(Image: Thinkstock)

President Barack Obama

(Image: Bloomberg News)

John Gerspach, chief financial officer of Citigroup

Tim Pawlenty, former governor of Minnesota and now CEO of the Financial Service Roundtable

(Image: Bloomberg News)

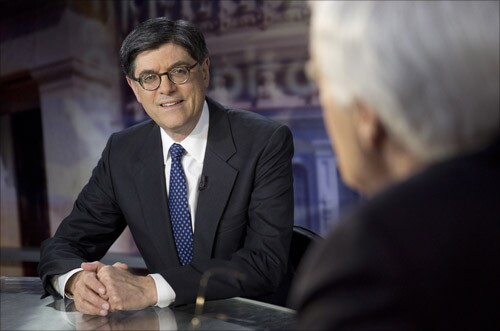

Treasury Secretary Jack Lew

(Image: Bloomberg News)

Sens. Carl Levin, D-Mich. and Jeff Merkley, D-Ore.

Rep. Carolyn Maloney, D-NY, a senior member of the House Financial Services Committee.

(Image: Bloomberg News)

Kenneth Bentsen, president of the Securities Industry and Financial Markets Association

(Image: Bloomberg News)

David Hirschmann, president and CEO of the U.S. Chamber of Commerce Center for Capital Markets Competitiveness

(Image: Bloomberg News)

Sally Miller, CEO of the Institute of International Bankers

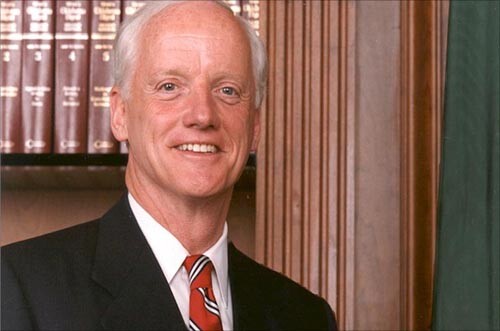

Frank Keating, former governor of Oklahoma and president of the American Bankers Association

(Image: Bloomberg News)