Are bankers and credit unions about to open up yet another front in their long-running conflict?

Signs appear to be pointing in that direction as the National Credit Union Administration mulls whether to formally propose a rule that would open the door to broader and more frequent use of alternative capital.

Bankers strongly oppose any sort of alternative capital for credit unions. The American Bankers Association, which is

“Instead, NCUA should be encouraging — and facilitating — conversions of credit unions to federal mutual savings bank charters should these institutions wish to expand their access to capital or their scope of operations,” Brittany Kleinpaste, the ABA’s director of economic policy and research, wrote in the group’s May 9 letter.

James Kendrick, first vice president of accounting and capital policy at the Independent Community Bankers of America, said alternative capital was equal in importance to member-business lending, the issue over which the

“Alternative capital will be used to lever capital and make more member business loans,” Kendrick said. “It turns otherwise narrowly focused credit unions into commercial banks that avoid paying taxes.”

While credit unions have long sought access to additional sources of capital, the issue has taken on renewed importance in recent years due to the NCUA’s adoption of a risked-based capital regulation that will require “complex” credit unions with riskier business models to hold more capital.

While the Federal Credit Union Act bars alternative capital from being considered in net worth calculations, it could be used to satisfy risked-based capital requirements.

The comment period on an advance notice of proposed rulemaking on alternative capital ended on May 9, and agency officials are just starting to comb through the more than 750 letters.

When the agency eventually releases a draft, it’s

Bankers have "clearly viewed this as something that would change the game,” Leggett said. “In their view, credit unions don’t get [access to alternative capital] without giving up their tax exemption.”

While it’s highly unlikely credit unions would ever willingly bargain away their federal tax exemption, it’s clear that gaining broader access to capital markets would represent a significant change to the status quo.

Unlike banks, which can tap into the capital markets at will, the Federal Credit Union Act defines earnings as the sole source of capital for most credit unions. There is one exception: Low-income designated credit unions are allowed to issue what the law describes as “secondary capital accounts,” though just a handful have taken advantage of the option.

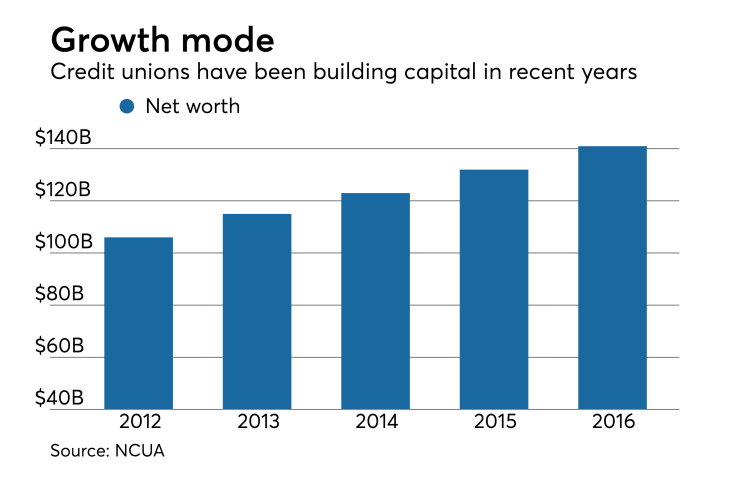

A total of 77 credit unions reported $180 million of secondary capital on their books at the end of last year. That compares with 5,785 total institutions and $141 billion of retained earnings, according to the NCUA.

“We have researched the potential market at some length. Based on our review no viable market currently exists,” Keith Sultemeier, president and CEO of Kinecta Federal Credit Union, a $4 billion-asset, low-income-designated credit union in Manhattan Beach, Calif., wrote in a May 3 letter. He said a market could develop if access were broadened.

Despite the seeming lack of appetite for alternative capital today, several institutions submitted letters strongly supporting a broader use of alternative capital, asserting that doing so would provide an additional way to grow and provide a cushion in difficult times.

“Credit unions facing pressure on capital levels have few choices, other than increasing fees, making loan rates less attractive or shrinking assets,” wrote Mike Ryan, general counsel at the $17.2 billion-asset Boeing Employees Credit Union in Tukwila, Wash.

“Therefore, allowing for supplemental capital … is even more important for federal credit unions than other financial institutions,” Ryan added.

In a May 9 letter, Alaska USA Federal Credit Union's chief risk officer, Cory Schwab, highlighted the potential boon to growth alternative capital could offer.

“It could assist with credit union product diversification, geographic expansion, and merger activities through strategic balance-sheet positioning,” Schwab wrote. “This would allow the industry to strategically plan for future periods while enhancing membership offerings.”

Out of the dozen credit union CEOs who submitted letters, only one opposed greater access to alternative capital.

Steve Brown, CEO of the $42.8 million-asset Alcoa Community Federal Credit Union in Benton, Ark., said his experience working in the savings and loan industry gave him a unique insight into how “good intentions of deregulation … killed that industry, hurt the national economy and harmed consumers in general."

The credit union industry "is pushing hard for regulatory relief that would allow stronger competition with the commercial banking industry and are losing sight of the unique nature of the industry,” Brown wrote in his May 3 letter.

The two biggest credit union trade associations, the Credit Union National Association and the National Association of Federally-Insured Credit Unions, strongly endorse additional capital options as long as credit unions are given wide latitude to develop the types of instruments ultimately offered to investors.

CUNA urged NCUA to permit what it termed “limited experimentation,” allowing individual credit unions to figure out which capital instruments were best suited to their markets.

“We recommend that, at this stage, the rule not limit permissible supplemental capital instruments to one or two restrictively defined instruments,” said Andrew Price, CUNA’s senior director of advocacy and regulatory counsel.

NAFCU went even further, suggesting a pilot program involving well-run and well-capitalized credit unions. Officials could examine their experiences with alternative capital to determine “best practices that could benefit the entire industry,” said Carrie Hunt, general counsel and executive vice president and government affairs.