(Image:

On banks that managed to maintain Camels 1 performance ratings throughout the 2006-2011 period:

Related Article:

(Image: Thinkstock)

Wells Fargo chief executive John Stumpf on why the financial system needs Fannie Mae and Freddie Mac:

Related Article:

(Image: Bloomberg News)

Stumpf on Wells Fargo's opportunity to cross-sell credit cards to its retail customers:

Related Article:

(Image: Bloomberg News)

On a bipartisan bill to reform Fannie and Freddie that's taking shape under Sen. Bob Corker:

Related Article:

(Image: Bloomberg News)

Treasury Secretary Jack Lew on criticism that regulators have been slow to implement Dodd-Frank:

Related Article: Lew Faces More Questions on Dodd-Frank Rules, GSE Reform

(Image: Bloomberg News)

Rep. Maxine Waters on the Justice Department's decision to defer prosecution of HSBC for money laundering, even as ordinary Americans do prison time for drug crimes:

Related Article:

On evidence bank executives are more focused on meeting new regulatory requirements than expanding revenues, doing deals or other initiatives:

Related Article:

(Image: Thinkstock)

On why too many banks have tellers working even when they're not needed:

Related Article:

(Image: Thinkstock)

On the JPMorgan (JPM) board's lineup of possible successors to CEO Jamie Dimon:

Related Article:

(Image: Bloomberg News)

Penny Pritzker, President Obama's nominee for Commerce Secretary, on her role as a co-owner in the 2001 collapse of Superior Bank:

Related Article:

(Image: Bloomberg News)

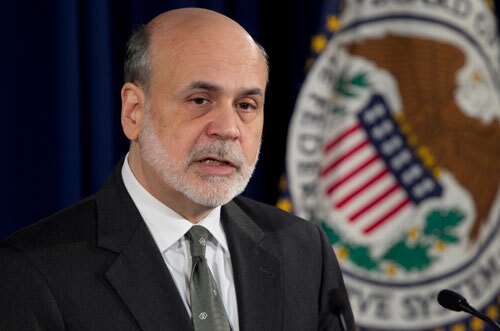

Federal Reserve Chairman Ben Bernanke rejecting calls to reinstate Glass-Steagall:

Related Article:

(Image: Bloomberg News)

On banks' practice of processing transactions from the highest to lowest in values, which tends to maximize overdraft fees:

Related Article:

(Image: Thinkstock)

On why more banks might take advantage of the hot IPO market to fund growth:

Related Article:

(Image: Thinkstock)

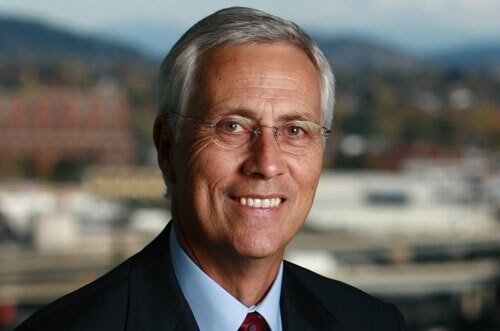

Umpqua Holdings CEO Raymond Davis on what banks must do to keep branches relevant:

Related Article:

On whether chip-and-PIN technology could have prevented the recent $45 million ATM heist:

Related Article:

(Image: Thinkstock)

On why more private-equity groups are likely to cash out of their investments in banks:

Related Article:

(Image: Thinkstock)

On why it's a good idea for some bankers to hire consultants to negotiate contracts with technology vendors:

Related Article:

(Image: Thinkstock)

On the importance for bank management of detailing a strategy prior to annual meetings:

Related Article:

Hancock Holding CEO Carl Chaney on why his company is closing branches in a number of large cities where it has low deposit market share:

Related Article: