Despite careful planning, TD Bank fumbles online banking upgrade

(Full story

Don't reinvent the wheel on housing finance: Restore Fannie and Freddie

(Full story

Guns pose a political risk for banks

(Full story

Here's another way Amazon and banks are collaborating

(Full story

Did banks' KYC controls fail in Russian efforts to swing election?

(Full story

Are banks doing enough to protect Zelle users?

(Full story

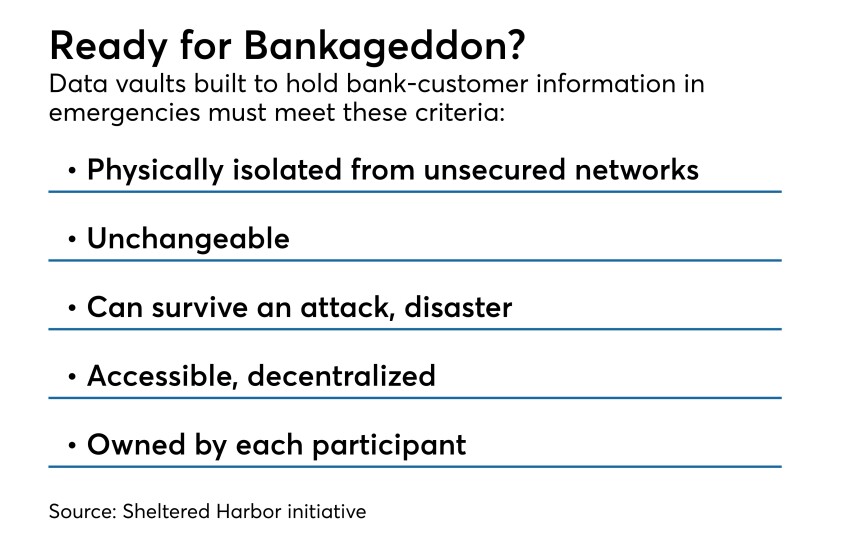

Banks' underground data vault is evolving — will it use blockchain next?

(Full story

Dems demand fair-lending docs from CFPB's Mulvaney

(Full story

A solution to California's pot-banking problem: Its own central bank

(Full story

LendingClub agrees to settle shareholder litigation for $125M

(Full story