Proposed legislation would give certain financial institutions greater capacity to lend.

The Small Business Credit Availability Act, which the House Financial Services Committee approved by a wide margin, would double the debt-to-equity ratio for business development companies. The current ratio for BDCs — closed-end funds that invest in developing companies and firms that are financially distressed — is set at one-to-one.

Increasing the leverage limit would permit BDCs to lend more to the small and midsize enterprises, or SMEs, that are the focus of the 1980 law that allows such companies to exist.

There is some statistical evidence that the change will increase competition for banks.

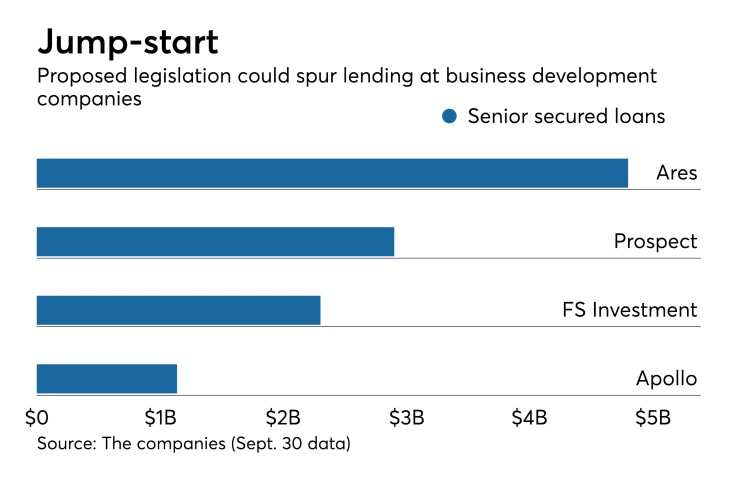

The 53 publicly traded business development companies, which make up about 70% of all BDCs, had about $80 billion of loans on their books on March 31, according to the Small Business Investor Alliance. Total senior secured loans by BDCs have risen more than fivefold since 2008, reaching $55 billion this year.

Those who run BDCs see things differently.

More leverage means more borrowing, which in turn could spur more opportunities for banks, said Michael Arougheti, co-chairman of the $12 billion-asset Ares Capital Corp., the nation’s largest BDC. “In many cases, it’s more efficient for banks to access the SME segment than by building their own origination networks,” he said.

To his point, Ares already has borrowing relationships with 27 banks that provide it with more than $3.5 billion in revolving credit facilities. Another prominent BDC, the $1.6 billion-asset TPG Specialty Lending, has a nearly $1.3 billion borrowing facility led by JPMorgan Chase. With more leverage permitted to BDCs, those numbers could conceivably grow.

Congress created the business development company model in 1980 in hopes of spurring investment in small businesses.

Considered a hybrid between an operating company and investment firm, they are required to maintain at least 70% of their investments in private firms or publicly traded firms with a market capitalization of less than $250 million. The typical annual revenue of most BDC borrowers ranges from $10 million to $100 million.

BDC executives maintain that the bill would provide a valuable boost to the economy, since consolidation and tighter lending standards imposed in the wake of the financial crisis have led to less bank lending in the SME space.

“Banks are focusing on large borrowers to achieve efficiency and small businesses to demonstrate that they’re serving their communities,” Arougheti said. “In general, SMEs are being left out.”

The bill is similar to legislation introduced in 2015 by then-Rep. Mick Mulvaney. His version, which was overwhelmingly passed the Small Business Committee, was never voted on by the full House. (Mulvaney was recently named interim director of the Consumer Financial Protection Bureau.)

Rep. Steve Stivers, R-Okla., who co-sponsored Mulvaney’s bill and is behind the latest push, labeled the current rules governing BDCs outdated. “We can do more to enhance their ability to deploy capital to America’s job creators,” he wrote in an email.

Stivers expressed hope his bill will receive a boost from the Congressional Budget Office’s scoring process. The office determined that Mulvaney’s bill would reduce federal revenue by $95 billion over a decade, largely by shifting business from C-corporations — like most banks — to tax-advantaged BDCs.

As long as they distribute at least 90% of net income, BDCs pay no corporate taxes, while profit passed through to shareholders are taxed at lower individual rates.

“We are waiting for the updated CBO score to be released before it can move forward to full House consideration,” Stivers wrote. “With some changes made to the bill from when it was introduced in [2015] we are hopeful the CBO score will be even lower.”

Despite the increased competitive threat, the American Bankers Association has taken no position on the bill, spokesman Mike Townsend said.

Meanwhile, a group of the largest BDCs have formed an advocacy group, the

“This bill includes common-sense reforms that will unleash economic potential and deliver major benefits to small and mid-sized businesses across the country,” Joseph Glatt, chief legal officer at Apollo Investment, said in a press release.