-

Crypto exchanges are adopting anti-fraud surveillance tools as they attempt to root out pump-and-dump schemes, insider trading and bogus orders.

March 1 -

Revolut has caught the attention of U.K. regulators over money laundering compliance, a predicament that sheds light on issues faced by the entire digital financial services industry.

March 1 -

Community banks and credit unions fear a Senate plan and other legislative ideas will nullify steps taken by Fannie Mae and Freddie Mac that have made it easier for smaller institutions to compete.

February 28 -

Aspiration, Wealthfront and SoFi have all begun offering high-yield savings accounts during the past few weeks.

February 28 -

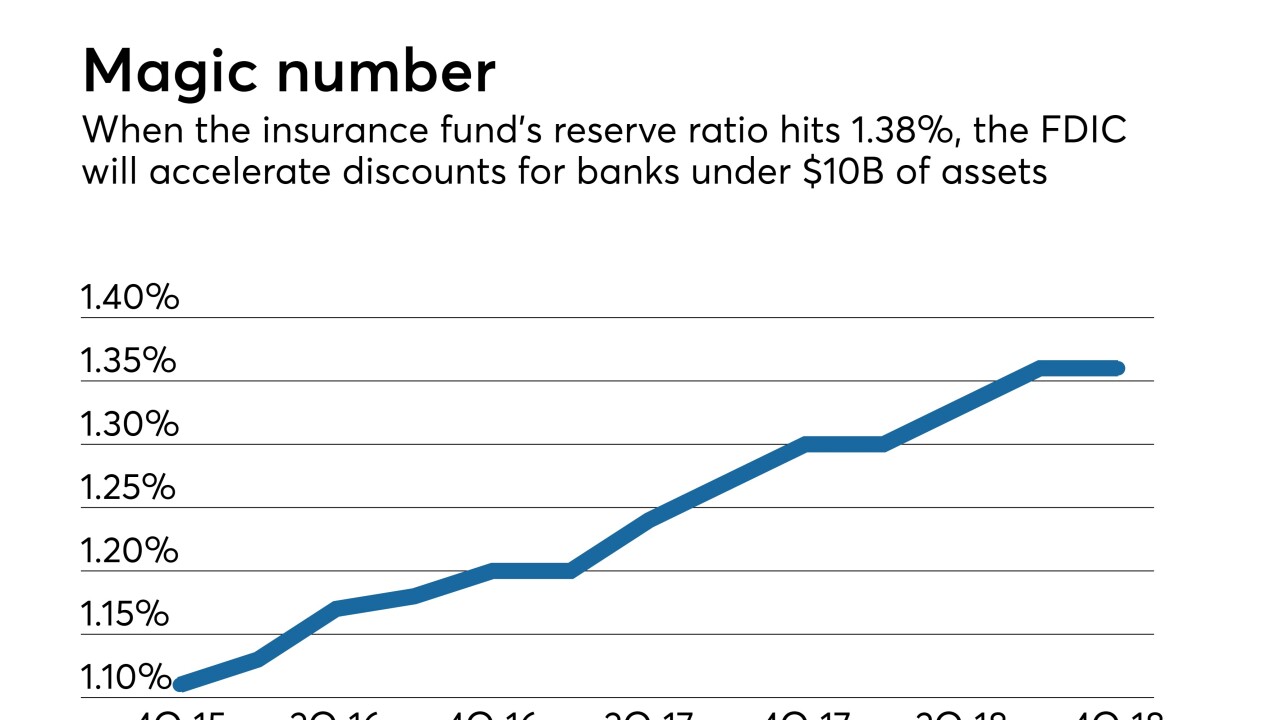

The FDIC reserve fund is nearing a threshold that will trigger a temporary reprieve on deposit insurance premiums for banks with less than $10 billion of assets.

February 28 -

The new regulation, codifying requirements already in practice, is meant to help the mortgage giants prepare for the adoption of a uniform security in June.

February 28 -

The agency recently proposed gutting the ability-to-pay standard in its small-dollar loan rule, a move that would benefit the payday loan industry and harm consumers.

February 28 Consumer Federation of America

Consumer Federation of America -

By applying to become an industrial loan company, the fintech would be able to use insured deposit accounts as a cheap source of funding without having to comply with the tough rules banks face.

February 28 Calvert Advisors LLC

Calvert Advisors LLC -

Bank’s involvement and complex financing draw ire of Barclay shareholders; banks report financial deceit by those who know seniors.

February 28 -

Credit unions in the Cornhusker State are waiting to see whether lawmakers move forward on on a bill that would allow banks the opportunity to block field of membership expansions.

February 28