Hurricanes wreak havoc, but they also present opportunities.

Certain sectors are poised to benefit from rebuilding efforts following Harvey and Irma, which by some estimates caused a combined $230 billion in damage. While banks have exposure to borrowers included in those numbers, recovery efforts will also provide opportunities for institutions vying to make more loans and deepen customer relationships in the storms’ aftermath.

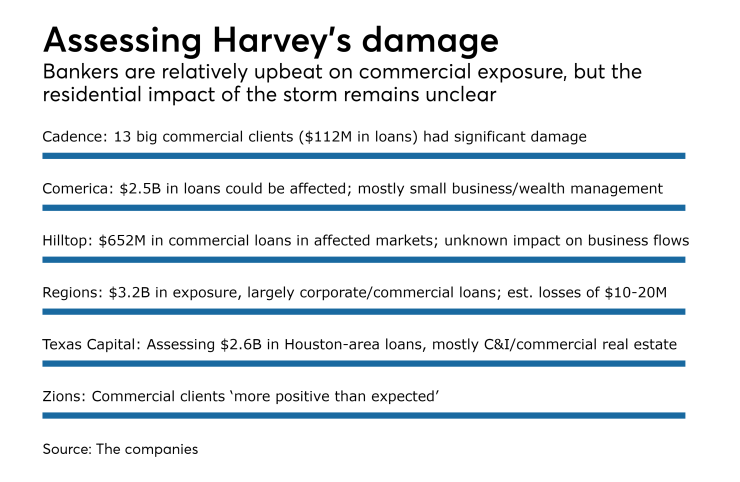

“My expectation is that there will be a lot of activity that occurs out of” Harvey, Paul Burdiss, the chief financial officer at Zions Bancorp., said during a recent Barclays conference. “I think Houston is going to come back stronger.”

The same can be said for Florida.

“Clearly there will be a lot of restoration and rebuilding,” said Jay Pelham, president of the $3 billion-asset TotalBank in Miami. “The prudent thing is to assess what type of lending you’re doing, in terms of short- and long-term credit.”

Certain sectors should do better than others, bankers said.

While flooded homes are a big concern right now, the situation should benefit hotels as people look for temporary accommodations. And there are some who will likely end up in apartments over the long term.

“We’re very small in hospitality, but we’ll clearly have a short-term uptick in demand,” Paul Murphy, CEO of the $9.8 billion-asset Cadence Bancorp, said during a conference call to discuss the Houston company’s Harvey exposure. Some displacement “might be temporary, but others might be permanent and some homes might not be rebuilt.”

Comerica has already noticed increased momentum in the multifamily sector, Ralph Babb Jr., the Dallas company’s chairman and CEO, told an audience at the Barclays conference. “As a result of Hurricane Harvey, leasing activity has picked up substantially,” he said.

Construction firms should also receive a boost from the recovery effort.

Ray Vitulli, president and chief operating officer of Allegiance Bank in Houston, said demand for construction loans could increase as people rebuild. The $2.7 billion-asset bank is also prepared to increase mortgage lending, though Vitulli said it’s “still a little early to tell” how the situation will play out.

Certain retailers and manufacturers could have an “immediate increase in demand” as people look to restock and remodel, Murphy said.

Consumer lending could also get a boost.

Auto lending will likely increase, said Christopher Marinac, an analyst at FIG Partners. Hundreds, if not thousands, of automobiles have been damaged, which could spur individuals and auto dealerships to seek replacements.

Not all sectors are expected to benefit.

"Office we think will likely remain soft," Murphy said. "There’s not much of a lift that comes to office from this.”

Some bankers said they are already gaining business as part of their outreach.

“We contacted one customer who has relationships with other banks … and helped him fund a payroll account when he couldn’t get in touch with his other institutions,” Pelham said. “He’s now talking about expanding his relationship with us.”

Overall, disasters can be a “net positive” for banks, said Joe Fenech, an analyst at Hovde Group, noting that a number of institutions in Louisiana ultimately benefited from rebuilding efforts after Hurricane Katrina in 20015.

“The timing of Katrina, in my view, actually helped to shield the affected banks from the more devastating impacts of the Great Recession” due to increased loan demand, Fenech said. Many of those banks “emerged stronger” from the financial crisis and became acquirers.

There are certain things to look for as banks become more engaged with rebuilding efforts.

Smaller institutions tend to alter their lending efforts after natural disasters, according to

Institutions also tend to make more mortgages that qualify for credit guarantees from government-sponsored enterprises, eventually selling them. That way, banks can “quickly recoup their capital and continue to lend,” the Fed report said.

Insurance rates also merit attention as Florida, Texas and adjacent states look past the recent storms. Higher insurance costs can influence the viability of certain projects, which could offset some of the positive momentum banks receive from recovery efforts.

“The flip side of a storm is that we’ll see insurance becoming more expensive, which could impact people deciding on building,” Pelham said. “And you might even see coverages that aren’t available, which could curtail banks’ abilities to make loans.”

Andy Peters and Jackie Stewart contributed to this article.