Discover Financial Services and Sallie Mae are both reporting a surge in borrowers seeking payment relief, signaling the start of a new era in which U.S. consumer lenders will have to focus heavily on minimizing their credit losses.

By last week, a total of 454,000 Discover customers had enrolled in a newly established program that allows them to skip up to two monthly payments. The enrolled balances represent about 4% of the company’s total loans, a figure that is expected to keep rising as job losses mount amid the coronavirus crisis.

At Sallie Mae, the forbearance rate for private student loans rose from 3.8% in the first quarter of 2019 to 6.2% on March 31. Three weeks later, it had spiked to 11.8%, the company disclosed Thursday.

Discover, based in Riverwoods, Ill., is a credit card lender that also offers personal loans and private student loans. Newark, Del.-based Sallie Mae is primarily a student lender.

Executives at both companies said Thursday that the forbearance programs they now have in place are similar to what they have offered in the past to customers affected by natural disasters.

Discover CEO Roger Hochschild argued that the vast job losses since March — 4.4 million additional unemployment claims were filed last week, the U.S. government reported Thursday — are more consistent with the aftermath of a natural disaster than a traditional recession.

Under the new program that Discover is offering to customers affected by the virus, those who ask for relief get an automatic payment deferral. If they call again, they can get a second deferral. After two monthly deferrals, customers who miss a payment will be classified as delinquent.

“The idea behind these programs is to bridge people over a shorter period of financial stress,” Hochschild said in an interview.

It remains to be seen whether a program designed for short-term economic hardship will be well suited for the downturn that

started last month. Economists generally believe that the length and severity of the contraction will depend heavily on how quickly the virus can be contained.

Discover has modeled a scenario in which the U.S. unemployment rate peaks at 9%, declines to around 7% by the end of this year, and then recovers slowly through 2022.

But Hochschild acknowledged that economic projections right now have a high degree of uncertainty. “My guess is there will be lots of ups and downs in forecasts between now and next quarter,” he said.

Discover, which also offers loan modifications to customers who need payment relief over an extended period of time, reported that the highest weekly enrollment in its credit card forbearance program came during the week ending April 5. Two weeks later, new enrolled balances were down by 45%.

Some of the decline in April could be related to the recent arrival of government stimulus funds, Chief Financial Officer John Greene noted Thursday during the company’s quarterly earnings call.

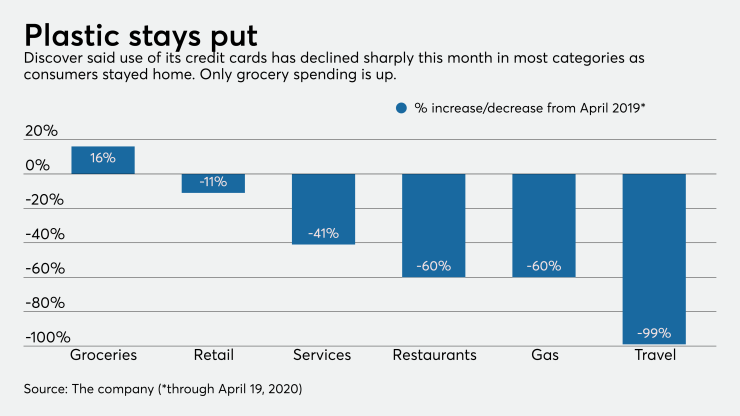

The $113 billion-asset card issuer also released data Thursday about how U.S. consumer spending patterns have changed during the pandemic. During the first 19 days of April, Discover cardholders spent 16% more on groceries than they did during the same period a year earlier.

But spending at both gas stations and restaurants fell by 60%. And travel spending — a category that includes purchases from hotels, airlines and car rental companies — declined by a whopping 99%. Discover withdrew its financial guidance for 2020, as did Sallie Mae.

Under Sallie’s forbearance policy, customers who ask for relief get a three-month reprieve from making payments.

Sallie Mae executives noted that less than 2% of the company’s loans that are currently in forbearance were delinquent for more than 90 days at any time during the last year.

“These are responsible and reliable customers who will be willing and able to resume their payments when the economy normalizes,” Chief Financial Officer Steven McGarry said during the company’s quarterly earnings call this week.

One issue that could affect loan originations this year at Sallie Mae — and to a lesser degree at Discover — is whether in-person college classes resume at the start of the 2020-21 academic year. Cal State Fullerton, which has around 40,000 students, announced this week that it is assuming it will operate virtually in the fall.

Sallie Mae CEO Jonathan Witter acknowledged the risks but said he is encouraged by the emphasis that President Trump’s plan for reopening America places on education. “At this time, we remain optimistic that education will broadly resume in the fall,” he said.