At a time of mild or nonexistent loan growth, middle-market borrowers in the Lone Star State are providing a boost to Fifth Third Bancorp and Huntington Bancshares.

New details have emerged about the negotiations that culminated in Capital One's blockbuster $35 billion agreement to acquire Discover. At one point last December, the two parties broke off discussions, according to a securities filing.

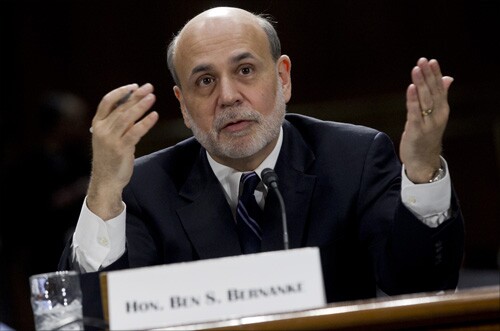

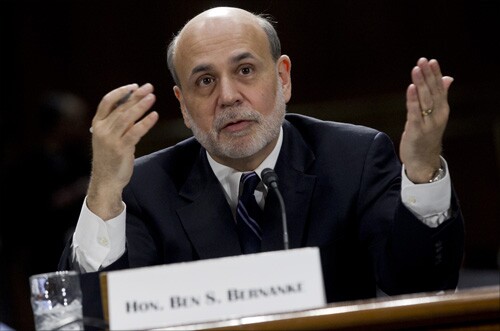

According to the Federal Reserve Board's latest financial stability report, persistent inflation and policy uncertainty are the primary worries for banks. Survey respondents expressed heightened anxiety over murky policy outlooks due to geopolitical turmoil and rapidly approaching domestic elections.

The Alabama regional lender says it expects expenses to taper off this year and anticipates challenged loans will gradually rise to historically average levels.

Truist Financial's top executive leadership team announces departures; First Horizon's chief credit officer is retiring; Ferry teams with Highnote to roll out a new Visa-branded payroll card; and more in the weekly banking news roundup.

The Dallas-based regional bank tapped a client for its co-pilot capabilities, where employees can message a bot instead of a human to get tech assistance.