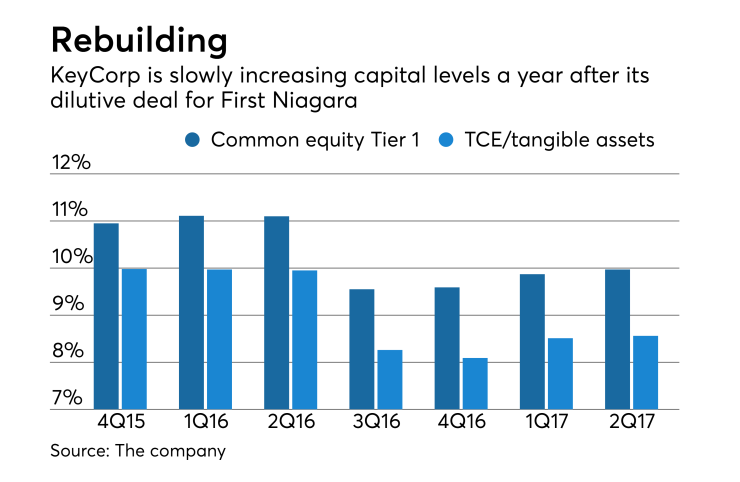

KeyCorp is doing what it can to address any lingering doubt about its purchase of First Niagara Financial Group.

The $136 billion-asset company was criticized when it agreed in October 2015 to pay $4.1 billion for First Niagara, especially over the lengthy period required to rebuild tangible book value. Key said it would take six years; some outsiders questioned the math and

Key raised the stakes on Thursday, telling analysts during a conference call that it is two years ahead of schedule.

It could take "three-plus years" to earn back the dilution, said Don Kimble, Key’s chief financial officer. “I think we’re well positioned to have a much quicker payback period than what initially was thought."

Such progress is critical to KeyCorp over the long run, industry experts said.

Tangible book value “is a critical question and relates to how people will eventually value” the company, said Marty Mosby, an analyst at Vining Sparks. “They are on track to earning that back — maybe even marginally ahead.”

Several factors are at work, industry observers said.

Key, which managed to quickly achieve the deal’s expected $400 million in expense cuts, has identified another $50 million in costs it plans to strip out. The rising interest rate environment has also been fortuitous.

“When you wrap those together, it sets this earn-back up as not as bad as what was assumed at the onset of the deal,” said Scott Siefers, an analyst at Sandler O’Neill.

KeyCorp has been improving other metrics since completing the deal, Mosby said. Return on tangible common equity rose from about 9% before the deal's announcement to nearly 13% on March 31, taking into account certain second-quarter items.

“If you have the dilution upfront, but not the returns, then the dilution is all that matters,” Mosby said. “But if you can create enhanced returns, you can offset some of that initial dilution quicker than what the market expects right now.”

Key, which only used expense cuts to justify the deal, has been making progress on a goal to generate $300 million in new revenue. The focus has been on areas such as mortgages, indirect auto and private banking, said Christopher Gorman, Key's president of banking.

Customer retention is doing better than expected. Deposits are growing and 70% of customers who left were tied to a single product or service, Gorman said.

Still, concerns linger that Key could someday pursue another highly dilutive deal. The issue was raised during Thursday’s call.

Key doesn’t “need further acquisitions to meet our long-term goals, but I’ve also learned to never say never,” said Beth Mooney, Key’s chairman and CEO. Acquisitions are not a part of the company’s growth strategy, she said.

“I believe our strategies are sound, our focus is clear and that we’re creating real value for our shareholders,” Mooney continued.

A reluctance to commit to large-scale bank M&A may be proof that Key is listening to shareholders who were surprised by the First Niagara deal, Siefers said. “I’m certain they are sensitive to their own shareholder base,” he said.

Smaller deals, such as Key’s July purchase of the

Similar acquisitions can add to revenue and create a more loyal customer base, said Terry McEvoy, an analyst at Stephens Inc.

“Across the banking industry, we’re seeing fintech partnerships with banks or outright acquisitions,” McEvoy said. “Fintech companies are coming to realize that being owned by a bank has a lot of value because of what banks bring to the table.”