Banks with large mortgage operations will face challenges over the rest of this year, and many will need to be more aggressive and adjust their business models to compete.

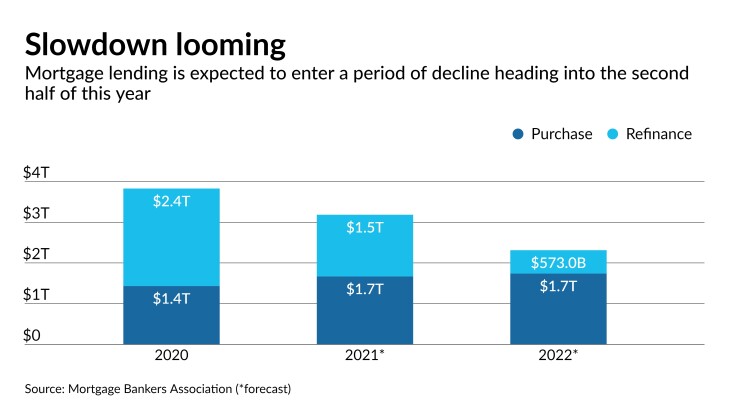

The Mortgage Bankers Association is bracing for a slowdown in overall activity, projecting that volume over the second half of 2021 could fall by 47% from a year earlier, to $1.2 trillion. Refinancing volume is expected to plummet by 77%, to $340 billion, as interest rates creep up.

A sharp decline in refis will put more pressure on bankers to fight for mortgages tied to home purchases, where volume should remain relatively steady as rates increase. That will intensify competition among mortgage lenders, forcing many to focus more on marketing, relationships with real estate professionals and customer service to drive volume.

“Competition will heat up — we’re already starting to see that,” said Chris Nichols, a strategist and head of capital markets at the $37.8 billion-asset South State in Winter Haven, Fla.

“When it was all about refis banks may have gotten a little bit in a fat-and-lazy mode, fielding calls,” Nichols added. “Now we’re going to have to be even better bankers. We’ll have to spend more on marketing, do more outreach, be more active salespeople — we’ll have to get out and make connections and win business.”

Several other factors will influence the momentum of the mortgage market, including the trajectory of rates, the efficacy of vaccines and an acceleration of home-building activity, industry observers said.

“I think we’ll start to get answers over the spring and summer,” said Stephen Scouten, an analyst at Piper Sandler. “I think it’s pretty clear that refi slows down a lot, but there’s room for home purchase activity as we come out of the pandemic.”

Long-term interest rates have risen by nearly 20% this year, crimping refinancing. But rates remain historically low, and bankers said that homebuying demand is start to pick up as spring weather moves in.

Certain markets, such as South Florida, have remained brisk for mortgage lending.

“Demand right now continues to be very strong,” said Jorge Gonzalez, vice chairman and CEO of the $18 billion-asset City National Bank of Florida. “Rates are still so low. I think the market can absorb" more rate increases "because they’re coming off such a low point.”

“Rates are up, but I think there are a lot of buyers out there that will want to take action now before rates really climb higher down the road,” Nichols said.

While some lenders could become aggressive with pricing or terms, Nichols said most still remember how that played out during the 2008 financial crisis. At the same time, lenders continue to monitor an estimated

“Credit quality is top of mind,” Nichols said. “I think banks are going stay pretty disciplined. … We’ll have to compete by working harder.”

The purchase market is slowly heating up, which should help mortgage-dependent banks maintain momentum over the next few months.

Applications to buy a home rose by 3% last week from a week earlier and were 26% higher than the same time in 2020, according to the Mortgage Bankers Association. The increase was “driven both by households seeking more living space and younger households looking to enter homeownership,” said Joel Kan, an MBA economist.

Kan said demand for home purchases is improving as more

"I still expect this year’s sales to be ahead of last year's, and with more COVID-19 vaccinations being distributed and available to larger shares of the population, the nation is on the cusp of returning to a sense of normalcy," said Lawrence Yun, chief economist at the National Association of Realtors.

While bankers are optimistic about the next few months, they hesitate to forecast what the market will look like heading into 2022.

“Longer term, it gets very difficult to predict,” Nichols said. “Will rates rise to a point that buyers bale? Will the economy hold up? It gets to be anyone’s guess at some point.”