As Treasury Department officials

The FSOC’s duty to identify “systemically important financial institutions” has been hamstrung by Dodd-Frank’s flawed concept of systemic risk, which confuses symptoms with causes, and shifts attention toward prescriptions that are unlikely to forestall the next financial crisis.

Dodd-Frank assumes that some institutions will radiate systemic risk when they fail — a risk that can spark a financial crisis — while others fail without systemic impact. The economic cost of systemic risk, according to this concept, is slower economic growth as financial services are disrupted in the wake of a financial crisis.

But these assumptions are dubious at best. Systemic risk is a modern analog to “

Similarly, Dodd-Frank-style systemic risk was invented to explain why SIFI failures are the cause of financial crisis. Like aether, maintaining a belief in systemic risk will perpetuate a flawed theory — in truth, SIFIs failed because there was a financial crisis, not the reverse.

The Dodd-Frank focus on SIFIs and systemic risk leads to a prescription to treat the symptoms of the crisis — more regulation for SIFIs. However, these treatments are at best indirect palliatives for the true causes of the crisis: misguided economic policies that sparked bubbles in the housing market and flawed capital rules that allowed financial-sector leverage to soar.

Moreover, the Dodd-Frank focus on SIFIs and systemic risk creates the impression that SIFIs play an especially important role in the economy and consequently must be preserved by all means necessary. The flip side of this view is that non-SIFI institutions are unimportant because their failure has no impact on financial stability.

Assuming that systemic risk actually exists, is it generated by the failure of a select few institutions? Can experts identify SIFIs by examining an institution’s scope, size, scale, concentration, interconnectedness and mix of activities?

The following

Few doubt that bank failures, even small bank failures, have negative economic impacts on customers. When a bank fails, customers — including many small businesses — face borrowing constraints that constrict their ability to conduct business. Some customers may even be forced into bankruptcy.

If community bank failures put customers in a bind, and systemic risk exists, logic dictates that large bank failures must impose especially outsized costs on the economy. This rationale was used to justify the 1984 government bailout of Continental Illinois, the seventh-largest bank in the U.S. at the time — and the first bank to be considered “too big to fail.”

Assume that Dodd-Frank was never passed. Then, consider the negative economic impact of the failure of today’s equivalent of a Continental Illinois.

Currently, the seventh-largest bank holding company is U.S. Bancorp. Its December 2016 consolidated assets and deposits totaled, respectively, $446 billion and $312 billion.

By comparison, let’s calculate the number of community banks with an equivalent-sized balance sheet. In December 2016, there were 5,922 U.S. insured depository institutions. Sorted by deposits, the cumulative deposits in the smallest 3,297 banks equal the deposits in U.S. Bancorp.

So imagine the negative economic impact generated by the simultaneous failure of 3,297 community banks. Would the failure of 56% of all banks in the U.S. banking system over a single weekend be costly, disorderly, create panic, spark bank runs — in other words, spark a financial crisis? Would many small businesses fail as a consequence? Almost surely.

Now, ask yourself if the economic consequences of the simultaneous failure of 3,297 community banks would be worse than the impact of the solitary failure of the seventh-largest bank?

Both events would create direct losses to bank customers. Both would create contagion as investors panic, lose confidence in the soundness of the financial system and the credibility of regulators, and withdraw their assets from remaining financial institutions until the government does something to restore confidence.

If your intuition tells you that the failure of the solitary large bank is likely to be less traumatic and more easily digested by the economy than the negative impact generated by the simultaneous failure of 3,297 community banks, then you do not believe in the Dodd-Frank concept of systemic risk.

The “Gedankenexperiment” suggests that big and small banks are alike in that if a sizable component of the industry fails — be it in the form of a single large failure or in the form of many community bank failures — there will be serious negative economic consequences. Systemic risk — which has been characterized as having the potential to generate a financial crisis— cannot be exclusively housed in a few large institutions.

The thought experiment is imaginary because, even if all the community banks in our simulation were insolvent, the government would never close 3,297 banks in a single weekend — it simply cannot do it. The record count for weekend closures is nine banks in October 2009. Even at this record pace, 3,297 bank closures would take 367 weeks—more than seven years.

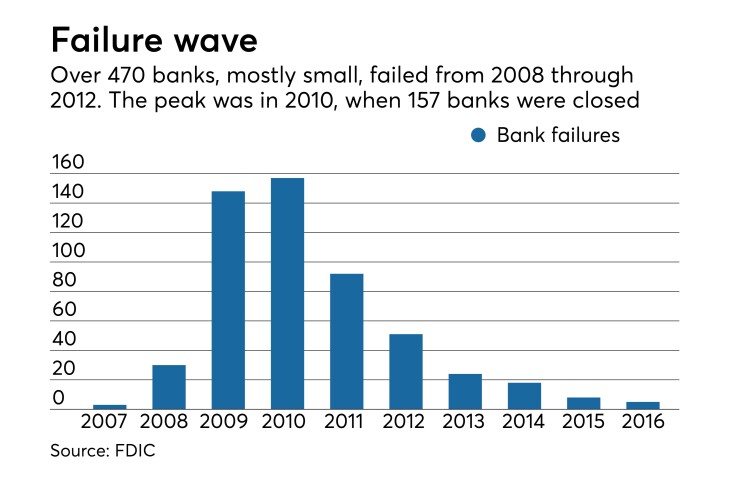

But real-world considerations suggest that the failure of a sizable share of community banks — even if their individual resolutions are delayed over time — would create sizable costs for the economy. Some may not think of this as a systemic event if they treat each individual failure as a separate event, instead of realizing that the financial crisis actually caused the slow-motion closure of hundreds of community banks over the course of years. And the economic costs have been legion.

Regulators postponed closing community banks until they had the resources to do so, even though delaying bank closures substantially increased failed-bank

Is the simultaneous failure of thousands of community banks demonstrably worse for the economy than the failure of one large institution? The nature of systemic risk hinges on the answer to this question.

There is no evidence backing the Dodd-Frank assumption that the economic loss rate inflicted by a bank failure increases dramatically beyond a certain institution-size threshold. Based on the FDIC’s resolution experience, loss rates on large bank failures are modest compared with loss rates for smaller institutions — a fact clearly at odds with the Dodd-Frank approach for identifying SIFIs. For example, the largest failure of all time — of Washington Mutual — cost the FDIC nothing.

Similarly, there is no evidence that interconnectedness, mix or the scope of an institution’s activities predict the loss rate that an institution’s failure will impose on the economy.

Does a SIFI failure cause more economic pain than the failure of a single community bank? Surely. But can the failure of hundreds of community banks, even if they fail in slow motion over years following a financial crisis have a systemic impact? I think so.

Perpetuation of the myth of light-bearing aether forestalled the development of modern light theory for more than a century. Progress on financial stability requires that we re-examine the Dodd-Frank concept of systemic risk and refocus attention on the real causes of financial crises.