How do we keep score in the banking industry? How do we know which banks are really winning and which banks are actually losing? It has never been harder to answer those questions.

One can look to other competitions where the answers are easier. In the recent Super Bowl, no one doubted the New England Patriots as the clear winner. Their fourth-quarter comeback was truly astonishing. Luck may have been a factor; they benefited from a few Atlanta Falcons miscues. But ultimately, the Patriots’ skill drove victory. Points weren’t lost, they were won.

Clear winners have also emerged in tech battles. Iphone

But poker is probably a better analogy for the game bankers are playing in today’s low interest rate environment. In poker you fold when your cards are bad, because not losing money is one way to make money. Poker players also benefit when opponents think you have a good hand – even if you don’t. But can a poker player with consistently bad cards win the game?

Particularly with the valuation of bank stocks, as well as mergers and acquisitions, scoring a bank’s growth prospects and strategic effectiveness is a very tricky business. An acquirer may look attractive to investors and see its stock price grow, but that bank isn’t necessarily a winner.

Just look at the general growth in bank stocks since Donald Trump’s presidential victory. The election convinced investors that interest rates will rise, the onerous regulatory environment for banks will ease, corporate income taxes will go down and economic growth will accelerate. These expectations pushed some bank stock prices up 40% or more. And yet earnings haven’t kept pace with this price growth. They will need to for current valuations to hold.

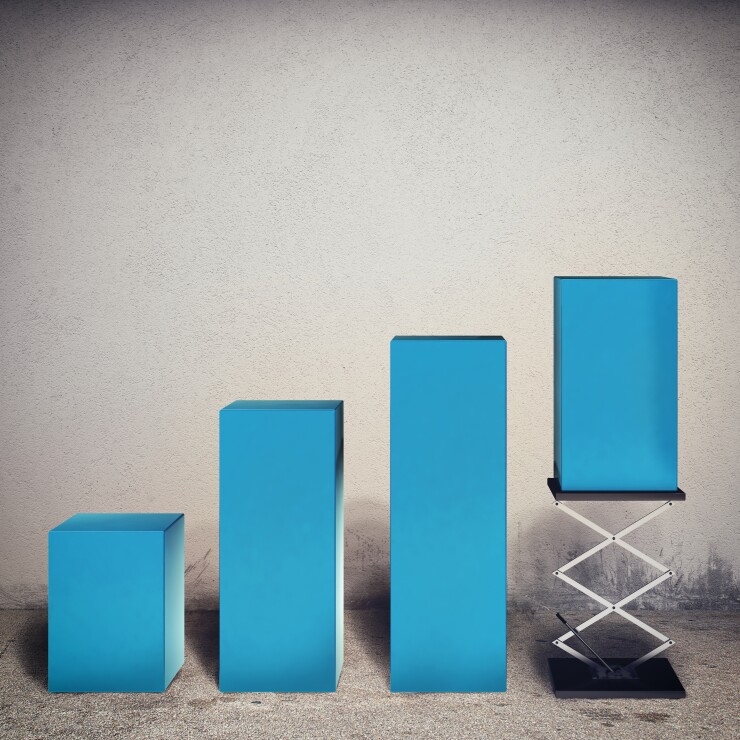

Today, bank stock investors reward banks that grow faster with higher valuations, but they also reward banks that mimic these high-growth banks in value-destroying ways, and penalize banks that choose to avoid mimicry in favor of actually creating value. Very few banks are able to achieve on their own the kind of earnings growth investors yearn for. And that’s why some try acquisitions.

A bank increasing its assets by 7.5% per year would double total assets about every 10 years. But one big acquisition could increase its assets by 30% all at once. How can that not be better? Well, that 30% asset increase would probably require around a 30% increase in shares outstanding. Shareholders of the bank being acquired demand a premium. The pro forma return on equity may be lower.

Even a sanely-priced, well-executed deal may end up bringing only modest benefits to the acquirer on a per-share basis, which is the basis that investors care about. What if the acquirer pays too much or something goes wrong with the execution?

An acquisitive bank can find itself objectively no better off than one that eschews deals. Such a bank would point to rapid growth in total assets and in stated book value per share (which ends up being inflated by goodwill), even as the growth in tangible book value per share is stagnant. While I’m sure some people would disagree with me, I believe it is that tangible book value growth that matters most.

It is not hard to think that the target banks have been shrewd. The pricing of large deals in recent years implies that targets have acquirers over a barrel, not the other way around. Sell today for an attractive premium to market and receive stock that may quickly appreciate in value if hoped-for synergies materialize. Even if the synergies come up short, the target’s shareholders still retain a portion of that premium. Targets seem to sense a key vulnerability on the part of acquirers: they’re tired of folding. They want growth, and to some management teams and investors, deals equal growth.

Of course, in my opinion, there have been some truly successful acquisitions, while banks that rarely or never acquire are also making an astute play.

The acquisitions completed by the Little Rock-based

I don’t get the sense that architects of recent bad deals were humbled by their failures. Some seem emboldened. I think the market’s insistence on rewarding acquirers — one of the biggest drivers of the industry’s dubious scorekeeping — enables this.

My recent favorite example of this was the

All of which is to say that it’s hard to agree on who the Patriots of banking are. The reason is that, even after thousands and thousands of bank M&A deals, there is still no firm consensus on how to keep score, no uniform way to assess after the fact whether a deal’s promises came to fruition, whether the acquirer did in fact end up better off with the target than it would have without it. Or at least there’s no pressing desire to discuss when there’s a miss.