-

Slowdowns in new factory orders and production, largely tied to the trade war with China, could translate to more defaults among industrial clients.

October 15 -

The bank is providing a point-of-sale loan to women seeking IVF treatments and getting funds to clinics, in some cases, within 24 hours.

October 15 -

Despite a strong economy, volume in the agency's flagship loan program has declined for two straight years. Here's why.

October 10 -

The company has rolled out an online platform for firms considering marketplace loans as an asset class.

October 10 -

The head of the firm's real estate investment arm pushed back at the idea that buildings with coworking companies as lead tenants are risky bets for lenders.

October 10 -

Renaud Laplanche, one of the first fintech disruptors, is launching an unusual type of credit product at Upgrade, his new company, that is a cross between a credit card and an unsecured loan.

October 10 -

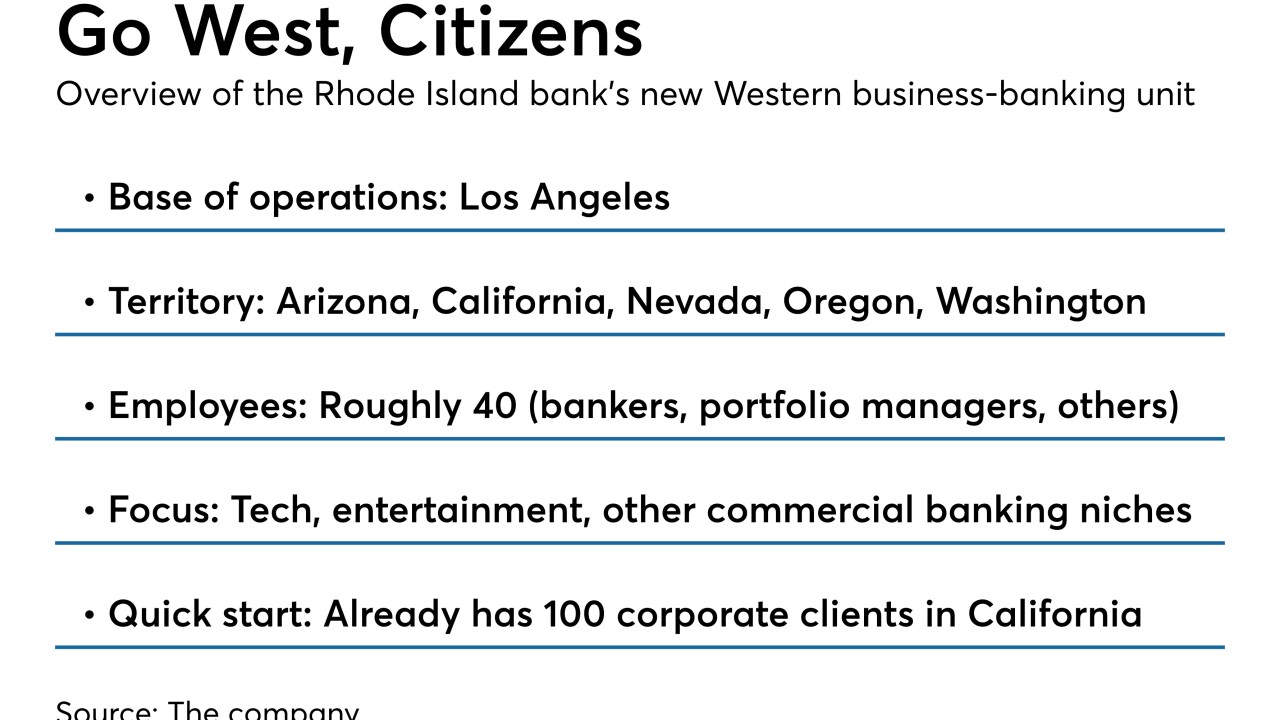

The Providence, R.I., bank recently installed a new regional head in California to oversee a commercial banking expansion into five western states. The bank says it’s trying to craft a successful growth strategy while reassuring investors it isn’t overreaching.

October 9 -

Maine Harvest Federal Credit Union, which will serve farmers and the food industry, opened this week and aims to make $12 million in loans over the next six years.

October 9 -

Barely noticed in a corner of the financial markets, leveraged loans originally worth about $40 billion are staging their own private meltdown.

October 9 -

Credit unions approved just 39.7% of small business loan applications in September, according to the Biz2Credit Small Business Lending Index.

October 9