-

Six of the eight regional banks that announced their stress capital buffers on Tuesday said they will need just a 2.5% cushion to weather an economic downturn. All eight said they’ll keep their dividends steady.

June 30 -

In response to the Federal Reserve's stress tests, Wells said it will lower its third-quarter distribution to shareholders. Meanwhile, JPMorgan Chase, Goldman Sachs and five other companies announced stress test capital buffers that exceed the minimum requirement.

June 29 -

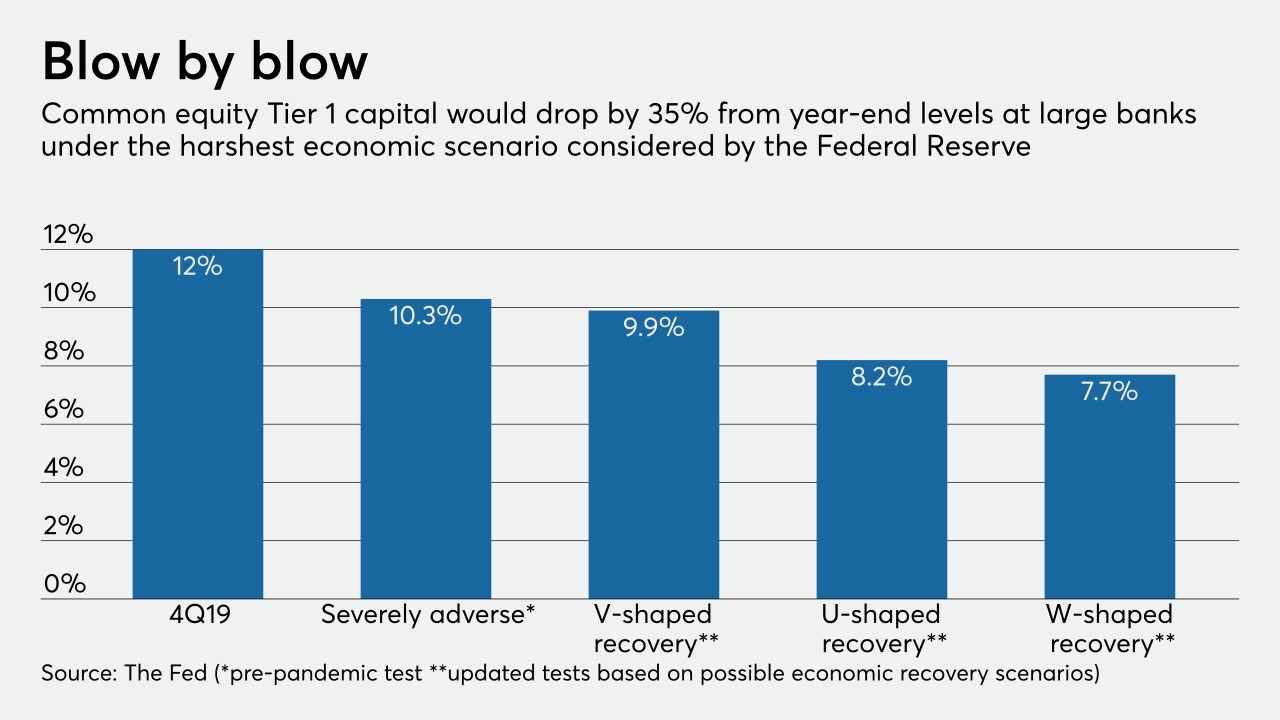

In the most sweeping capital distribution order since the financial crisis, the Federal Reserve says it will prohibit big banks from buying back their stock in the third quarter and limit dividend payments to second-quarter levels.

June 25 -

As they prepare to exit government conservatorship, Fannie Mae and Freddie Mac have enlisted the investment banks to help them boost capital and evaluate market opportunities.

June 15 -

The last bank where he was CEO, Opus Bank, ran into trouble largely because it made too many acquisitions in too short a time span. This time around, Gordon will take a more methodical approach.

June 15 -

The industry was well positioned in terms of net worth before the pandemic and recession, but some institutions could run into issues with sluggish earnings and a surge in deposits.

June 12 -

Organizers of Coastal Community Bank withdrew their application after the pandemic disrupted efforts to raise capital.

June 11 -

The group behind NewBank is pursuing a charter with the Office of the Comptroller of the Currency to offer banking services nationwide.

June 10 -

Stephen Gordon would become chairman and CEO of Genesis Bank, which is looking to raise $53 million in initial capital.

June 9 -

In an effort to help the industry manage the economic downturn, some credit unions won't be required to submit plans to lower their retained earnings for the rest of this year.

June 9