WASHINGTON — House Republicans and regional banks are hoping that recent comments by Federal Reserve Board Chair Janet Yellen can add fuel to their efforts to replace the $50 billion asset threshold for systemically important banks with an international regulatory indicator test.

Rep. Blaine Luetkemeyer, R-Mo., reintroduced a bill Wednesday that would use the Basel Committee’s assessment methodology to determine which banks should be subject to standards for systemically important financial institutions. The Fed already uses a similar approach to measure bank risk.

The criteria the Fed is using are "identical to what we are trying to” capture, Luetkemeyer said in an interview. We “didn’t realize at the time the Fed already did this when it came up with its own annual systemic score.”

While Yellen did not endorse this specific effort, she said last week that the current threshold should be changed and broadly supported an indicator test.

“If Congress sticks with a dollar threshold … we would support some increase in the threshold,” Yellen told the Senate Banking Committee. “An approach based on business model or factors is also a workable approach from our point of view.”

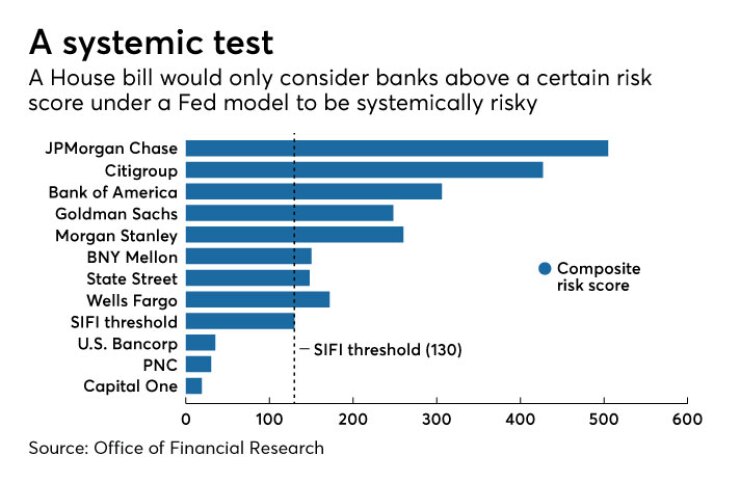

The Basel model calculates an institution’s composite systemic risk score based on a bank’s size, interconnectedness, substitutability, complexity and cross-border activity. The Fed’s version replaces substitutability with a measure of reliance on short-term funding and is also tougher, resulting in higher scores for domestic banks after the Fed judged the Basel methodology to be on the low end.

Both the Fed and the Basel models set the threshold at a composite score of 130, designating all institutions above that line as systemically important. Luetkemeyer’s bill would use the same threshold to determine which banks should be subject to enhanced requirements under the Dodd-Frank Act. If the bill were enacted, it would keep the largest banks subject to those standards, but benefit regional banks, which are thought to have lower scores. (The Fed does not release a bank’s score publicly.)

According to the Office of Financial Research, banks like JPMorgan and Citigroup scored on the higher end of the systemic spectrum in 2015 with scores in the 400s, while Bank of New York Mellon and State Street were some of the lower-scoring global systemically important banks, just above the 130 level.

A typical regional bank, in contrast, scores in the single or double digits. In 2013, U.S. Bank scored a 35, PNC had a 30 and Capital One had a 19.

“There is a very distinct gap between those banks that are systemically important and those that are not,” Luetkemeyer said. “What we are telling [the Financial Stability Oversight Council] is we have a better number here than $50 billion.”

Regional banks have already rallied around Yellen’s comments and are expected to endorse Luetkemeyer’s approach.

“We see Fed Chair Janet Yellen’s comments ... as a positive move for economic growth,” said Matt Well, a spokesman for the Regional Bank Coalition. “By looking at an institution’s full business model, we can calibrate regulations based on the risk they present to the financial system, alleviating less risky institutions like regionals from one-size-fits-all regulations and driving economic growth.”

But the bill, which passed in the last Congress with 20 Democrats supporting it, has spurred concerns by the biggest banks. It would likely dedesignate large regional banks like SunTrust, PNC and U.S. Bancorp, which the biggest banks see as competitors. The eight U.S. banks that are already determined to be global systemically important banks would remain subject to the current enhanced regulatory standards.

The bill is also opposed by community banks, which favor a simple increase in the threshold over an indicator test.

The indicator test “tends to get very complex,” said Paul Merski, executive vice president of congressional relations at the Independent Community Bankers of America.

An increase “keeps it clean and simple,” he said. “It is not perfect, but once you start looking at business models and practices, it gets much more complex and it gets very complex to write those demarcations in statute.”

Some Democrats are also likely to take issue with the bill because it would substantially decrease the universe of banks that are considered systemically important financial institutions. Many will argue that while the $50 billion asset threshold may not be a perfect number, the Fed has significant flexibility to tailor regulations above that level.

Luetkemeyer said the same approach could be used under his bill.

“The Fed and FSOC can still designate” or “dedesignate based on their additional research or information they have,” Luetkemeyer said. “There is enough flexibility for these two entities to still do their job.”

Ian Katz, a policy analyst at Capital Alpha Partners, said that, while changing the construct of the SIFI test will be discussed, Congress still may end up relying on an asset threshold.

“It may be a number combined with other metrics or guidelines, but I think a number will be part of what is finally agreed to. Otherwise it's just a little too amorphous for some lawmakers, especially in the Senate,” Katz said. Some lawmakers, he said, may also see an indicator-based calculation as giving the Fed too much leeway.