How digital banking is changing customer behavior

Perk preferences

Death by a million cuts

What millennials need

Where's my money?

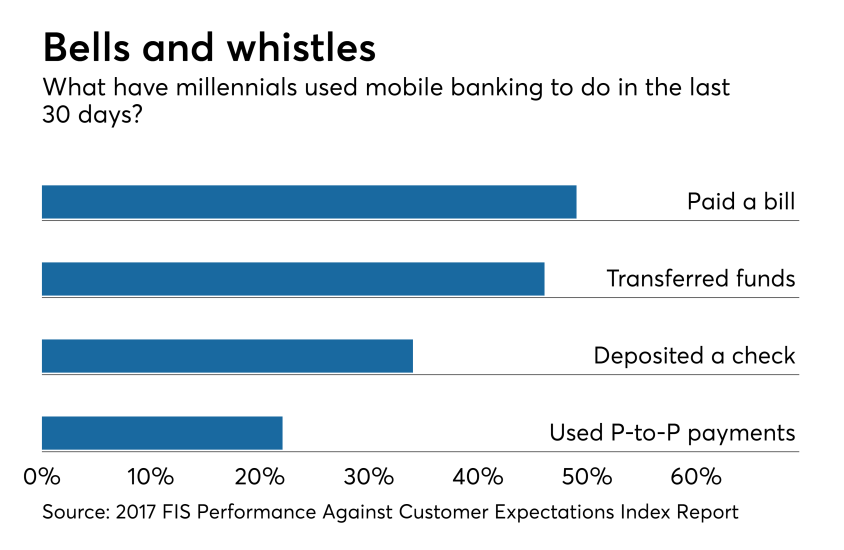

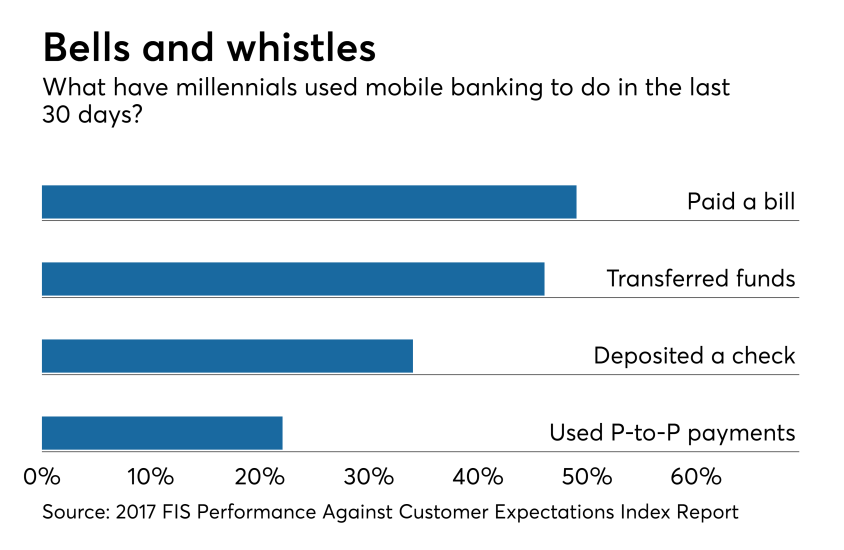

Mobile senders

Mobile Payments' sweet spot

The Alabama regional lender says it expects expenses to taper off this year and anticipates challenged loans will gradually rise to historically average levels.

Truist Financial's top executive leadership team announces departures; First Horizon's chief credit officer is retiring; Ferry teams with Highnote to roll out a new Visa-branded payroll card; and more in the weekly banking news roundup.

The Dallas-based regional bank tapped a client for its copilot capabilities, where employees can message a bot instead of a human to get tech assistance.

Leaders of ORNL Federal Credit Union are piloting Zest AI's new artificial intelligence-powered assistant to ensure equitable underwriting practices and measure performance against similar institutions.

Powered by younger, affluent cardholders, American Express saw a 6% increase in billed business during the first quarter, while weak growth still plagues its small-business segment.

For the better part of the past decade, the Federal Reserve Board in Washington has played a more active role in presidential searches by regional reserve banks. The shift seems to have made the system more diverse, but some argue it's at the expense of regional bank independence.