On Republican presidential candidate Rand Paul's attempt to woo Bitcoin enthusiasts:

Related Article:

On whether banks or regulators are to blame for the derisking phenomenon that has limited access to banking services for legal businesses the government perceives as high-risk:

Related Article:

On whether banks or regulators are to blame for the derisking phenomenon that has limited access to banking services for legal businesses the government perceives as high-risk:

Related Article:

On former Federal Reserve chair Paul Volcker's proposal to consolidate regulatory agencies and strengthen the Federal Reserve's power:

Related Article:

On an alternative way to reform the regulatory restructure:

Related Article:

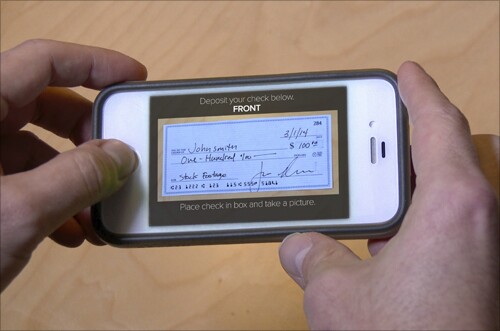

On the relative safety of Bitcoin transactions compared to other payment methods:

Related Article:

On how the actions of regulators, banks and legislators combine to create more risk in the banking system:

Related Article:

On United Community Bancshares' plan to hold off on future acquisitions after reaching $9.5 billion in assets:

Related Article:

On whether mobile apps that allow customers to keep better tabs on their checking account balances will mean the end of overdraft fees:

Related Article:

On how financial technology startups will alter the traditional banking system:

Related Article: