Ocwen Financial has reached a settlement with 10 states under which it may not acquire servicing rights for eight months but will avoid financial penalties.

The settlement does not end the

Allegations that Ocwen mishandled escrow accounts were at the heart of the actions brought by the 10 states that took part in the settlement, and are the subject of the pending suits.

The CFPB and the Florida Office of Financial Regulation declined to comment about the settlement. The North Carolina Commissioner of Banks, the other lead state on the April lawsuits, said its cease-and-desist order is still in place.

The settlement bars Ocwen from acquiring mortgage servicing rights until April 30, 2018, according to an 8-K filing Thursday with the Securities and Exchange Commission. The company agreed to find a new servicing platform and will not add any new loans to the RealServicing system it currently uses.

The settlement also allows Ocwen to merge with or acquire an unaffiliated company or its assets to complete the shift from RealServicing to the new platform provided it gives state regulators a 30-day notice and the states do not object to the transaction.

"This is obviously a positive development for Ocwen and its customers," said industry analyst Chris Whalen, who previously said the federal regulator was

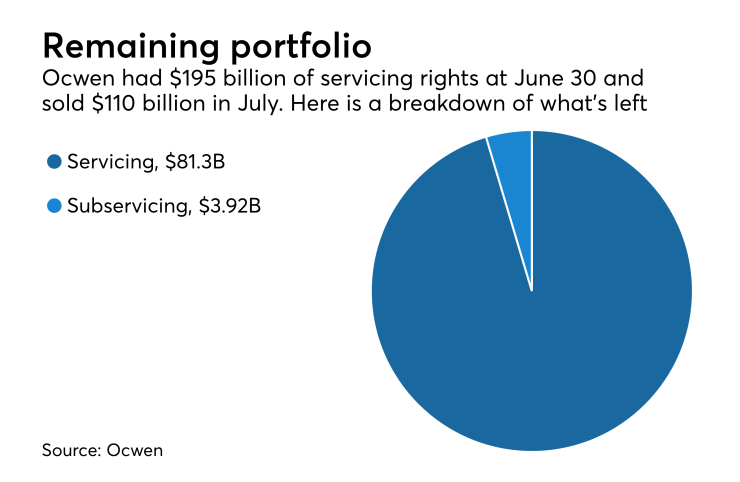

Ocwen serviced approximately $195 billion of loans at the end of the second quarter, according to the company's 10-Q filing. In July, it sold

It recently settled a Telephone Consumer Protection Act case for $17.5 million, while in July the company settled a

In March, before the latest round of lawsuits, Ocwen reached an agreement

In this latest settlement, Ocwen agreed to hire an auditor to perform an escrow review of between 8,000 and 10,000 loans.

"None of the agreements contain any monetary fines or penalties, although Ocwen will incur costs complying with the terms of these settlements, including in connection with the escrow analysis and transition to a new servicing system," the 8-K said.

The states involved in the settlement are: Georgia, Idaho, Illinois, Maine, Michigan, Mississippi, Montana, Rhode Island, South Carolina and Wisconsin. Indiana and Nevada previously withdrew or allowed cease-and-desist orders to expire, the 8-K said.

"Ocwen is pleased to have reached mutually agreeable resolutions with 12 states to resolve regulatory actions brought against the company in April 2017. We continue to work cooperatively with the remaining 19 state regulatory agencies and two state attorneys general, and are committed to seeking timely and acceptable resolutions with these states," Ocwen spokesman John Lovallo wrote in an email. "We look forward to productive relationships with all regulatory bodies, and to continue our mission of helping homeowners, especially those struggling to remain in their homes."

Ocwen did not admit to any wrongdoing in the settlements.

"The consent order provides that Ocwen will transition its servicing portfolio off of its current servicing platform to a platform better able to manage escrow accounts and establish a new complaint resolution process," the Georgia Department of Banking and Finance said in a press release. "Ocwen shall hire a third-party firm to audit a statistically significant number of escrow accounts in high-risk areas of the portfolio to determine whether problems continue to exist around the management of escrow accounts and to identify the root cause of those problems."

The company and regulators can now "move forward with a focus on what specific steps need to be taken in order to provide consumers with accurate processing of their mortgage payments and for improved customer service in the future," Melanie Hall, commissioner of the Montana Division of Banking and Financial Institutions, said in a press release.

Ocwen has faced many legal and regulatory challenges in recent years. In December 2013 it reached a settlement over foreclosure and modification processes with the CFPB and state regulators. A year later, it made a separate agreement with New York regulators that removed company founder William Erbey as CEO.