Falling cash balances at small banks are driving them to rely more heavily on the Federal Reserve's facility for short-term loans as a source of liquidity.

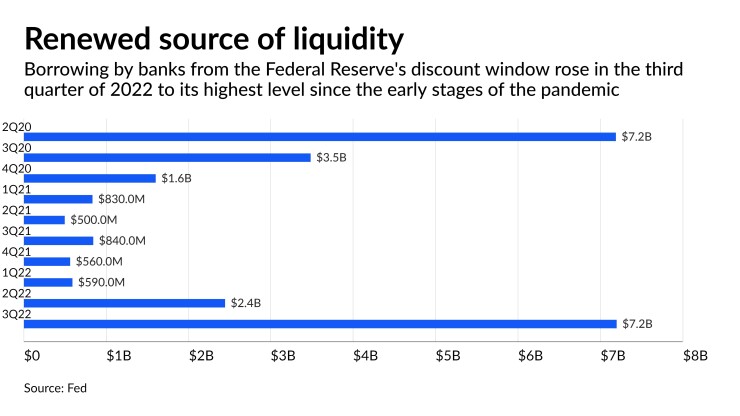

Domestic banks borrowed $7.2 billion from the discount window in the third quarter of 2022, the highest level in almost two years, according to Fed data.

Banks with assets of $3 billion or less drove that increase. Such banks borrowed via the discount window an average of four days in 2022, compared with an average of two days for banks in larger asset classes, according to the Fed data.

Banks with less than $10 billion of assets saw declines of between 46% and 55% in their cash-to-assets ratio during the first nine months of 2022, according to a Federal Reserve Bank of New York analysis of call reports.

"The notable decline in the total level of reserves in the banking system this year may have been an important factor in the rise in discount-window borrowing," the New York Fed researchers said.

When banks have less cash on hand, they are more likely to rely on external funding sources, including the discount window, to cover short-term funding needs. That is particularly true for smaller banks, which are less sensitive to

"Big banks are reluctant to use the discount window because they fear that if it got out, the markets would view them at risk, and that would cost them more money in funding and possibly even be systemically dangerous," said Karen Petrou, co-founder and managing partner of Federal Financial Analytics. "Small banks are much less exposed to markets."

The Federal Reserve doesn't make public the names of specific banks that have borrowed at the discount window.

The Fed's discount window gives financial institutions with insured deposits a source of funding when they need liquidity in the short term. The loans are made directly from the central bank to the bank in need, typically on an overnight basis.

Before a 2020 policy change that removed the higher cost of borrowing from the discount window, the discount rate was higher than the federal funds rate, which banks use when they lend among themselves.

Loans issued via the discount window hit almost $50 billion in April 2020, when banks of all sizes took out large loans from the central bank despite healthy reserve balances. As the COVID-19 crisis progressed and banks faced fewer funding challenges than had been expected, levels of outstanding discount-window loans fell back to pre-pandemic levels.

Balances began to rise again last year. Discount-window borrowing increased from $588 million in the first quarter to $2.4 billion in the second quarter.

The Fed's decision to remove the discount-window rate penalty and extend loan time frames may have contributed to the discount window's increasing competitiveness with the Federal Home Loan banks as sources of funding for smaller banks, the New York Fed researchers found.

In recent months, borrowing from a Home Loan bank would have cost a bank between 90 and 130 basis points more than borrowing at the discount window, depending on the length of the loan, according to the New York Fed. Before the pandemic, it was cheaper to take out a loan from a Home Loan bank.

Still, advances from the Home Loan banks