There’s more to Southern California than warm weather and sunshine.

The area is also getting more looks from bank organizers than any other part of the country. Two of the five bank charters approved since 2011 have been planned for that region, with two more applications pending.

Though the numbers are relatively small, they are meaningful given the overall dearth of de novo activity since the financial crisis. And the concentration of applications in one region certainly merits closer inspection.

There are several reasons for the mini wave, industry experts said. Southern California rebounded strongly after the crisis, creating an interest in starting new banks. Organizers are also hoping to lure small-business customers away from the region’s established players while taking advantage of disruptions caused by consolidation.

“The entrepreneurial spirit of Southern California makes it an ideal spot for a community bank to open up,” said Chris Walsh, director of banking at Blue Gate Bank in Costa Mesa, Calif., which opened in January. “There are so many small and midsize business opportunities.”

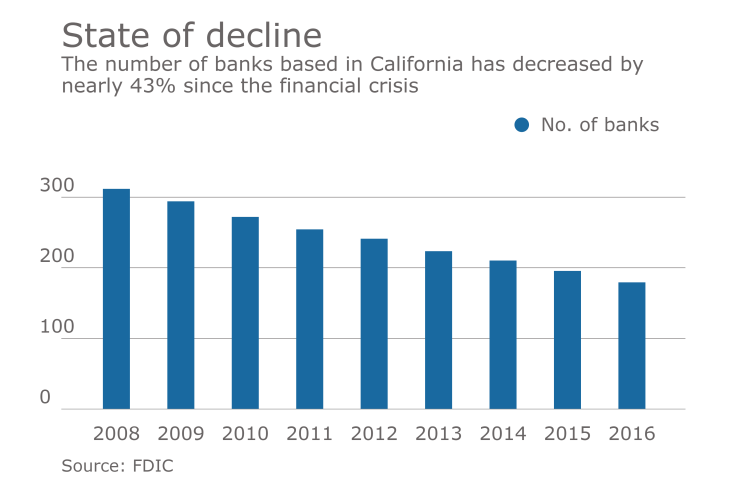

A steady decline in the number banks based in California has provided an opening for new banks to pick up employees, investors and customers.

The number of institutions in the state has fallen by nearly 45% since late 2008, to 179 institutions on Dec. 31, based on data from the Federal Deposit Insurance Corp. Los Angeles had a 37% rate of decline from 2008 to 2016, with 76 banks still around. San Diego, which had 31 banks at the end of 2008, has only nine now.

The nationwide rate of decline was 29% over the same period.

“When you have consolidation … there’s often dislocation of customers,” said Gary Tenner, an analyst at D.A. Davidson. “That’s where the opportunity is. There are likely experienced bankers in the markets and these de novos think they can leverage that.”

Higher interest rates could also make it easier for a new bank to open, Tenner added.

Orange County, just south of Los Angeles, is a popular locale. Blue Gate is based in Costa Mesa, and the proposed SoCal Bank is planned to open in Santa Ana. Core Commercial Bank would have been located in Newport Beach, but it failed to raise the necessary capital after received regulatory approval, several sources said.

San Diego would also get a new bank if the proposed Endeavor Bank is approved.

Requests for comment from SoCal, Core Commercial and Endeavor were not returned.

Orange and San Diego counties have diversified economies that would help banks avoid concentration risk, said Rodney Brown, president and CEO of the California Bankers Association. Each market has a growing technology sector and a multitude of professional services such as accounting and law firms. Universities also provide a deep bench of talent for banks in hiring mode.

“The economy is very healthy,” Brown said. “We’ve enjoyed strong economic growth and there’s really meaningful job creation in higher-compensated professions. All of the right ingredients are there to serve consumers or businesses and grow a franchise over time.”

The new banks could thrive at attracting small-business clients, said Ruth Razook, CEO of RLR Management Consulting, which has worked with two of the California de novos. She noted that her firm moved its business to a smaller bank after a larger institution required it to hold significant deposits to avoid fees.

Many of the applications in California have emphasized a focus on small and midsize businesses. Doing so would make sense because it would help a fledgling bank bring in larger deposit accounts, which in turn could help fuel loan growth, Tenner said.

Blue Gate has zeroed in on several niches, working with homeowners associations, professional practices and escrow firms, which largely reflects the bankers it has been able to hire, Walsh said. He added that the Gallaher family, a predominant Blue Gate investor and a founder of First Community Bank in Santa Rosa, has helped the bank gain traction.

Renewed interest in de novo banking has been strictly investor driven, a spokesman for California’s Department of Business Oversight said. The state’s banking regulator has not been actively soliciting new banks.

An FDIC official, who asked not to be named, was unsure why California has drawn more interest than other states, though he said attractive growth markets could play a role. He noted that the FDIC, along with the Office of the Comptroller of the Currency and the Federal Reserve, had hosted events in different regions to discuss the de novo process, including a session in San Francisco last year.

The OCC is encouraged to see applications from bankers who recognize the value of being part of the federal banking system and are committed to meeting the high standards required of national banks and federal savings associations, an agency spokesman said.

The Fed did not provide any comment.

Bank organizers will face some challenges. California’s state regulator is taking deeper looks into business plans to make sure that any proposed bank would have a diversified loan portfolio, the agency’s spokesman said.

The FDIC official said the agency’s process isn’t necessarily more rigorous now, but organizers must be ready to address questions about areas, including cybersecurity and mobile banking, that didn’t get much attention a decade ago.

It could prove difficult finding qualified executives willing to go through the hassle of starting a new bank. Regulators want founders with management experience absent of blemishes tied to the financial crisis, industry expert said. Directors are also facing greater scrutiny, including reviews of their credit histories.

“In the past, if you threw together a management team and capital and kind of had a vanilla business plan, you would probably get approved,” said Tim Chrisman, founder of Chrisman & Co., an executive recruitment firm that worked with Blue Gate. “Now the bar is a lot higher for de novos in terms of talent.”

Another hurdle involves capital. Core Commercial, for instance, was unable to raise the nearly $28 million it needed to open. At one point, a single director was poised to own about a fifth of the proposed bank’s common stock.

De novos need investors who are prepared to remain shareholders for at least a decade. Not everyone has the stomach to wait around for a new bank to turn a consistent profit, industry experts said.

“I’m not optimistic we will have a significant number of new charters,” said Gary Findley, a lawyer who worked on Blue Gate’s application. “Part of it is the cost, the quality and qualifications you need for directors and officers. You need a well-thought-out business plan, and not a lot of management wants to go through that.”