Emboldened by accolades for its mobile app and other digital investments, BBVA Compass in Birmingham, Ala., is wading into the market for unsecured personal loans popularized by fintechs. But is the $87.3 billion-asset bank late to the party?

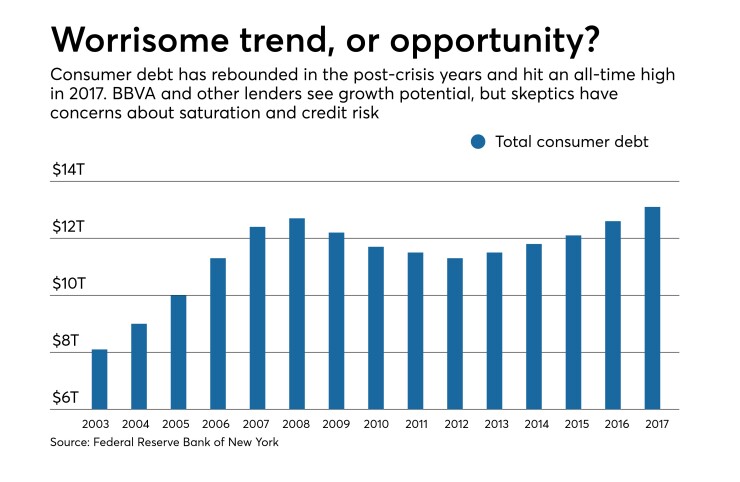

The rise of online lenders demonstrates that consumers want unsecured personal loans and they want to be able to apply for them on their phones and other devices. In fact, some investors argue the market could be oversaturated as evidenced by the market share that fintech lenders have already taken and the

But officials at BBVA Compass, the American subsidiary of the Spanish Banco Bilbao Vizcaya Argentaria, insist the market is big enough to accommodate more players and that they have a few competitive advantages over nonbank lenders — including knowing their customers better.

“Digital transformation has been our vision in the longer term,” said Shayan Khwaja, BBVA Compass' executive director of consumer lending. “We’ve seen the asset class grow, and fintech has shined a light on how we can take this value proposition to the consumers. The general population is fairly savvy with digital products. They’re not just used to it, but they’re demanding it.”

Banks have sought to

Several have already experimented with unsecured personal lending, including

Others have gotten into personal lending through third-party relationships, with

BBVA Compass first rolled out its Express Personal Loan in its branch network in 2015 and later invited select customers to apply online. The loan is marketed primarily for debt consolidation, ranging in size from $2,000 to $35,000 when opened online and carrying an annual percentage rate between 5.91% and 35.06% depending on the borrower’s credit profile.

Of course, consumers can apply for the loan in a branch for amounts up to $100,000, but BBVA hopes its tech will appeal to those who would rather not visit a branch. Consumers can apply for the loan on BBVA’s website or through its mobile app, and BBVA promises a rapid decision. Customers who already have checking accounts with the bank can receive funds on the same day they apply, while those who do not are typically approved that day and funded two or three days later.

BBVA also offers customers the option to provide their credit information and check their rate or loan offer without damaging their credit score.

The product is available online or in person to anybody in BBVA Compass' existing markets, except for California, where it currently only offers the loan in branches or to a prescreened population.

Though BBVA has 61 branches in California, Khwaja said the bank is still studying that potential market and is not yet ready to launch its personal loan product over digital channels there. The bank believes the abundance of fintech there means that California consumers may have high expectations for a digital loan product, and BBVA wants to fine-tune its approach before bringing it to that market.

“The hurdle’s probably a little bit higher in California,” Khwaja said.

Khwaja did not say how large BBVA’s unsecured consumer portfolio is right now, nor would he share the average FICO score, interest rate or loan amount for its customers.

Chris Marinac, an analyst at FIG Partners, said the move into a digital personal loan product was forward-thinking and made sense given

“Banks have to be proactive in how they find new loans today. The industry still is struggling to get additional loan growth,” he said. “[Banks] can’t rely on just commercial real estate or construction.”

Yet Moody’s Investors Service called BBVA’s announcement a credit negative, citing greater loss rates on unsecured consumer loans overall and mounting competitive pressures.

“BBVA Compass’ appetite for unsecured consumer loans comes at a time when it has wisely pulled back in its auto and credit card lending,” Moody’s wrote in a note to investors. “Given that looser underwriting and competition similarly characterize the unsecured lending market, and BBVA Compass has a modest market share, it remains unclear how long the bank will be committed to the unsecured consumer loan market.”

BBVA will also need to protect against the heightened risk of fraud and its associated losses, said Julie Conroy, a research director at Aite Group. She warned that online loan origination channels are particularly susceptible to synthetic identity fraud.

With synthetic identity fraud, the thief fabricates a totally new identity, often by stitching together bits and pieces of other identities stolen in data breaches. The fraudster uses that new identity to apply for a loan and makes off with the proceeds, with no intent to ever make good on the promise to repay.

“If you don’t detect this on the front end, oftentimes it goes completely undetected and banks wind up writing these off as credit losses because they think it’s somebody that just flaked out and never paid their bills,” Conroy said.

Khwaja said BBVA has invested in the talent and tools it needs to guard against fraud. He also maintains that as a bank, BBVA has some advantages that fintech lenders don’t have. For starters, the bank has a lower cost of funds.

It also has a more complete picture of the risk it’s taking on when it lends to an existing customer because it has a better idea of what that customer’s actual cash flows look like, as opposed to a fintech lender that only has a lending relationship with a customer.

Investors sometimes have a bias against consumer lending, but Marinac does not see anything wrong with expanding into unsecured consumer lending as long as BBVA is adequately reserving against losses it may incur in that portfolio.

“If they grow reserves and they provide themselves coverage on reserves for the higher chargeoffs, why should we complain about that?” Marinac said.