-

Mastercard reported a sharp decline in payments in its most recent quarter, but some digital seeds it planted before the coronavirus pandemic are already bearing fruit.

July 30 -

Banks, data aggregators and fintechs have clashed for a decade over how consumers’ bank account data should be shared with third parties. The agency says it will offer a plan, and industry officials have plenty of suggestions already.

July 30 -

One way banks can prepare for a smooth cutover to new standards is by implementing a core banking / payment solution that uses ISO 20022, says Infosys Finacle's Peter Ryan.

July 29 Infosys Finacle

Infosys Finacle - Investors 'double down' on Remitly, driving value to $1.5B as coronavirus propels mobile remittances

Remitly has raised $85 million in its latest fundraising round, valuing the company at $1.5 billion as the COVID-19 pandemic drives consumers to increasingly send remittances digitally.

July 29 -

The global card issuer will provide its tokenization technology for JPMorgan Chase's virtual card program in early 2021.

July 28 -

Over the weekend, hackers broke in through a third-party vendor to steal names, email addresses and other personally identifiable information.

July 27 -

The Federal Financial Institutions Examination Council is best suited to craft uniform policies to protect consumer data. A patchwork of state rules is cumbersome.

July 23 Orrick

Orrick -

The IBM-BNP collaboration and other new developments show that high-profile breaches haven't deterred banks from using the cloud to store data.

July 22 -

The biggest takeaway from this hack should be large digital media companies reworking their admin controls

July 22 LunarCrush

LunarCrush -

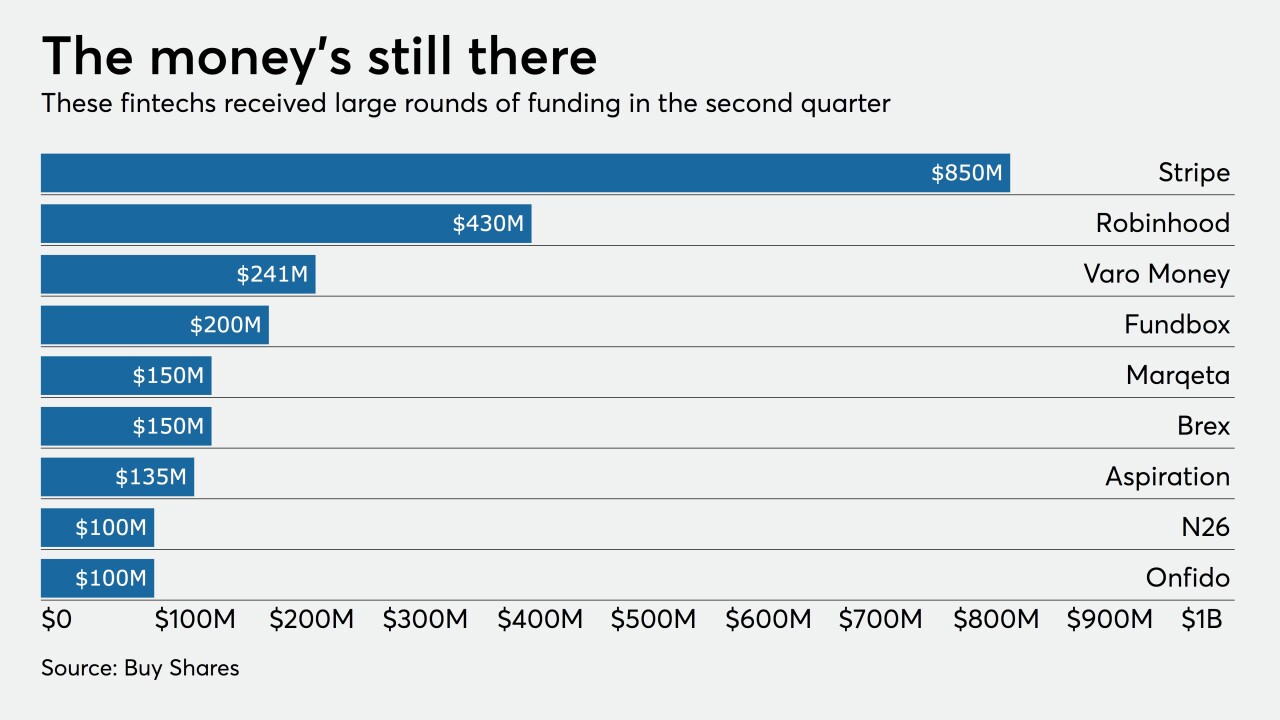

Business models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

July 20