-

The U.S. EMV migration has been rough, but one of the sharpest pain points of all was felt by merchants not yet processing chip cards who were hit by a costly surge in chargebacks.

August 8 -

Once fraud has been detected and a customers usual payment mechanism is broken, what happens next to ensure that customer remains happy and loyal?

August 8 Pegasystems

Pegasystems -

If new research from NCR about a flaw in chip cards proves to be reproducible by fraudsters, it may undermine the core benefit of EMV security.

August 4 -

The transactions look so ordinary that most banks' fraud filters aren't able to detect them. And the perpetrators aren't typical hackers they are middle-aged churchgoers who believe they are taking back what's rightfully theirs.

August 4 -

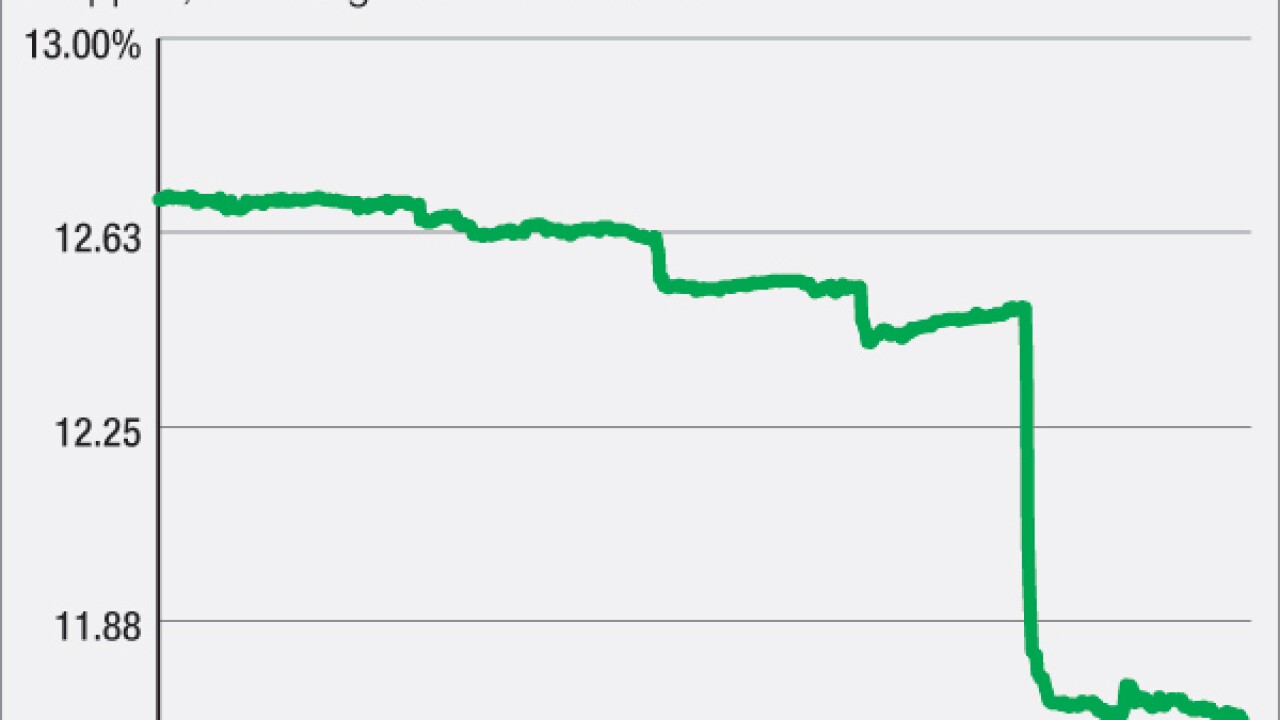

Overall card fraud losses in Europe have declined slightly over the last five years, but that trend is starting to reverse course, based on new data from FICO and Euromonitor International that points to sharp regional upticks in card-not-present fraud.

August 4 -

In the wake of the Bitfinex heist, protecting consumers must again be at the forefront of the digital currency community.

August 4 Consumers' Research

Consumers' Research -

The situation turns on whether the CFTC inadvertently pushed Bitfinex to adopt a weaker security system than it had been using. However, the way the bitcoin exchange used the new system was significantly flawed, security experts said.

August 3 -

Bots have slowly begun to creep onto the online payments scene, and they could offer a whole new, simpler way to part with our cash.

August 3 SecurionPay.com

SecurionPay.com -

Barclays threw out security questions for telephone banking access this week and began using voice recognition technology, representing a step in an industry-wide move to eliminate passwords and challenge questions.

August 2 -

TouchID, facial recognition, behavior patterns, knowledge-based authentication, SMS codes the means of authenticating continue to proliferate. The smart minds in security have yet to settle on one which is the most effective.

August 2