BB&T’s CEO, Kelly King, wants to step up the pace of branch consolidations this year, even closing some branches that are profitable. The Winston-Salem, N.C., company will need fine levels of detail to pinpoint the correct branches to close and it plans to rely heavily on geographic information systems software.

As BB&T and other banks look for every possible competitive advantage, no matter how small, GIS software is playing a key role in developing ever-more-precise views of data. While GIS tools have been around for years, the software has become more advanced recently and more and more banks are using it for an increasing number of projects.

“You could look at a spreadsheet with 30 columns and try to figure out your decision, or you could look at a map and see it all in one place and the decision becomes much more apparent,” said Jon Voorhees, a former senior vice president for retail distribution at Bank of America, who is now an adviser at Peak Performance Consulting Group in Austin, Texas.

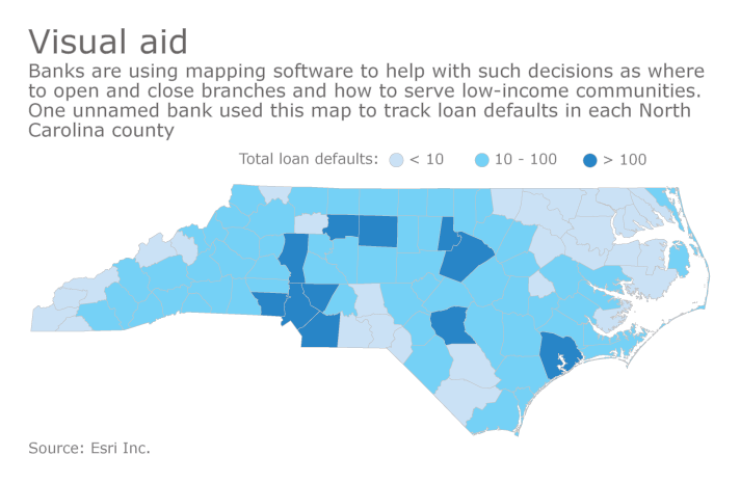

As recently as 2010, banks’ use of maps consisted of paper stapled to the wall marked up with Sharpies, said Helen Thompson, the financial services sector leader at Esri, the Redlands, Calif., company that makes ArcGIS software. Now, banks create maps using multiple layers of data, tracking everything from the rate of nonperforming loans to levels of homeownership in specific census tracts. Mapping software can also help banks monitor potential security threats and even manage where and how to deploy executive talent.

“If there is any sort of data that can be tied geographically to your business, we can incorporate that data into a map,” said Elio Spinello, a partner at RPM Consulting in Northridge, Calif., which creates sophisticated maps for banks and credit unions.

Branch consolidation is one of the most widely used applications of GIS software. During the recent round of fourth-quarter earnings reports, several bank CEOs said they planned to accelerate branch closings this year in an effort to improve profits.

“We're being more aggressive in terms of branch closings where [one branch is] actually profitable, but by combining two profitable ones into a new branch, then two plus two becomes five,” King, who is also chairman of the $214 billion-asset BB&T, said during its earnings call.

David White, a BB&T spokesman, said in an emailed statement that BB&T “employs extensive mapping software that uses proprietary data, along with standard demographic data, to aid in our branch analysis decision making,”

For branch-consolidation decisions, a bank can map its own branches and its rivals’, as well as demographic data, housing data and physical barriers to branch access, such as a river or interstate highway that blocks traffic.

“We are seeing a lot more branching decisions being scrutinized more empirically,” Spinello said. “Our clients really focus their requests for us to look at every possible scenario and quantify the cost of each decision.”

Banks are scrambling to hire talent with expertise in all types of data analysis, said Doug Rickart, a vice president and recruiting manager with Robert Half Financial Services. Because GIS applications can be used in a wide range of departments, candidates who understand geographic data are especially in demand.

“The job market for students with a geography degree is exceptional,” said Alan Murray, a geography professor at the University of California-Santa Barbara who specializes in location modeling and regional planning.

Financial firms can use GIS software in a variety of ways, Spinello said. For example, RPM correlates economic data from the Fed with demographic census information, such as levels of car ownership, to help banks deploy new marketing campaigns for auto loans.

The Center for Responsible Lending, a consumer advocacy group in Durham, N.C., used GIS tools to create maps that showed subprime lenders set up shop in areas where they could target vulnerable consumers, said Delvin Davis, a senior research analyst. The center has done similar projects for monitoring banks’ lending to minorities.

“Having a map paints a picture that sometimes numbers by themselves can’t create,” Davis said.

Real-time data feeds have become especially useful to help banks monitor potential security threats, Thompson said. During the recent presidential inauguration and the subsequent protest marches, banks could determine where customers were using ATMs to get a better idea of where fraud might occur, she said.

It’s primarily larger and regional banks that are using GIS software, but RPM’s Spinello said geographic data tools may be more helpful for community banks in making decisions such as where to open or close branches.

“The smaller banks have a lot more on the line with each individual branching decision,” Spinello said. “It’s more important for them to make a sound decision with every branch. Bank of America or someone of that size, they can afford to make a few mistakes.”