-

Personal income gains, coupled with historically low interest rates, should help cushion borrowers and reduce the likelihood of a rise in defaults despite the recent increase in auto lending, according to a new report from London-based Capital Economics Ltd.

March 10 -

Their top executives sure don't. Income streams are constrained in every business line, the economic picture remains murky, and big banks are talking about cutting more expenses again.

March 8 -

HarborOne Bank, a mutually owned co-operative bank in Brockton, Mass., plans to sell shares to the public.

March 7 -

During the fourth quarter of 2015, U.S. auto loans carried longer terms, while average monthly payments rose, and a larger percentage of loans went to less creditworthy borrowers, according to a new report from Experian Automotive.

March 3 -

Santander Consumer USA Holdings delayed the filing of its annual report Monday amid discussions with the Securities and Exchange Commission regarding unresolved accounting issues.

February 29 -

The Houston-based institution plans to build profit into the repayment agreement for a loan, with profit replacing interest, under the model of other Muslim-based lenders.

February 26 -

More borrowers with spotty credit are failing to make monthly car payments on time, a troubling sign for investors who have snapped up billions of dollars of securities backed by risky auto debt.

February 24 -

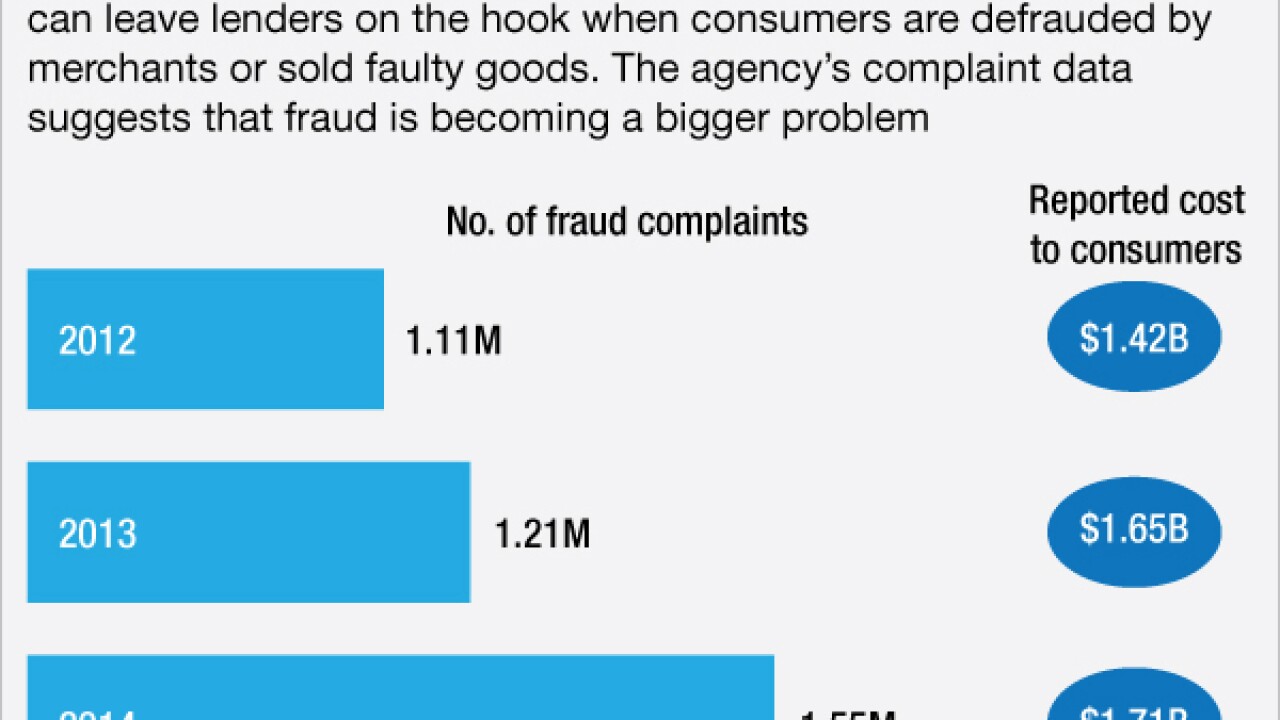

Shoppers who finance the purchase of cars, furniture and home improvements are protected under a decades-old federal regulation. Now consumer groups are urging the FTC to update its rule and consider offering the same protections to victims of home-mortgage or auto-leasing scams.

February 19 -

Key differences in the CFPB's agreements with Toyota and Honda are making it harder for the CFPB to make systemwide changes to the auto lending market. Here's why.

February 19 -

The Detroit company is plowing ahead with its growth strategy at a time when some shareholders are agitating over its sagging share price.

February 11