Americans are becoming more anxious about money.

Money is now the dominant source of stress in people's lives, beating out personal relationships and work, according to a study by Northwestern Mutual earlier this year. More than half (54%) are anxious about money; 25% worry about it all the time or often. Just over half said they feel financially insecure; 24% said they feel this way all the time or often.

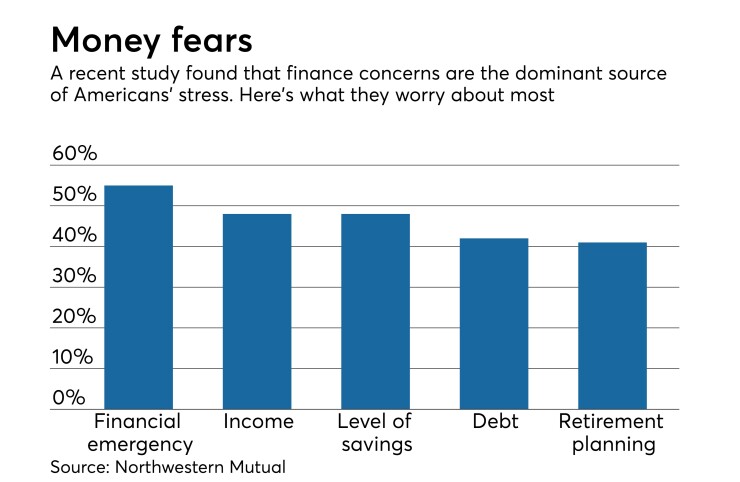

Specifically, people worry about the rising cost of health care, coping with financial emergencies, income, debt and their ability to save for retirement.

This anxiety has sparked a growing market among fintechs that say their money management apps can help reduce Americans' financial stress.

“We're setting out to remove the negativity and the anxiety associated with money and managing your budget and saving, and turn that into a positive,” said Lionel Le Meur, chief commercial officer at Qapital.

Most financial management apps tell people what they should and shouldn’t do, he said, which is stressful for people who fail to execute on the recommendations.

“The majority of people don't have a stable, good way of managing their money in a way that gives them confidence,” Le Meur said. “That's a driver of anxiety. There's the negativity of, you should be saving, you should be saving, you should be saving. Cut your spending, cut your spending. Then you don't know how. And on top of that is the anxiety of not doing it.”

Qapital’s app, which is used by 1.3 million people, starts by asking people about their goals and interests — in other words, it starts from a happier place.

It helps them come up with rules for achieving those goals and automates the savings. For example, it might put portions of each paycheck in a savings account and an investment account through a feature called PayDay Divvy. (The funds are still available to a consumer in the event of an emergency.) It keeps customers up to date on how they’re doing.

These features exist in other apps with a savings component, like Digit and Moven.

Qapital does a few unique things. It lets users use a personal photo as the visual backdrop for each of their goals. Le Meur, for instance, set a shared goal with his wife to save for a ski vacation; the background for that goal is a photo of the mountains they plan to visit. Another goal, saving for his young daughter’s college education, features her photo.

Seeing the photo and being told he’s on track to meet a goal is motivational, Le Meur said.

“That picture helps create an emotional connection between the money and a personal goal you have,” he said.

Another is the ability to link a Fitbit to the app and set up a goal that moves, for example, $2 to savings for every 10,000 steps.

Qapital also offers consumers what it calls “money missions” — personalized advice to improve their financial well-being. One person might be encouraged to change a spending behavior. Another might be advised to buy something that will give them time back, such as a cleaning service.

“It's a very positive, engaging environment that removes negativity and builds confidence,” Le Meur said. “People can save money and when they're spending money, they don’t have to feel bad about it. They can spend confidently because they know the app is taking care of their savings.”

Users pay $3, $6 or $12 per month for the app.

MoneyLion has a similar goal of helping consumers reach financial wellness. The first thing the app does is measure the user’s level of financial stress with something the company calls a “financial heart.” (This has not been launched to all customers yet, but to a subset of customers.)

“That financial heart is effectively like a Fitbit or an EKG monitor for your finances,” said Dee Choubey, CEO and founder of MoneyLion. “We measure our steps and our heart rate, but we never measure financial stress. Our first value proposition to our consumers is, let’s quantify the level of financial stress you're undertaking and make money more approachable.”

The app then helps to reduce financial stress, he said. MoneyLion tries to build a complete financial picture of a consumer’s financial behavior and assets, with the help of data aggregators, and use that data to recommend action steps.

If it sees a consumer is going to run out of money within the month, the app will recommend unlocking a loan against the consumer's own investment account.

“Seventy percent of Americans can't borrow from the bank they have deposits with; that’s a real problem,” Choubey said.

That is because banks traditionally rely on customers’ FICO score instead of the types of data MoneyLion analyzes, he said. MoneyLion recently launched a version of its product that employers can offer to employees, to help them manage their money better, as a mutually beneficial perk.

“Employers have lots of issues with workforce stress — people not showing up on time because of financial distress or not coming to work because their car broke down,” Choubey said.

MoneyLion also has a partnership with Fitbit whereby if the customer walks 15,000 steps, it puts a dollar in their investment account. The highest tier of MoneyLion customers pay $29 a month. But users who use the app every day get that money back.

Titan is an actively managed robo-adviser that calls itself a “hedge fund in your pocket.” It offers a 20-stock portfolio consumers can invest in starting at $1,000, and has 5,000 clients so far. It examines customers’ money anxiety through their qualms about market turbulence.

“It's almost wired in us to be concerned about money,” said co-founder and CEO Clayton Gardner. “It comes down to the human fight-or-flight instinct: We've trained ourselves that there will be scarcity at some point, and that's particularly true with money.”

When clients start to panic that the market is in a downturn and they’re going to lose money, Gardner mainly blames news organizations.

“It's generally a recitation of something they read in the media,” he said. “People who don't know much about money tend to listen to the next smartest person they respect. Unfortunately, that tends to be financial pundits.”

Titan’s response is to educate people and help them learn how investing actually works, he said.

Editor at Large Penny Crosman welcomes feedback at