Jack Jenkins-Stark, SVB Financial Group's chief financial officer, is sounding upbeat these days.

Following a Herculean earnings restatement late last year over how it accounted for warrants that caused the company to file its 10-K late, Mr. Jenkins-Stark says he is looking ahead to a favorable business environment for the $5.5 billion-asset Santa Clara, Calif., company while competitors struggle with the flat yield curve.

"Yield curve flatness is not really an issue for us," Mr. Jenkins-Stark said in an interview last week.

The parent of Silicon Valley Bank does very little commercial real estate lending or consumer banking. It caters to venture capital firms and start-up companies in the technology and life sciences industries. These companies - frequently flush with cash from capital raising - tend to be so focused on getting their businesses humming that they do not quibble over the interest rate on their deposits.

The net interest margin expanded 109 basis points last year, to 6.46% at yearend, and in the first quarter it may have surpassed 7%.

Fresh from filing a belated annual report last week, Mr. Jenkins-Stark said SVB is busy increasing fee income, adding off-balance-sheet funds, and promoting an ongoing international initiative.

"We spend a fair amount of time on those aspects - as well as just kind of smiling to ourselves about whether [a net interest margin of] 7% or 8% is possible," he said. His company calls a 7% margin "the Holy Grail."

SVB's story may be unique among small-cap banking companies. Beth Messmore of Merrill Lynch & Co. wrote in a report released last week, "We anticipate decelerating EPS growth trends across … small-cap banks in the first quarter and 2006, exacerbated by the prolonged flat yield curve."

However, SVB's margin continues to benefit from a strategy that entails keeping only low-cost deposits on the balance sheet and moving other funds into off-balance sheet investment funds.

"Their balance sheet has gotten to where they really only have core deposits on it. Everything that is interest rate-sensitive they put off balance sheet," said Frederick Cannon, an analyst with Keefe, Bruyette & Woods Inc. in San Francisco.

Sixty-three percent of SVB's deposits do not bear interest.

Meanwhile, the company said that the rates it charges on loans have been rising during the Federal Reserve Board's spate of interest rate hikes. At yearend it had $2.84 billion of loans, 85% of them commercial, 9% consumer, and 6% in commercial real estate. The loan book grew 21% from a year earlier.

Some analysts have expressed concern about SVB's strategy.

"Among the people who are more bearish, the worry is the Fed is going to stop [raising rates], and all of a sudden this massive margin expansion is going to halt," said Brent Christ, an analyst with Swiss Reinsurance Co.'s Fox-Pitt, Kelton Inc., who has a "neutral" rating on SVB's stock.

The bears also worry about the cost this year of expensing employee options under new accounting rules, he said.

