Demographic shifts are feeding new customer expectations, which are in turn creating an opening in the market for nonbank competitors and upstart firms. Industry observers now predict that within a decade, the biggest bank will be a technology firm.

A number of recent industry reports have attempted to detail how banks are responding to the challenge, whether through investment, data management or new strategies to engage with customers. But with every step, there are obstacles.

Even as customers primarily conduct transactions over mobile, banks are discovering they still expect branch service to be an option. Traditional apologies for service interruptions may not sit well with a customer base both expecting efficient service and potentially able to choose technology firm offerings as an alternative. And technology investments themselves are up for scrutiny, either because of potential workforce impact, or just the burden of increased costs.

Here is a look at some findings in recent industry studies of banking technology trends.

The outsider challenge is real

While big tech firms explore the possibility,

Digital or physical? Both

For instance, more customers are using their phones for transactions — in its

Even tech-savvy millennials want a virtual experience with tangible offerings: Chase's mobile-only service, Finn, is

According to J.D. Power’s new

Beware the inconvenienced customer

Fifty-seven percent said opening a bank account should take no longer than one hour, and 47% said a mortgage application should take no longer than one day. Young consumers also noted the banking transactions that proved the most inconvenient because of a need to resubmit information: Opening bank accounts and credit card applications were the top sources of frustration.

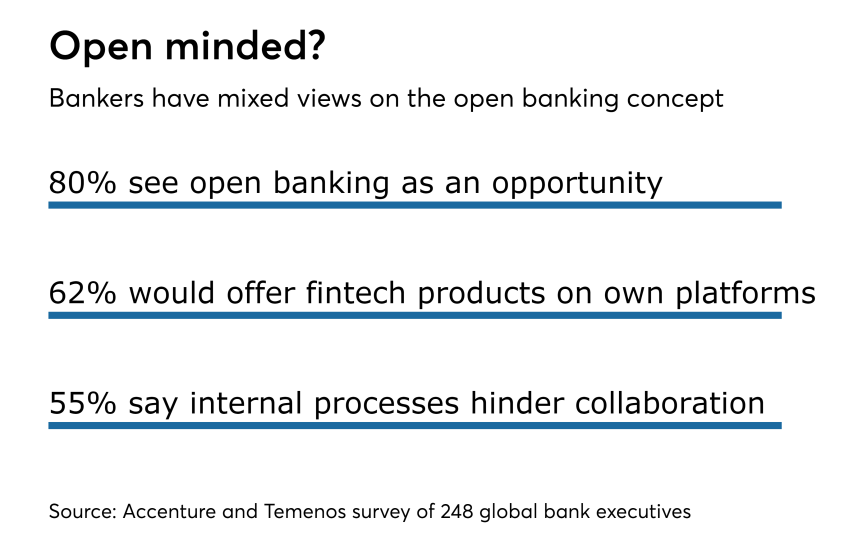

Embracing open banking?

A PwC report on

Change from within

Best uses for customer data

What tech is hot with banks?

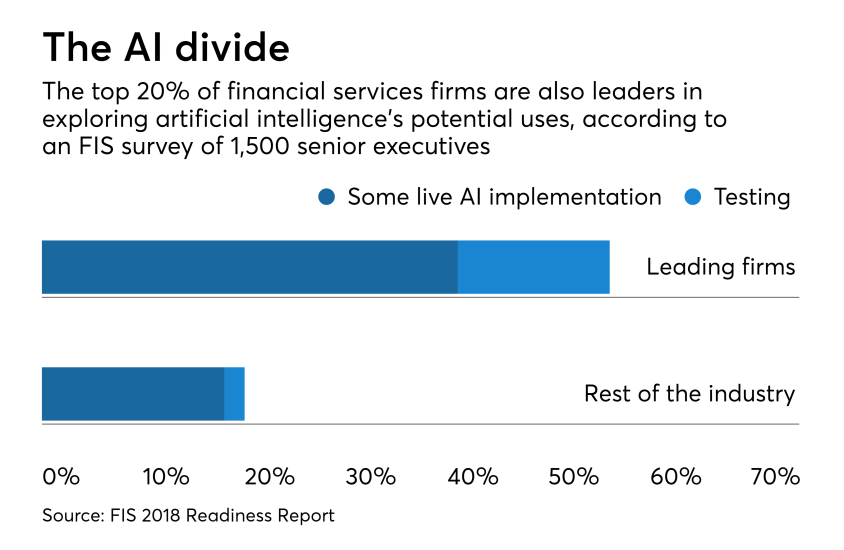

AI, too soon?

But early adoption poses its own challenges. FIS found that even among industry leaders, just 41% said they had some AI applications live, compared to 18% of respondents from the rest of the industry. According to Accenture, 26% of the 1,200 executives it surveyed believed just 1 in 4 of employees were ready to work with AI. It also found that in response to AI adoption, only 3% of banks were planning to significantly increase investment in retraining programs for employees over the next three years.