- For more content like this, from the industry leader in global payments coverage, please visit

PaymentsSource.com .

As

The

“The federal relief programs that helped us deliver better than expected results in 2020 have created a headwind to our revenue and earnings in 2021," Henry warned during a fourth-quarter earnings call.

Green Dot also benefited from an increase in consumers shopping online and the launch of its GO2bank.

“The results we're seeing with GO2bank are very promising and exceeding our expectations, “ Henry said. “For example, more than half of our customers have opted in for overdraft protection and applications for our secured card are 20% higher than our original forecast. This level of demand gives us confidence in our strategy and our continued investment to market and expand this product.”

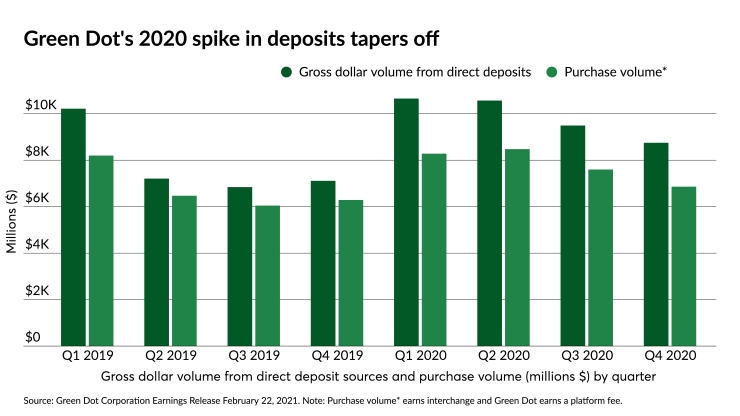

Gross dollar volume from direct deposit sources reached $8.75 billion in the fourth quarter, a year-over-year increase of 23%. Purchase volume rose 9% from a year earlier to $6.86 billion.

But on a running quarterly basis during 2020 for both of these metrics, Green Dot showed declines, reflecting similar downward quarterly performances in 2019.

“Gross dollar volume in the quarter was also boosted by a second round of stimulus funds received late in December, which added approximately $570 million during the last two days of 2020," Jess Unruh, interim chief financial officer and chief accounting officer at Green Dot, said in the earnings call. “Our gift card revenue has been negatively impacted by the decline in retail foot traffic because of COVID.”

Henry called the performance of its PayCard unit “our Rocky Balboa story for 2020” as the sales team doubled down on its efforts to add roughly 1,300 new corporate clients in 2020 boosting the unit’s revenue for the year by 6% in what had been expected to be a down year.

Overall, Green Dot reported a net loss of $24 million for the fourth quarter, for a loss per share of 45 cents. However, after accommodating an impairment charge, Green Dot’s adjusted non-GAAP net income was $17.3 million, which gave it earnings per share of 31 cents, 13 cents better than

Total operating revenue was $284.3 million in the fourth quarter, up 14% from a year earlier and besting the projection of analysts at

In his forecast for 2021 performance, Henry emphasized the company's dependence on government stimulus funds. The guidance incorporates only the late-December relief package that has stimulus funds through January, and the supplemental federal unemployment benefits of $300 per week through March 2021.