-

Community Banks with the Largest C&I Loan Portfolios

March 1 -

Citigroup is one of the world's largest lenders to the fossil fuel industry, but CEO Jane Fraser vowed on Monday that the bank would achieve net-zero greenhouse-gas emissions in its financing activities by 2050.

March 1 -

Community banks, which for years have relied heavily on commercial real estate lending, have been tightening underwriting standards, conducting more frequent loan reviews and stepping back from certain subsectors to minimize their credit exposure.

February 28 -

Already contending with stressed retail, hotel and restaurant loans, bankers are beginning to view office lending — historically a safe bet — as increasingly risky as companies of all types rethink their space needs.

February 28 -

Going green takes time, so lenders need to start revamping entire business relationships now, according to one sustainability-focused nonprofit. That process could include setting environmental goals for fossil-fuels companies and other customers that are conditions for continuing to finance them.

February 26 -

Soybean, corn and wheat are trading at their highest levels since 2014, meaning farmers are more likely to catch up on loan payments and pursue expansions that require them to take out more loans.

February 25 -

Shared national credit balances rose 5% last year, and the percentage of at-risk loans nearly doubled. Regulators point out that banks have stashed away extra capital, but a lot will depend on the speed of the economic recovery and the performance of nonbank loans.

February 25 -

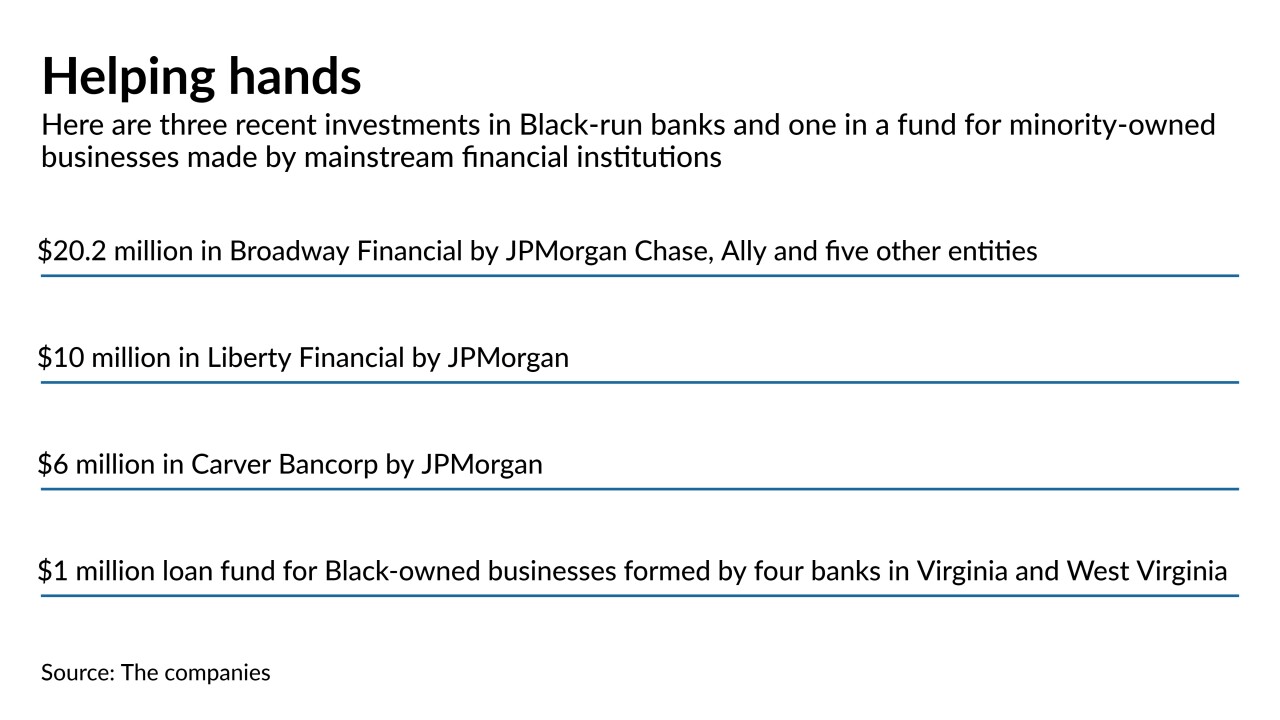

Several large and midsize banks are investing millions of dollars in Black-run banks, while four community banks have started a fund to make interest-free commercial loans in underserved communities.

February 24 -

It would ignore technical glitches plaguing the entire Paycheck Protection Program and could end up delaying loans to larger borrowers who also need relief, bank executives and their trade groups say.

February 22 -

M&T had long coveted the Connecticut regional but couldn't make a deal work. Their merger is the latest example of regional banks joining forces to compete in an industry undergoing rapid transformation.

February 22