When Varo Bank — a challenger bank that received a federal charter this year and now has 2 million customers — first started offering bill-negotiating services, it found there is value in being selective.

“Everyone got excited about getting their bills negotiated down, but a lot of people were going for bills that didn’t apply,” said Jaime Jerusalmi, head of partnerships and business development at San Francisco-based Varo. “That delivers the wrong experience.”

That is a primary lesson learned from Varo’s latest partnership with ApexEdge, a Boston company that offers bill and subscription management solutions as either a co-branded or referral service and is better known for its consumer-facing site, Billshark. The negotiation “sharks” will contact internet service providers, telecommunications firms and more to haggle for savings on a consumer’s behalf. But the company has learned over time which bills — such as those that cover multiple, bundled services — are worth fighting for.

“If someone submits a $20 internet bill, we won’t be able to save much,” said Steven McKean, CEO and co-founder of ApexEdge.

Varo first partnered with ApexEdge in 2019 to offer its services, but soon realized that blanketing all customers with bill-reduction offers was a recipe for dashed expectations. Toward the end of 2019, Varo refined its strategy with the help of ApexEdge to target users with bills that had the highest chances of success, according to Jerusalmi.

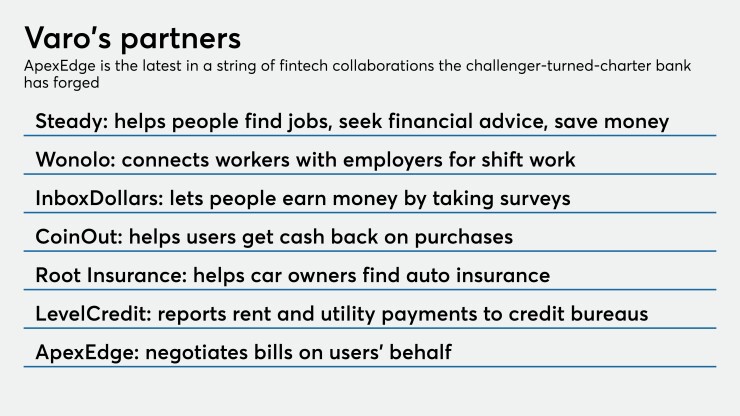

This partnership is one of several meant to help customers of Varo —

Besides ApexEdge, Varo works with Steady and Wonolo, providers of apps that help consumers find work, and InboxDollars, a company that rewards participants for completing surveys. The digital bank has also partnered with the cash-back app CoinOut, auto insurer Root Insurance and credit-building service LevelCredit.

“Our north pole is to become the bank that proactively brings relevant solutions to customers,” said Jerusalmi. This can only be done through partnerships, he said.

“We created a network of partners that help customers spend smarter or get extra cash,” said Jerusalmi. “The value proposition of Billshark is at the core of that, in terms of helping customers reduce their bills.” Varo also gets a referral fee.

Successful bill negotiation hinges on factors such as the provider, the type of service and the size of the bill. ApexEdge employees will engage with television, wireless, phone, internet, satellite radio and home security providers, but will not wrangle price cuts for utilities, insurance or credit cards. In general, McKean has found that customers who bundle multiple services, such as several phone lines with their wireless provider, are likelier to find savings. Varo also filters for bills that exceed $50 a month.

Targeted customers may get an email or message within the Varo app notifying them that they may be able to reduce certain bills with Billshark. To sweeten the offer, Varo will estimate the customer’s savings based on the company’s track record, such as $15 per month off a phone bill that amounts to $180 worth of savings per year.

“I’ve done marketing of third-party products for a while,” said Jerusalmi. “If you can provide that level of information in terms of what they could get, it’s very helpful for anyone trying to squeeze more money out of their budgets.”

Jerusalmi is pleased with customer engagement so far. “We’ve seen huge success in terms of customer interest,” he said.

Based on select campaigns where Varo personalized its messaging, Jerusalmi estimates that 50% to 60% of customers open the emails and more than half express interest in seeing whether Billshark could negotiate a better rate. Once they reach the Billshark site, McKean estimates that 10% to 14% sign up, and see savings of $180 to $190 per year.

Customers will pay the same rate as if they had signed up on Billshark.com directly: The company takes a 40% cut of savings but does not charge if it is unsuccessful. In this way, it is similar to competitor

Any consumer can enroll with Billshark directly. But both Jerusalmi and McKean see this bank-fintech partnership as a natural fit. Jerusalmi points out that by recommending this service directly to its customers, Varo users can feel more comfortable trusting it to protect their personal information.

“They know we’ve curated the offer, we’ve looked into Billshark, we understand its model and that personally identifiable information won’t be sold in the dark web,” said Jerusalmi. In the future, he hopes to integrate more customer-friendly features, including the ability to upload bills in the app.

ApexEdge, whose platform can be launched by banks and credit unions via application programming interfaces, has seen interest rise from financial institutions in the last 12 to 18 months. McKean says the company has partnered with a number of neobanks, small financial institutions and fintechs, such as the financial wellness app provider Albert, personal finance adviser NerdWallet, and student-oriented digital bank BankMobile.

McKean points out the large tech companies such as Amazon have set high expectations for customer experience, and those expectations have filtered down into the financial space. “Instead of ‘here are your transactions’ we can say ‘here are your transactions, we can help you do better with your money, press a button to take action.’ It works great with banks because it’s peanut butter and jelly.”

Varo was founded in 2015 and became the first fintech provider among several similar applicants to receive a national bank charter. Like other challenger banks, it offers no-fee deposit accounts and early access to paychecks. CEO Colin Walsh has spoken critically of traditional banks for hitting customers with monthly fees and overdraft charges, among other things.

“We think of ourselves as something more than just a checking and savings account,” said Jerusalmi. “We think our role is also to help customers improve their financial lives more broadly.”