Few large banks have dared to pursue acquisitions in recent years, but that could soon change following the results of this year’s stress tests.

The Federal Reserve on Wednesday approved the capital plans of all 34 bank holding companies subject to its annual Comprehensive Capital Analysis and Review, and many of the banks responded by increasing dividend payouts and share buybacks well beyond what investors and analysts were expecting.

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which should boost stock prices and, in turn, prompt more dealmaking, said Chris Marinac, an analyst at FIG Partners.

While the megabanks almost certainly won’t be jumping back into M&A soon — regulators would be hesitant about allowing the likes of JPMorgan Chase and Bank of America to get much larger — some regional banks that have largely stayed on the sidelines may feel emboldened to pursue deals again, Marinac said. Of the stress-tested banks, only the $215 billion-asset BB&T in Winston-Salem, N.C.; the $132 billion-asset KeyCorp in Cleveland; and the $100 billion-asset Huntington Bancshares in Columbus, Ohio, have had the temerity to make acquisitions of late.

“Will banks like PNC start to make M&A moves?” Marinac said. “I think some of them will, probably sometime later in 2018 and more possibly in 2019.”

With regulators obviously feeling more comfortable about capital levels and banks’ ability to withstand severe economic downturns, bankers are likely to be less fearful about proposing deals in the first place, said Marty Mosby, an analyst at Vining Sparks.

“There’s going to be more consolidation because now banks’ ability to use this excess capital to make acquisitions has been validated,” Mosby said.

Indeed, regulatory pushback has been among the biggest impediments to bank M&A, said Marinac.

“There was a fear factor about what regulators would allow banks to do” in terms of acquisitions, Marinac said. “Now regulators have shown they are more open to looking at something. They’re not going to kick banks in the shin for proposing an acquisition.”

Still, don’t expect banks to make major changes in how they run their businesses, or a change in their strategic plans, as a result of higher stock prices, Mosby said. No one should expect banks to accelerate their investments in technology or hiring, he said.

“They’re not going to be operating their bank any differently,” Mosby said. “They have a lot more capital than they really need and they’re going to give it back to their shareholders.”

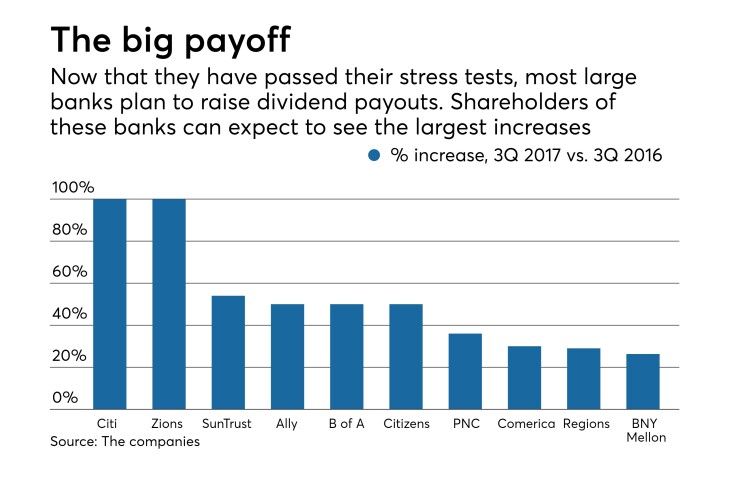

Most CCAR banks’ plans call for a gradual increase in the rate they return capital to shareholders. The $65 billion-asset Zions Bancorp. in Salt Lake City will increase its dividend by 4 cents per quarter over the next four quarters until it reaches 24 cents in the second quarter of 2018.

The $138 billion-asset Fifth Third Bancorp in Cincinnati plans to increase its dividend to 16 cents in the third quarter, and then raise it again to 18 cents in the second quarter of 2018. Fifth Third will also increase the amount of its share-buyback program by 76% over the previous year’s program.

The program “reflects our ability to maintain prudent capital levels while returning a significant amount of capital to our shareholders,” CEO Greg Carmichael said in a Wednesday news release.

And there’s the rub, Marinac said. Even with their success in this year’s CCAR results, banks should not get too aggressive with their dividend hikes and buybacks.

“Credit quality is still important. Banks have to be vigilant in credit and building reserves,” Marinac said. “They’ve figured out the capital question, now banks have to make sure they don’t screw this up."