advantage.”