How Promontory Financial Became Banking's Shadow Regulator

Big Banks Win, Taxpayers Lose as Fannie Insurance Overhaul Spiked

Housing Group Taps Dubious Data, HUD Ties to Demand Millions from Banks

Why the CFPB Keeps Losing Its Senior Staff

Unusual OCC Order Hits Bank for Discriminating Against White Males

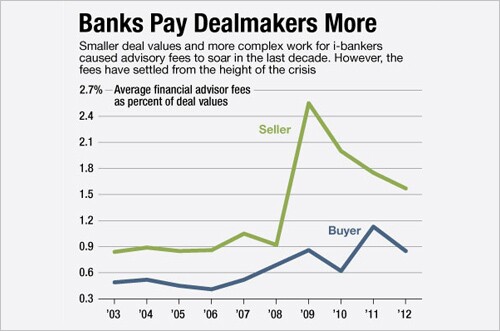

Bank M&A Fees Have Skyrocketed in the Past Decade

Gay Bankers, Once Silent, Speak of Progress and Hurdles

Four Takeaways from JPM's Massive $13B Mortgage Settlement

Three Bankers Who Tackled Social Media with Fun and Flair

How Elizabeth Warren Breaks the Mold as Freshman Senator

Is FDIC Waging a Stealth Crackdown on Online Lenders?

Citigroup Boys' Club Highlights Industry Gender Gap

Bank M&A in Three Acts: Hunting, Buying, Integrating

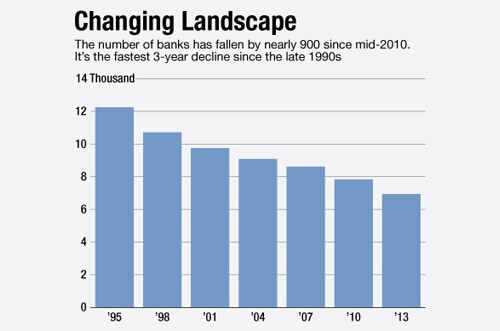

Slate Writer Is Dead Wrong to Root Against Community Banks

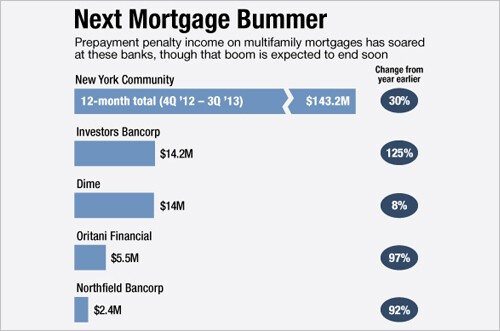

Banks Brace for End of Prepayment Penalty Boom

How Big Banks Killed a Plan to Speed Up Money Transfers

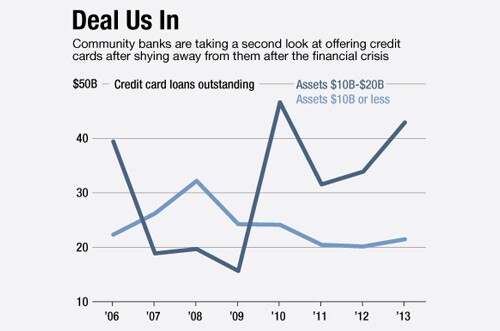

Small Banks, 'Squeezed to Death,' Re-Embrace Cards

How California Law Put a Hot Payments Innovator on Ice

Buried in Fine Print: $57 Billion of FHA Loans Big Banks May Have to Eat

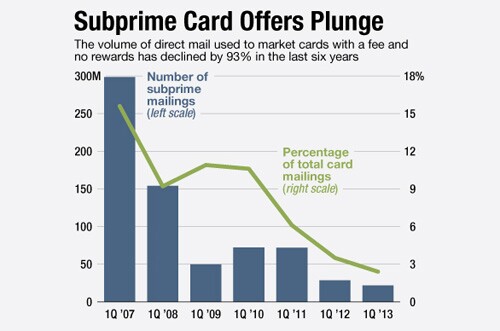

Downfall of Subprime Cards Spawns Opportunity

Banks Probe Regulatory Limits of Credit Card Add-Ons