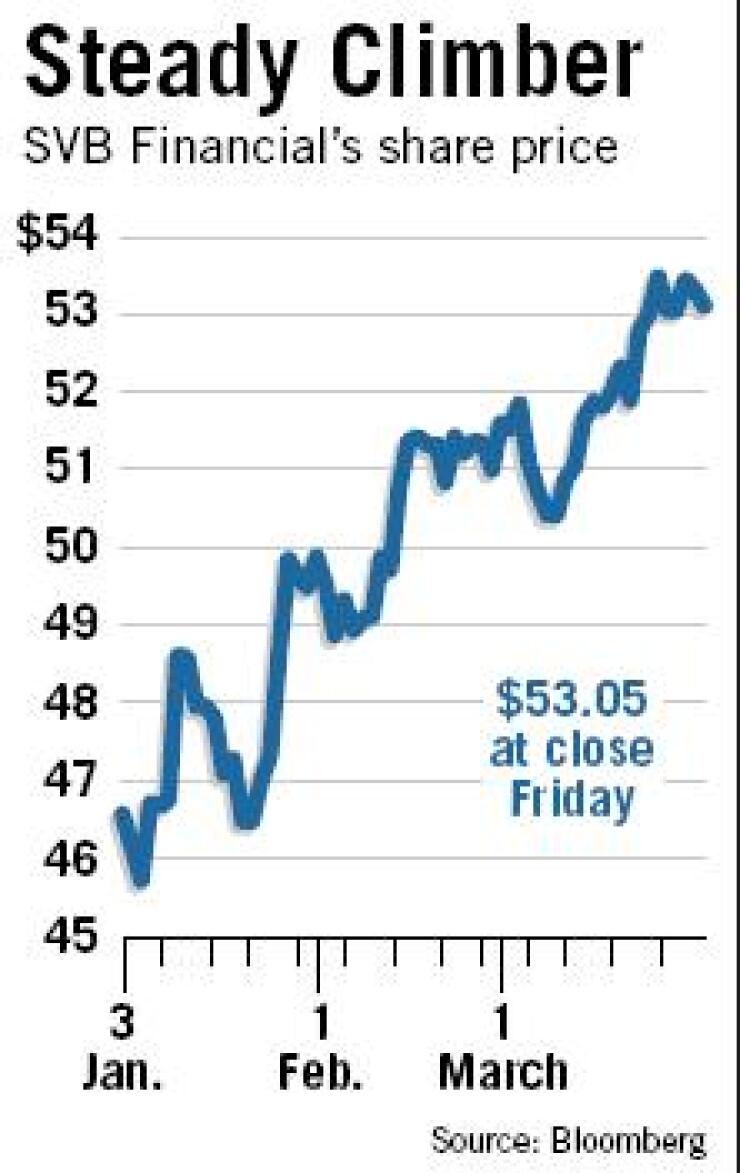

Wall Street expects SVB to report that first-quarter earnings fell a penny from a year earlier, to 61 cents a share, and that full-year earnings rose 26 cents, to $2.66, according to nine analyst estimates provided to Thomson Analytics last week.

However, Mr. Jenkins-Stark said he expects the margin to expand even after the Fed rate hikes end, because SVB is replacing lower-yielding securities with commercial loans.

"One of the ah-ha's that the investment community has stumbled upon is that our NIM is likely to increase even in a flat interest rate environment," he said.

While investors are concentrating on SVB's net interest margin, executives are busy with other issues. Last year the company was wrapped up in a restatement of five years' worth of financial reports tied to flawed accounting on warrants it obtained in connection with loans to start-up companies. The restatement required tracking down and calculating the value of warrants, including some that were 10 years old.

The issues are not completely behind the company. In its 10-K, filed March 27, SVB acknowledged material weaknesses in its financial reporting and oversight that it has been working to remedy since the third quarter.

Mr. Jenkins-Stark is hiring accountants, increasing training, installing a database for warrants, and implementing processes to ensure the company complies with new accounting rules. The material weaknesses will be resolved no later than early next year, he said.

The restatement prevented SVB from giving complete financial data for the second and third quarters of last year, but Mr. Jenkins-Stark said it did not keep his company from expanding its business. (It gave full earnings information for those quarters when it restated Dec. 31.)

SVB has benefited from a rebound in the venture capital industry in the past two years. Fourth-quarter net income rose 23% from a year earlier, to $25.6 million, and earnings per share rose 13 cents, to 67 cents.

The company opened a Shanghai office in December and offices in London and Bangalore in late 2004. In China and India it provides consulting services to U.S. customers, while in London it generates loans. The company says 1% of its outstanding loans last year were originated through the London office.

The London operation "has been successful, but we've also constrained it considerably," Mr. Jenkins-Stark said. "What we wanted to do was put our toe in the market, begin to learn the market, and then decide whether we wanted to go in with more resources and a greater level of commitment of funds."

Neither he nor the analysts who cover SVB are predicting significant revenue any time soon from the overseas operations, but they are upbeat about the model's prospects beyond the United States.

Mr. Cannon called international expansion "a long-term essential."

Kathy Steinbrecher, an analyst at Wedbush Morgan Securities, who initiated coverage in January with a "buy" rating, said last week, "They are replicating the business they have in Silicon Valley overseas.

"I don't expect a material change in revenue, but I think that is a positive trend for them."