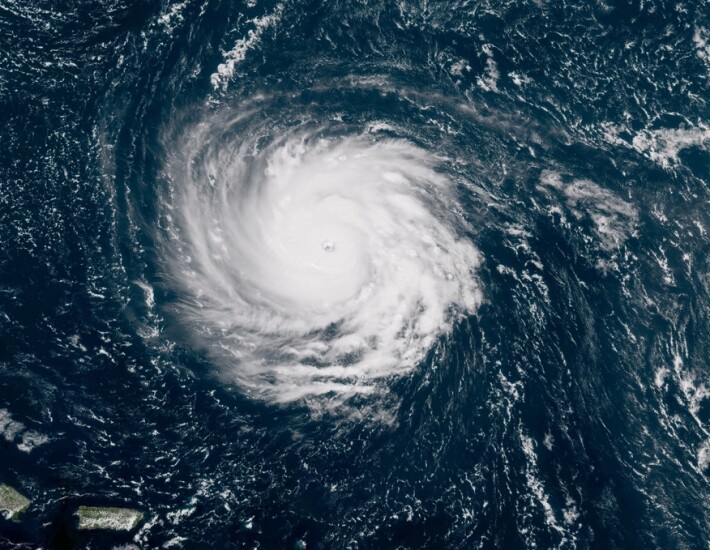

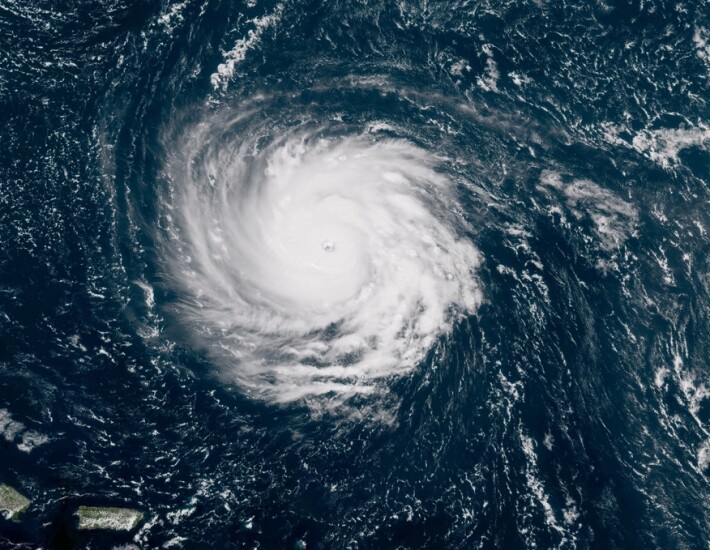

Wrath of Harvey and Irma

Irma could have been worse

SBA’s go-it-alone approach

Heroes emerge

Funds start to flow in

A helping hand

Optimism on commercial exposure

High costs

Flood insurance

Test for SBA

The top five banks and thrifts have combined total assets of nearly $13 trillion.

The JPMorgan Chase CEO took aim Tuesday at the proposed Basel III endgame rules, hindrances to mergers and bureaucratic burdens. "I would love to have a more productive relationship with regulators, but I think it takes conversation," Dimon said.

Many legal experts think the Supreme Court will rule in favor of the Consumer Financial Protection Bureau in a case challenging its funding. Such a ruling would unleash a flurry of litigation that has been on hold pending the outcome of the constitutional challenge.

Lawmakers including one of the original sponsors of the Corporate Transparency Act have filed an amicus brief in the appeal against an Alabama court ruling that the law is unconstitutional, which would throw into question Treasury's newly-established beneficial ownership structure.

The Connecticut bank —a regional traditionally regarded as a cautious lender — said nonperforming loans and leases rose 53% year-over-year. The uptick was in mostly the commercial-and-industrial loan space, although there was one nonperforming commercial real estate loan, executives said.

The two regional banks are anticipating that borrower demand will increase in the back half of the year. High interest rates and economic uncertainty have been muting the appetite for borrowing.