Taxi-medallion lending is as rocky a business as ever, but look below the surface, beyond the chaos created by ride-sharing apps, and one may see signs of a stabilizing market.

Granted, there have been a lot of problems to peer through in recent months.

At the $28 billion-asset BankUnited, one of the largest taxi lenders, a key measurement of borrowers’ ability to make loan payments has dramatically worsened. Meanwhile, both the number of trips taken in New York yellow cabs and total fare revenue have continued to fall.

One large New York-area taxi lender—the $4.5 billion-asset ConnectOne Bancorp in Englewood Cliffs, N.J.— said at an investor conference last week that it plans to exit the business. Other lenders are cutting their exposure; the $15 billion-asset Sterling Bancorp in Montebello, N.Y., reduced its taxi loan book 4% between yearend and March 31, to $49.8 million.

Yet the market appears to be adjusting to a new normal. That includes lower medallion values, but also a more stable market with more potential buyers. New regulations have made it easier for banks to renegotiate terms with medallion owners, such as lowering rates and extending payment periods.

“There is a robust workout environment going on behind the scenes,” said Matthew Daus, an attorney at Windels Marx Lane & Mittendorf who advises banks on medallion loans. “They’re giving borrowers a more realistic ability to pay back the loan.”

In the meantime, there is no denying the current dismal state of taxi-medallion loan portfolios at most banks. Ride-sharing apps are the primary culprit as they have grabbed a big portion of taxis’ business.

The average number of daily yellow-cab trips in March fell 16% from a year earlier to 332,075. Average daily farebox revenue fell 15% to $4.8 million in the same period.

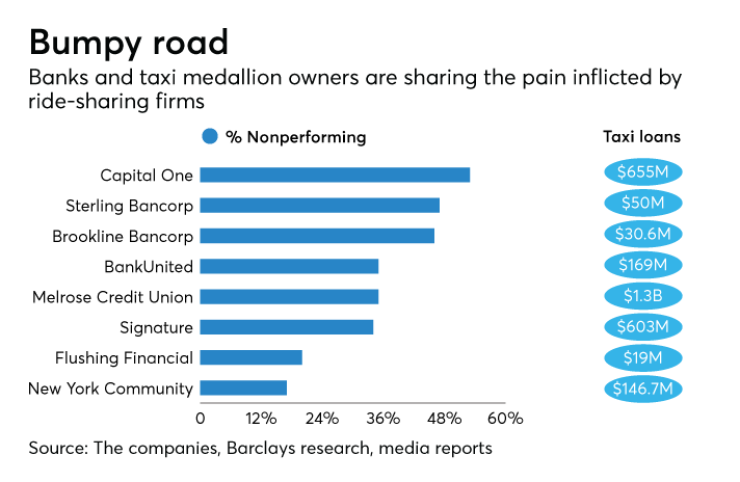

“Obviously, with Uber and Lyft and others coming into that marketplace, there are a lot of challenges there,” Scott Blackley, the chief financial officer at Capital One Financial, said on May 16 at the Barclays Americas Select Franchise Conference. About half of Capital One’s $655 million-asset taxi-medallion portfolio was nonperforming at March 31, according to Barclays.

The market challenges have decimated lenders with outsize exposure to taxis. Regulators in February placed into conservatorship the $1.7 billion-asset Melrose Credit Union in Briarwood, N.Y.; a large majority of its loans were for taxi medallions.

BankUnited, in Miami Lakes, Fla., has seen a sharp uptick in loans that do not meet industry guidelines for debt service coverage ratio, a measurement of a borrower’s ability to make monthly loan payments. About 82% of its medallion loans had coverage ratios of less than 1%, an increase from 57% of taxi loans at Dec. 31, according to Barclays. The National Credit Union Administration views medallion loans with less than 1% coverage ratios as risky.

BankUnited increased its loan-loss provision for taxi-medallion loans to $9.5 million at March 31 from $1.2 million at Dec. 31. And it charged off $5.9 million of such loans in the first quarter, up from $500,000 a year earlier.

The trend in coverage ratios suggests future deterioration in credit quality at New York lenders such as BankUnited, Signature Bank and New York Community Bancorp, Jason Goldberg, an analyst at Barclays, wrote in a May 18 report.

The pain in taxi loans is not just limited to New York. The $4 billion-asset Brookline Bancorp in Massachusetts in the first quarter cut the collateral value of taxi medallions in Boston by half to $100,000 each. Brookline also increased reserves for medallion lending to $7.6 million, or about 25% of its $31 million portfolio, CFO Carl Carlson said during an April 27 conference call.

Experts point to some hopeful signs for the longer term.

The New York City Taxi & Limousine Commission recently approved new rules that should help medallion owners, Daus said.

One new rule lets an individual who owns a single medallion sell it to another individual or to a company that operates a fleet of taxis. Individuals had only been allowed to sell to a buyer who did not own a medallion. That rule should enhance liquidity in the medallion market, he said.

Even more significant is a new rule that does not require independent owners to drive their cabs a minimum number of shifts per year. Instead, these medallion owners can hire other drivers. That should vastly increase the appeal and value of medallion ownership, Daus said.

“If you have a couple of friends who you could get to drive, you can get a second job doing something else,” he said.

Moreover, most lenders have limited their exposure to the market. The $23 billion-asset Valley National Bancorp in Wayne, N.J., has about $139 million in New York taxi-medallion loans; but that represents less than 1% of its total loans. Even better for Valley, the “vast majority” of its taxi loans are accruing and show positive cash flows, Sandler O’Neill analyst Frank Schiraldi wrote on April 26.

The presence of taxi-medallion loans has not scared away potential buyers, either. The $9 billion-asset Berkshire Hills Bancorp in Pittsfield, Mass., on Monday agreed to buy the $2.2 billion-asset

The examples of banks like Valley National and Commerce show that taxis can still be a viable business, after the market adjusts to the fact that ride volumes and revenue are going to be lower than in the past, Daus said.

“Uber will never be faster than a yellow cab in Midtown Manhattan,” Daus said. “The market may shrink, but demand for a yellow cab will always be strong.”