Related:

Citigroup and Credit Card Disputes

USAA Makes Remote Check Deposit More Accessible

Related:

Santander Focuses on Business

Related Links:

BBVA Looks to Selfies for Security

Related Links:

Capital One Looks Out for the Bargain Hunters

Related:

B of A Debuts Digital Assistant

TD's Moven Partnership

Related:

JPMorgan Chase Uses Mobile to Drive Auto Sales

Related:

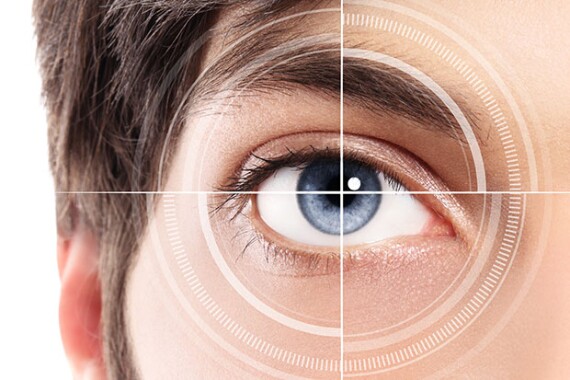

Wells Fargo Has Its Eye on Authentication

Related: